Introduction: Why PCI Compliance Is Critical for Hotels

In today’s digital-first hospitality industry, hotels handle vast amounts of sensitive guest information every single day so PCI Compliance is very important. From online reservations and mobile check-ins to point-of-sale (POS) systems at front desks, restaurants, and spas, hotels process thousands of credit and debit card transactions. This makes the hospitality sector one of the most attractive targets for cybercriminals.

Hotel PCI compliance is no longer optional—it is a critical requirement for protecting guest payment data, maintaining trust, avoiding financial penalties, and preventing devastating data breaches. Failure to comply with the Payment Card Industry Data Security Standard (PCI DSS) can result in severe fines, reputational damage, lawsuits, and even loss of the ability to process card payments.

This comprehensive guide explores PCI compliance for hotels, why it matters, how hotels can meet PCI DSS requirements, common challenges in the hospitality industry, and best practices for preventing payment fraud.

What Is PCI DSS Compliance?

Understanding PCI DSS

PCI DSS (Payment Card Industry Data Security Standard) is a global security framework established by major credit card brands, including Visa, Mastercard, American Express, Discover, and JCB. The standard applies to any organization that stores, processes, or transmits cardholder data.

For hotels, this includes:

-

Front desk payment systems

-

Online booking engines

-

Property Management Systems (PMS)

-

Point-of-sale systems (POS)

-

Third-party payment processors

PCI DSS sets strict guidelines to ensure cardholder data is protected against theft, misuse, and unauthorized access.

Why PCI Compliance Is Especially Important for Hotels

1. Hotels Are High-Value Targets for Cybercriminals

Hotels collect payment data from guests across multiple touchpoints—online reservations, phone bookings, walk-ins, room service, and ancillary services. This broad attack surface makes hotels prime targets for hackers.

2. Shared and Distributed Systems Increase Risk

Unlike many other businesses, hotels often operate:

-

Multiple locations

-

Franchise and management models

-

Integrated third-party vendors

Each system connection increases vulnerability if not properly secured.

3. Guest Trust Is Everything

A single data breach can permanently damage a hotel’s reputation. Guests expect their credit card information to be protected, and failure to do so leads to loss of loyalty and negative reviews.

What Data Does PCI DSS Protect?

PCI DSS focuses on cardholder data and sensitive authentication data, including:

-

Primary Account Number (PAN)

-

Cardholder name

-

Expiration date

-

Service code

-

CVV/CVC codes

-

PIN data

Hotels must never store sensitive authentication data after authorization.

PCI DSS Compliance Levels for Hotels

PCI compliance requirements vary depending on transaction volume.

PCI Compliance Levels

| Level | Annual Transactions | Typical Hotel Type |

|---|---|---|

| Level 1 | 6+ million | Large hotel chains |

| Level 2 | 1–6 million | Regional hotel brands |

| Level 3 | 20,000–1 million | Mid-sized hotels |

| Level 4 | Fewer than 20,000 | Small hotels & boutiques |

Most independent hotels fall under Level 3 or Level 4, but compliance is still mandatory regardless of size.

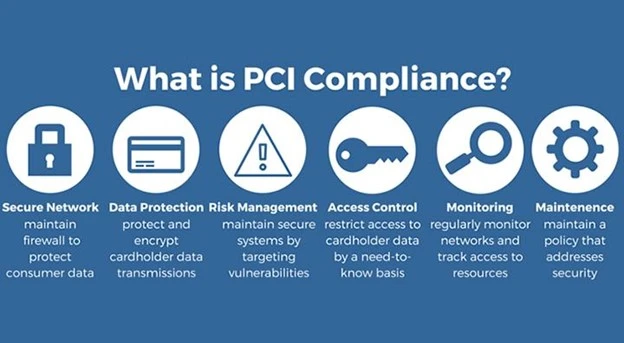

The 12 PCI DSS Requirements Explained for Hotels

1. Install and Maintain a Secure Network

Hotels must use firewalls to protect cardholder data and segment payment systems from other networks such as guest Wi-Fi.

2. Do Not Use Vendor Default Passwords

Default passwords on POS systems, routers, and PMS software must be changed immediately.

