Customer Due Diligence (CDD) is one of the most critical processes for businesses that operate in regulated sectors such as finance, banking, real estate, fintech, cryptocurrency, and professional services. As global regulations tighten to combat money laundering, terrorism financing, fraud, and other financial crimes, organizations must implement strong CDD frameworks to stay compliant and protect their operations.

This comprehensive guide breaks down everything you need to know about CDD requirements, including what they are, why they matter, the different levels of due diligence, legal obligations, best practices, and how businesses can implement an effective CDD program.

By the end, you’ll have a clear understanding of how CDD works, what regulators expect, and how to build a reliable compliance process that reduces risk while enhancing customer trust.

1. What Is Customer Due Diligence (CDD)?

Customer Due Diligence refers to the process of verifying a customer’s identity, assessing their risk level, and evaluating whether they pose any potential threat related to financial crime. CDD is required by Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations across the world.

The main purpose of CDD is to:

-

Confirm the identity of customers

-

Understand the nature of the customer’s activities

-

Determine risk levels associated with the customer

-

Detect suspicious behavior or transactions early

-

Ensure compliance with local and global regulations

In short, CDD helps businesses ensure that customers are who they say they are and that their activities are legitimate.

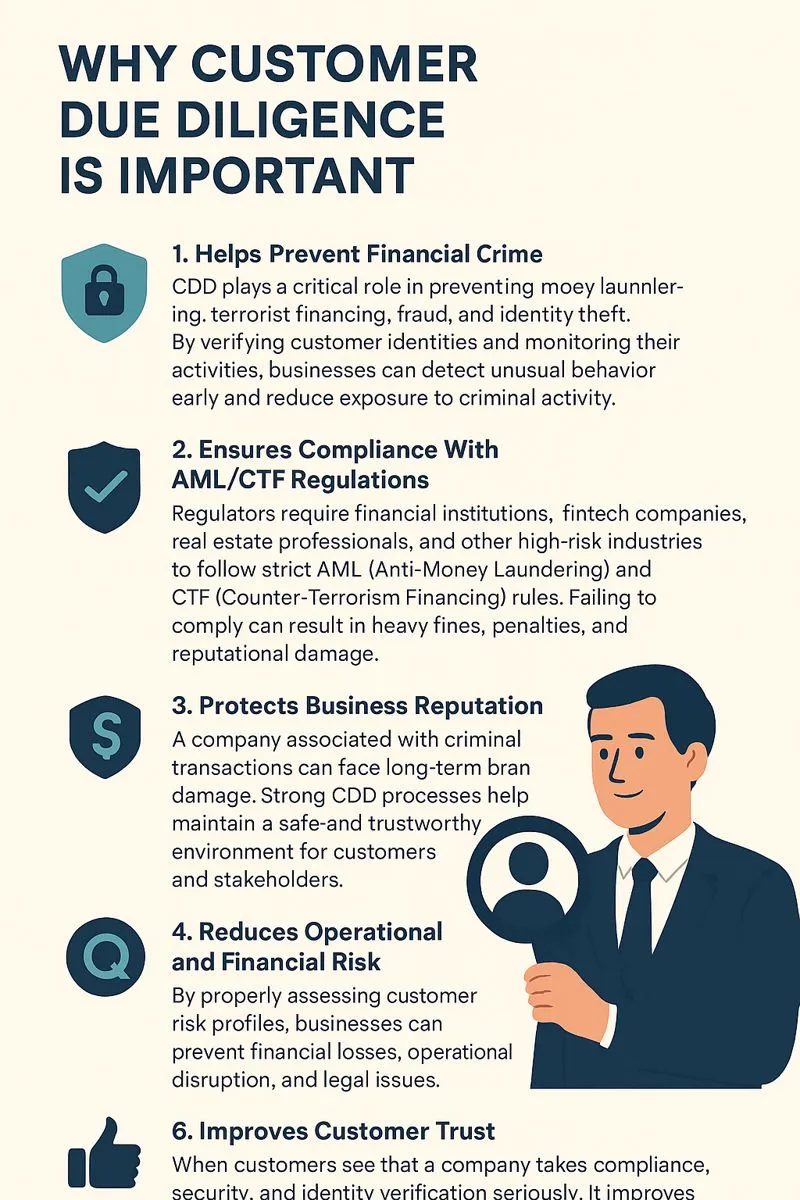

2. Why Customer Due Diligence Is Important

Modern businesses face increasing pressure from regulators to prevent illegal activity—from fraud and tax evasion to money laundering and terrorist financing. CDD is essential because it:

✔ Prevents Financial Crime

By verifying identity and monitoring customer activity, companies can detect potentially fraudulent or suspicious behavior early.

