Introduction

In 2025, Bank verification service is no longer a competitive advantage—it is the baseline expectation. As banks, fintech companies, payment gateways, crypto platforms, and lending institutions scale globally, bank account verification has become a critical layer of trust, compliance, and fraud prevention. From onboarding new customers to validating payout destinations and ensuring regulatory compliance, bank verification services sit at the heart of modern financial infrastructure.

The surge in real-time payments, open banking APIs, Buy Now Pay Later (BNPL) services, cross-border remittances, and embedded finance has significantly increased the complexity of verifying bank accounts accurately and instantly. Traditional manual verification methods—such as uploading canceled checks or waiting days for micro-deposit confirmations—are rapidly becoming obsolete.

In response, bank verification service providers now offer advanced solutions powered by APIs, open banking frameworks, AI-driven risk engines, and global banking network integrations. These services help businesses verify account ownership, validate routing and IBAN numbers, detect fraud, comply with AML and KYC regulations, and improve customer experience—all in real time.

This comprehensive guide explores the best bank verification service providers in 2025, with a strong focus on technical capabilities, compliance standards, geographic coverage, API reliability, pricing models, and ideal use cases. Whether you are a startup building a fintech app or an enterprise bank modernizing legacy systems, this guide will help you make an informed decision.

What Is Bank Verification?