3. Protect Stored Cardholder Data

Hotels should minimize data storage and use encryption or tokenization where storage is required.

4. Encrypt Transmission of Cardholder Data

All payment data transmitted across public or open networks must be encrypted using secure protocols.

5. Use and Update Antivirus Software

Anti-malware solutions must be deployed and regularly updated across all systems handling payment data.

6. Develop and Maintain Secure Systems

Security patches and software updates must be applied promptly to all systems.

7. Restrict Access to Cardholder Data

Only authorized personnel should have access to payment information based on business need.

8. Identify and Authenticate Access

Each user must have a unique ID, and strong authentication methods should be enforced.

9. Restrict Physical Access

Servers, terminals, and documents containing card data must be physically secured.

10. Monitor and Test Networks

Hotels must track access to network resources and regularly test security systems.

11. Regularly Test Security Systems

Vulnerability scans and penetration testing are essential to identify weaknesses.

12. Maintain an Information Security Policy

A documented security policy ensures staff understand their roles in protecting guest data.

Common PCI Compliance Challenges in the Hospitality Industry

Multiple Payment Touchpoints

Front desks, bars, restaurants, spas, and online booking platforms all create compliance complexity.

Legacy Systems

Older PMS and POS systems may not meet modern security standards.

Third-Party Vendors

Hotels often rely on external vendors for payment processing, requiring careful vendor compliance management.

Staff Turnover

High turnover rates increase the risk of poor security practices and inadequate training.

How Hotels Can Prevent Payment Fraud

Tokenization and Encryption

Replacing card data with secure tokens reduces exposure and compliance scope.

Secure POS Systems

EMV-enabled and PCI-compliant POS terminals help prevent card-present fraud.

Network Segmentation

Separating payment systems from guest networks limits damage in case of a breach.

Employee Training

Staff should be trained to recognize phishing attacks and follow secure payment procedures.

Regular Security Audits

Frequent assessments help hotels stay ahead of evolving threats.

The Role of Third-Party Vendors in Hotel PCI Compliance

Hotels often outsource:

-

Booking engines

-

Payment gateways

-

Channel managers

While vendors may handle transactions, the hotel remains responsible for ensuring PCI compliance.

Hotels should:

-

Verify vendor PCI certification

-

Include compliance clauses in contracts

-

Monitor vendor security practices

Benefits of PCI Compliance for Hotels

Reduced Risk of Data Breaches

Compliance significantly lowers exposure to cyber threats.

Avoidance of Fines and Penalties

Non-compliance can result in fines ranging from thousands to millions of dollars.

Increased Guest Trust

Guests are more likely to book with hotels that prioritize security.

Improved Operational Efficiency

Standardized security practices reduce operational chaos and downtime.

Consequences of PCI Non-Compliance

-

Financial penalties from card brands

-

Higher transaction fees

-

Legal liability and lawsuits

-

Loss of payment processing privileges

-

Brand and reputation damage

PCI Compliance Best Practices for Hotels

-

Minimize card data storage

-

Use compliant PMS and POS systems

-

Conduct regular vulnerability scans

-

Maintain clear security policies

-

Work with PCI-compliant vendors

-

Perform annual self-assessments

Future Trends in Hotel Payment Security

Contactless and Mobile Payments

Hotels must ensure new payment methods remain PCI compliant.

AI-Driven Fraud Detection

Advanced analytics help detect suspicious transactions in real time.

Cloud-Based Security

Secure cloud solutions reduce infrastructure risks when properly configured.

How to Get Started with Hotel PCI Compliance

-

Identify where cardholder data flows

-

Reduce and eliminate unnecessary data storage

-

Upgrade to PCI-compliant systems

-

Train employees regularly

-

Conduct compliance assessments

-

Partner with trusted security providers

Conclusion: PCI Compliance Is a Business Imperative for Hotels

Hotel PCI compliance is not just a regulatory requirement—it is a fundamental business responsibility. By safeguarding guest payment data and preventing fraud, hotels protect their reputation, revenue, and customer trust.

As cyber threats continue to evolve, hotels that proactively invest in PCI compliance will stand out as trusted, secure, and forward-thinking hospitality providers.