✔ Ensures Regulatory Compliance

Banks and other regulated entities must comply with AML and CTF laws. Failure to do so can result in heavy fines, sanctions, or even loss of license.

✔ Protects Company Reputation

Being associated with criminal activity can damage brand credibility and erode customer trust.

✔ Minimizes Operational Risk

A strong CDD program reduces the likelihood of penalties, financial losses, and internal fraud.

✔ Improves Customer Trust

When customers see that a business takes security seriously, it increases confidence in the company’s reliability.

3. The Main Customer Due Diligence Requirements

CDD requirements can vary slightly by jurisdiction, but globally they follow similar principles defined by the Financial Action Task Force (FATF). The core requirements include:

1. Customer Identification and Verification (KYC)

Businesses must collect customer information such as:

-

Full legal name

-

Date of birth

-

Address

-

Identification number

-

Government-issued ID or passport

This step is part of Know Your Customer (KYC), which forms the foundation of CDD.

2. Beneficial Ownership Identification

For corporate or business clients, companies must identify the “ultimate beneficial owners” (UBOs)—the individuals who ultimately own or control the entity.

This prevents criminals from hiding behind shell companies.

3. Understanding the Purpose and Nature of the Business Relationship

Companies must understand why the customer is opening an account or using the service. This includes:

-

Intended use of the account

-

Expected transaction patterns

-

Source of funds

This information helps assess the customer’s risk profile.

4. Ongoing Monitoring of Customer Activity

CDD doesn’t end after onboarding. Businesses must monitor:

-

Large or unusual transactions

-

Inconsistent patterns

-

High-risk activity

-

Cross-border transfers

Ongoing monitoring ensures that customer behavior aligns with the initial risk assessment.

5. Risk Assessment and Risk-Based Approach

CDD requires businesses to classify customers as:

-

Low-risk

-

Medium-risk

-

High-risk

High-risk customers require enhanced due diligence and deeper investigation.

4. Levels of Customer Due Diligence

Not all customers pose the same level of risk. Because of this, regulators allow different levels of CDD depending on the type of customer and transaction.

1. Simplified Due Diligence (SDD)

Used for low-risk customers, such as:

-

Public companies

-

Government agencies

-

Customers from low-risk jurisdictions

SDD involves basic identity verification without extensive background checks.

2. Standard Customer Due Diligence (CDD)

The default level applied to most customers. It includes:

-

Full identity verification

-

Basic background checks

-

Initial risk assessment

This applies to most individuals and small businesses.

3. Enhanced Due Diligence (EDD)

Required for high-risk individuals or entities such as:

-

Politically Exposed Persons (PEPs)

-

High-net-worth clients from high-risk jurisdictions

-

Cryptocurrency users in certain scenarios

-

Businesses in industries prone to money laundering

-

Customers with suspicious transaction patterns

EDD includes:

-

Additional documentation

-

In-depth verification

-

Source-of-funds or source-of-wealth checks

-

Senior management approval

-

More frequent monitoring

5. Who Must Comply With CDD Requirements?

Many industries are legally required to perform CDD. These include:

-

Banks and credit unions

-

Fintech companies

-

Cryptocurrency exchanges and wallet providers

-

Money service businesses (MSBs)

-

Accounting and bookkeeping firms

-

Lawyers and legal service providers

-

Insurance companies

-

Real estate agents and property managers

-

Lending platforms

-

Investment firms and brokers

Even non-financial businesses may be required to perform CDD depending on local laws.

6. Key Documents Used in Customer Due Diligence

Common documents collected during CDD include:

For Individuals

-

Passport

-

National ID card

-

Driver’s license

-

Utility bills

-

Bank statements

-

Tax identification numbers

For Companies

-

Certificate of incorporation

-

Articles of association

-

Tax registration records

-

Business licenses

-

Shareholder registers

-

Beneficial ownership declarations

Collecting accurate documentation is crucial to prevent identity fraud and impersonation.