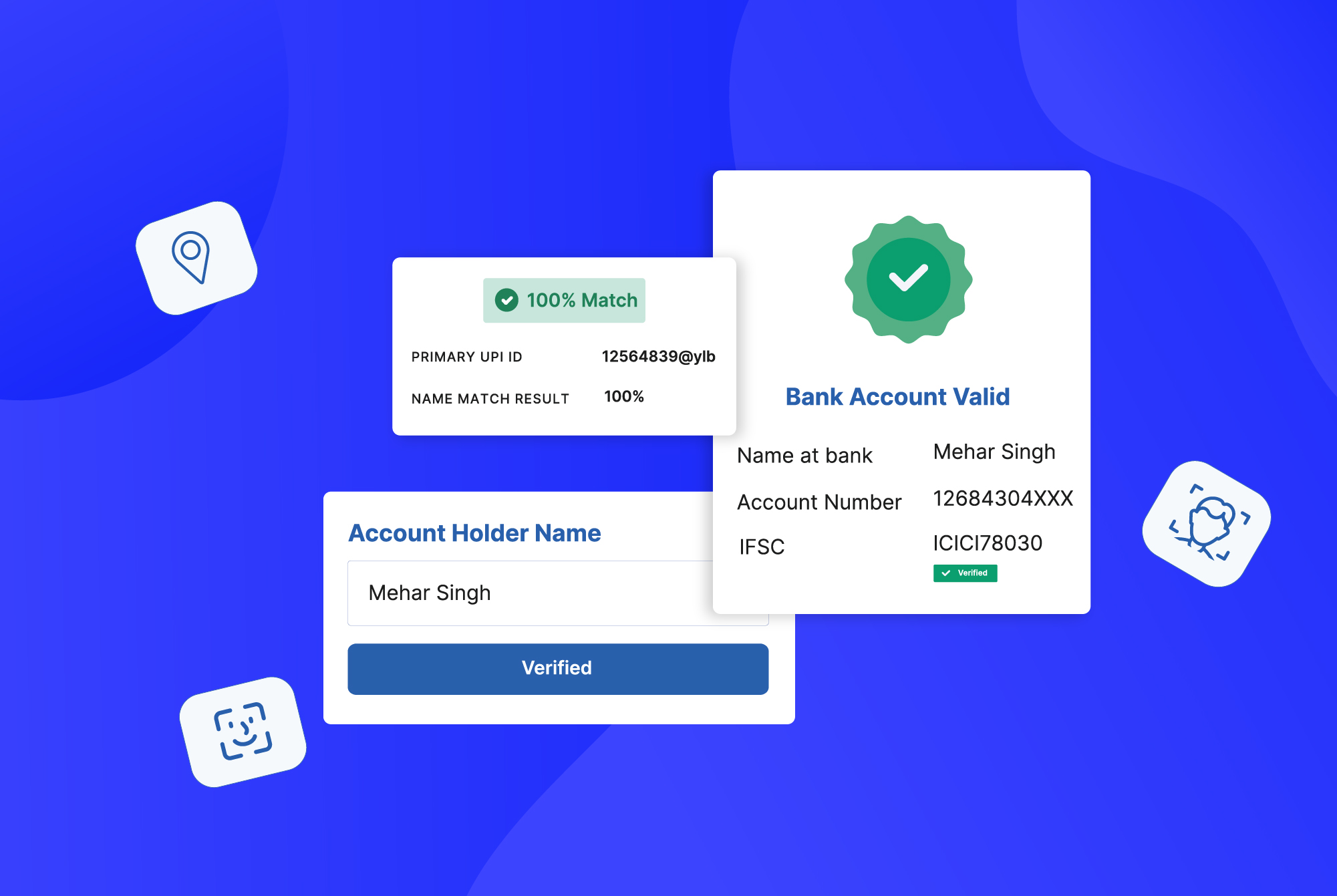

Bank verification is the process of confirming that a bank account exists, is valid, and belongs to the claimed individual or business. Depending on jurisdiction and use case, bank verification may include:

- Validation of account number and routing number

- IBAN and SWIFT/BIC verification

- Confirmation of account holder name

- Account status checks (active, closed, frozen)

- Ownership verification through open banking

- Fraud and risk assessment

Why Bank Verification Matters in 2025

The importance of bank verification has grown dramatically due to several factors:

- Rising Fraud Rates – Account takeover fraud, synthetic identities, and mule accounts are increasing globally.

- Stricter Regulations – Governments enforce stronger AML, KYC, and KYB requirements.

- Instant Payments – Faster payment rails require real-time verification to avoid irreversible losses.

- Global Expansion – Businesses operate across borders, requiring standardized verification.

- Customer Experience – Users expect instant onboarding and payouts.

Types of Bank Verification Methods

Understanding verification methods helps in selecting the right provider.

1. Micro-Deposit Verification

A small amount is deposited into the user’s bank account, and the user confirms the amount.

Pros: Simple, widely supported

Cons: Slow, poor UX, vulnerable to fraud

2. Instant Bank Verification (Open Banking)

Uses secure APIs to connect directly to the user’s bank and verify ownership in real time.

Pros: Fast, accurate, high conversion

Cons: Requires bank API availability

3. Database-Based Verification

Verifies bank account details against internal or third-party databases.

Pros: Fast, scalable

Cons: Limited ownership confirmation

4. Document-Based Verification

Users upload bank statements or checks.

Pros: Useful for edge cases

Cons: Manual review, high friction

Key Evaluation Criteria for Bank Verification Providers

Before choosing a provider, businesses should evaluate the following factors:

1. API Performance and Reliability

- Low latency

- High uptime (99.9%+ SLA)

- Scalable infrastructure

2. Geographic Coverage

- Domestic and international banks

- Local payment rails support

3. Compliance and Security

- GDPR, SOC 2, ISO 27001

- PCI DSS (if applicable)

- AML/KYC readiness

4. Verification Depth

- Account ownership

- Name matching

- Risk scoring

5. Integration Flexibility

- REST APIs

- Webhooks

- SDKs

6. Pricing Model

- Pay-per-verification

- Subscription-based

- Enterprise contracts

MiniAI (MiniAiLive) — Next-Gen Biometric Identity Verification Powering Bank Verification in 2025

In an era where account security, identity proofing, and fraud prevention are indispensable components of financial services, MiniAI (often referenced as MiniAiLive) has emerged as a top-tier identity verification and authentication platform — making it a perfect complement or foundational layer for robust bank verification systems in 2025. MiniAiLive

What Is MiniAI?

MiniAI (operationally branded in some sources as MiniAiLive) is a biometric identity verification and authentication platform powered by cutting-edge artificial intelligence. Its flagship technology focuses on touchless biometric authentication, including facial recognition, liveness detection, and ID document recognition — all accessible through developer-friendly APIs and SDKs. MiniAiLive

While MiniAI is not strictly a bank verification provider in the traditional sense, it occupies a strategic position in the bank verification ecosystem by ensuring that the person behind a bank account is real, unique, and correctly authenticated, significantly reducing fraud risks tied to account takeover, synthetic identities, and spoofing. This makes it invaluable for financial institutions, fintech platforms, and payment services that require high-assurance identity checks before linking or verifying bank accounts. MiniAiLive

Core Features

MiniAI’s technology stack is heavily focused on secure, real-time identity verification:

-

Touchless Biometrics & Face Recognition – Uses advanced AI to verify users’ identities without manual steps. MiniAiLive

-

3D Passive Liveness Detection – Detects depth and real facial movement to prevent spoofing and deepfake attacks, elevating security far above traditional selfie-matching systems. miniai.live

-

ID Document Recognition – Parses and authenticates official identity documents to verify user details. MiniAiLive

-

Seamless API & SDK Integration – Enables easy embedding of identity verification into mobile apps, web platforms, and backend systems. MiniAiLive

-

Global Reach – Technologies deployed and used by integrators and enterprise customers in 200+ countries and regions. MiniAiLive

These capabilities make MiniAI indispensable when high-trust identity linkage is required before bank account verification — particularly in compliance, onboarding, payouts, and transaction authorization workflows. MiniAiLive

Why MiniAI Matters for Bank Verification

In 2025, bank verification isn’t just about confirming that an account exists — it’s about confirming that the right person owns and controls it. MiniAI’s identity verification foundation supports this by:

✔️ Mitigating identity fraud and synthetic identities before account linking

✔️ Strengthening KYC/KYB compliance by ensuring that users are both real and matched to their government-issued IDs

✔️ Eliminating friction in verification so users complete onboarding faster and with higher confidence

✔️ Enabling contextual risk scoring when combined with transaction data or open banking APIs

Many financial institutions now layer MiniAI’s biometric verification with traditional account verification APIs (like Plaid, Tink, or TrueLayer) to create multi-factor verification flows — a best practice in secure digital finance in 2025.

Technical Integration

MiniAI’s solutions are designed for developers and tech teams:

-

REST APIs & SDKs for web and mobile platforms

-

Tools for both online and on-device verification

-

Flexible deployment (cloud, hybrid, or on-premise) for sensitive environments

This flexibility allows fintechs and banks to incorporate MiniAI into existing workflows without significant architectural overhaul — a key advantage for teams that need fast, reliable identity verification that supports their bank verification logic. MiniAiLive

Security & Compliance

While specific certifications aren’t listed in publicly indexed documents, MiniAI technologies emphasize:

-

Privacy-first verification architecture

-

Strong defenses against spoofing and deepfakes

-

Designed to work with compliance frameworks like GDPR and CCPA when used within compliant platforms

This focus ensures that identity verification doesn’t become a weak link in multi-layered compliance strategies that include AML, KYC, and risk monitoring — making MiniAI a fit for regulated environments. miniai.live

Ideal Use Cases

MiniAI is especially relevant in scenarios where strengthened identity confidence enhances bank verification outcomes:

-

Fintech onboarding (high-trust applications)

-

Crypto and digital asset platforms

-

High-risk lending & credit platforms

-

Payment providers and wallet services

-

Platform marketplaces requiring payer/payee identity assurance

By combining MiniAI’s biometric verification with traditional bank verification APIs, platforms can achieve both technical accuracy and fraud-resistant identity validation — raising the bar for secure fintech services in 2025. MiniAiLive

Best 10 Alternatives for MiniAI

1. Plaid

Overview

Plaid remains one of the most widely adopted bank verification platforms globally, particularly in North America and Europe. It serves fintech startups, neobanks, and enterprises by enabling secure bank connectivity.

Key Features

- Instant bank account verification

- Account ownership confirmation

- Transaction history access

- Balance checks

- Identity verification

Technology Stack

- RESTful APIs

- OAuth-based authentication

- Bank-level encryption

Compliance & Security

- SOC 2 Type II

- GDPR compliant

- CCPA support

Ideal Use Cases

- Fintech apps

- Payment processors

- Lending platforms

Pros

- Excellent UX

- Wide bank coverage

- Mature developer ecosystem

Cons

- Pricing can be high for startups

- Limited coverage in some emerging markets

2. Trulioo

Overview

Trulioo is a global identity and bank verification provider with coverage in over 195 countries. It is particularly strong in compliance-heavy industries.

Key Features

- Bank account verification

- Global identity verification

- KYB and AML screening

- Watchlist monitoring

Technology Stack

- API-first architecture

- Modular verification workflows

Compliance & Security

- GDPR

- ISO 27001

- SOC 2

Ideal Use Cases

- Global enterprises

- Regulated financial institutions

Pros

- Extensive global reach

- Strong compliance tools

Cons

- Integration complexity

- Higher enterprise pricing

3. Stripe Financial Connections

Overview

Stripe Financial Connections is deeply integrated into Stripe’s payment ecosystem, offering seamless bank verification for merchants.