7. Regulatory Agencies Behind CDD Requirements

Several global and local regulatory bodies enforce CDD rules. The most notable include:

-

FATF (Financial Action Task Force) – sets global AML standards

-

FinCEN (US)

-

FCA (UK)

-

EU AML Directives (Europe)

-

AUSTRAC (Australia)

-

MAS (Singapore)

Each country creates its own laws based on FATF recommendations.

8. What Is Ongoing Monitoring and Why Is It Important?

Ongoing monitoring is a continuous process of checking whether customer activity aligns with expected behavior. It involves:

-

Monitoring high-value transactions

-

Screening against sanctions lists

-

Reviewing for unusual or suspicious activity

-

Updating customer records periodically

If red flags appear, businesses may need to file a Suspicious Activity Report (SAR).

Ongoing monitoring ensures long-term compliance and dramatically reduces the risk of financial crime going undetected.

9. Red Flags and Risk Indicators in Customer Due Diligence

Businesses should look out for signs such as:

-

Customers reluctant to provide documentation

-

Transactions inconsistent with customer profile

-

Sudden unusual transfers

-

Cross-border activity involving high-risk countries

-

Use of complex ownership structures

-

Unusually large cash deposits

-

Frequent foreign currency exchanges

-

Transactions with no clear business purpose

Identifying these red flags early allows companies to take action before major issues occur.

10. How Technology Improves the CDD Process

Modern businesses increasingly use automation and digital tools to manage CDD more efficiently. Technology can help with:

✔ Digital Identity Verification

Using biometrics, document scanning, and AI to verify identity quickly.

✔ Automated Sanctions Screening

Instant checks against global watchlists, including OFAC, UN, and EU lists.

✔ Ongoing Monitoring Automation

Real-time alerts for suspicious behavior or rule-breaking transactions.

✔ Risk Scoring

Advanced algorithms evaluate customer risk profiles automatically.

✔ Streamlined Onboarding

Faster, smoother processes enhance customer experience.

Digital CDD not only improves compliance but also reduces costs and human error.

11. Best Practices for Building an Effective CDD Program

✔ Implement a Risk-Based Approach

Focus more resources on high-risk customers instead of applying equal scrutiny across all accounts.

✔ Keep Policies Updated

Regulations change frequently. Businesses must update CDD processes to stay compliant.

✔ Train Employees Regularly

Staff must recognize red flags and understand compliance responsibilities.

✔ Maintain Accurate Records

Documentation must be stored securely and retained according to local legal requirements.

✔ Use Reliable Technology

Automated systems reduce manual errors and provide real-time monitoring.

✔ Conduct Periodic Reviews

Regular audits ensure the CDD program remains effective.

12. Common Challenges Businesses Face With CDD

Despite its importance, CDD comes with several challenges:

-

Manual processes slow down customer onboarding

-

High administrative costs

-

Difficulty verifying international customers

-

Complex ownership structures

-

Evolving regulatory requirements

-

Data privacy concerns

Using technology and a risk-based approach can help solve many of these issues.

13. The Future of Customer Due Diligence

CDD is rapidly evolving as technology transforms how identity verification and risk assessment work. Future trends include:

➤ AI and Machine Learning

These tools will enhance fraud detection and predict suspicious behavior.

➤ Blockchain for Identity Verification

Decentralized identity could revolutionize KYC and CDD processes.

➤ Global Standardization

More countries will align with FATF guidelines.

➤ Enhanced Real-Time Monitoring

Faster detection of unusual activity will help prevent financial crime before it occurs.

Businesses that adapt early will gain a competitive advantage and reduce compliance risks.

Conclusion

Customer Due Diligence (CDD) is no longer optional—it’s a vital component of any business operating in a regulated environment. By verifying customer identity, assessing risk levels, monitoring transactions, and understanding customer intent, businesses strengthen their defenses against money laundering, terrorism financing, and fraud.

A strong CDD program not only ensures regulatory compliance but also enhances brand trust and protects the company from reputational and financial harm. With increasing regulatory pressure and advanced financial crime, organizations must prioritize CDD, adopt modern technologies, and implement risk-based frameworks to stay secure and compliant.