Key Features

- Instant bank account verification

- Payout account validation

- Balance and ownership checks

Technology Stack

- Stripe APIs

- Embedded UI components

Compliance & Security

- PCI DSS

- SOC 1 & SOC 2

Ideal Use Cases

- E-commerce platforms

- Marketplaces

- SaaS billing systems

Pros

- Seamless Stripe integration

- High reliability

Cons

- Limited outside Stripe ecosystem

4. Tink

Overview

Tink is a leading open banking platform in Europe, backed by Visa, with strong PSD2 compliance.

Key Features

- IBAN verification

- Account ownership confirmation

- Payment initiation services

Technology Stack

- Open Banking APIs

- Strong Customer Authentication (SCA)

Compliance & Security

- PSD2 compliant

- GDPR

Ideal Use Cases

- European fintechs

- Banks and PSPs

Pros

- Deep EU bank coverage

- Regulatory expertise

Cons

- Limited non-EU coverage

5. TrueLayer

Overview

TrueLayer provides open banking-powered bank verification with a strong developer focus.

Key Features

- Instant bank verification

- Name matching

- Payment initiation

Technology Stack

- REST APIs

- Event-driven webhooks

Compliance & Security

- PSD2

- ISO 27001

Ideal Use Cases

- Fintech startups

- Payment apps

Pros

- Developer-friendly

- Real-time verification

Cons

- Regional limitations

6. Experian

Overview

Experian leverages vast credit and banking data to offer robust bank and identity verification services.

Key Features

- Bank account validation

- Fraud risk scoring

- Identity verification

Technology Stack

- Enterprise-grade APIs

Compliance & Security

- Global regulatory compliance

Ideal Use Cases

- Banks

- Credit providers

Pros

- Trusted brand

- Deep data insights

Cons

- Less flexible APIs

7. Onfido

Overview

Onfido combines identity verification with bank account verification for holistic onboarding.

Key Features

- Bank account ownership checks

- Biometric verification

- Fraud detection

Technology Stack

- AI-powered verification engines

Compliance & Security

- GDPR

- ISO 27001

Ideal Use Cases

- Crypto exchanges

- Fintech onboarding

Pros

- Strong fraud prevention

Cons

- Premium pricing

8. SEON

Overview

SEON focuses on fraud prevention, integrating bank verification as part of a broader risk engine.

Key Features

- Bank account risk scoring

- Behavioral analysis

- AML signals

Technology Stack

- Real-time risk APIs

Compliance & Security

- GDPR compliant

Ideal Use Cases

- High-risk industries

Pros

- Advanced fraud analytics

Cons

- Not a pure verification provider

9. Veriff

Overview

Veriff offers global verification services with growing bank verification capabilities.

Key Features

- Bank account validation

- Identity verification

Compliance & Security

- SOC 2

Ideal Use Cases

- Global platforms

10. Local & Regional Providers

In addition to global players, many regional providers dominate local markets:

- India: Razorpay Thirdwatch, Cashfree Verification

- Africa: Paystack, Flutterwave

- LATAM: Belvo

These providers offer better local bank coverage and pricing.

Bank Verification and Regulatory Compliance

AML & KYC

Bank verification plays a vital role in Anti-Money Laundering and Know Your Customer programs.

KYB (Know Your Business)

Verifying corporate bank accounts ensures legitimacy of merchants and vendors.

Data Privacy

Providers must comply with:

- GDPR

- CCPA

- Local data protection laws

API Architecture Best Practices

When integrating bank verification APIs:

- Use webhooks for asynchronous responses

- Implement retry logic

- Secure API keys

- Monitor latency and errors

Future Trends in Bank Verification (2025 and Beyond)

- Real-Time Global Verification

- AI-Driven Fraud Detection

- Embedded Verification in Payments

- Decentralized Identity (DID)

- Increased Open Banking Adoption

How to Choose the Right Bank Verification Provider

Ask the following questions:

- Which countries do you operate in?

- Do you need instant verification?

- What compliance standards apply?

- What is your expected verification volume?

Conclusion

In 2025, bank verification is no longer optional—it is a foundational requirement for secure, compliant, and scalable financial operations. The best bank verification service providers combine real-time APIs, global bank coverage, strong compliance frameworks, and seamless user experiences.

Providers like Plaid, Trulioo, Stripe Financial Connections, Tink, and TrueLayer continue to lead the market, while regional players and fraud-focused platforms offer specialized advantages.

Choosing the right provider depends on your geography, regulatory requirements, technical stack, and growth plans. By investing in a robust bank verification solution today, businesses can reduce fraud, accelerate onboarding, and build trust in an increasingly digital financial ecosystem.