In today’s fast-evolving digital landscape, deepfake detection is becoming more sophisticated than ever. With the rapid growth of AI-generated deepfakes—hyper-realistic synthetic videos, images, and audio—the risk to businesses, governments, and individuals continues to escalate. Traditional verification methods are no longer enough. Organizations must now adopt advanced identity-proofing solutions that blend deepfake detection, biometric identity verification, and secure document authentication into one unified strategy.

This comprehensive guide explores how these technologies work, why they’re essential, and how modern tools like the MiniAI Deepfake Detection SDK are empowering developers and businesses to fight deepfake-based fraud at scale.

Financial institutions are facing a rapidly evolving fraud landscape. According to our Global Fraud Report, 96% of fraud prevention experts are concerned about the growing industrialisation of fraud, and 79% report a sharp rise in the sophistication of fraud attacks in the past year. With these escalating threats, relying on basic verification methods is no longer enough to safeguard institutions.

Deepfake Detection: Combating the Globalisation of Fraud

Fraud has become a global threat that crosses borders and impacts financial institutions in every region. Recent reports show that fraud is increasingly industrialised, highly coordinated, and spreading faster than ever—often evolving through new technologies that enable more sophisticated attacks. According to the Association of Certified Fraud Examiners (ACFE), businesses worldwide lose an estimated 5% of their annual revenue to fraudulent activity, highlighting the scale of the problem.

Fraudsters Are Turning to Deepfakes

Our Global Fraud Report reveals that more than half of respondents in EMEA have experienced a rise in fraud attempts, with 71% expressing significant concern about deepfake-based attacks. As deepfake technology becomes more accessible, fraudsters are using AI-generated faces, voices, and videos to bypass traditional identity checks—creating a new era of digital impersonation.

Regulations Like DORA Highlight the Need for Digital Resilience

The European Union’s Digital Operational Resilience Act (DORA) reinforces the critical importance of digital resilience and advanced fraud prevention. Financial institutions may need to allocate €5 million to €15 million to meet compliance requirements and strengthen their fraud defenses. This regulatory pressure adds to the urgency for banks and fintechs to adopt more robust identity verification technologies.

Why Advanced Deepfake Detection and Identity Proofing Are Essential

To reduce the rising costs of fraud and regulatory compliance, financial institutions must be able to answer two fundamental questions with confidence:

-

Can I trust that the person on the screen is real?

-

Can I trust that the ID being presented is authentic and untampered?

Basic verification methods are no longer sufficient. Institutions must deploy advanced identity proofing and AI-driven deepfake detection capable of identifying synthetic identities, manipulated videos, and forged documents—regardless of geography or attack vector.

Modern deepfake detection technology ensures that organizations can reliably verify users, prevent impersonation, and maintain digital trust in an increasingly hostile fraud environment.

Synthetic Identities: The Same Threat, New Tricks

Synthetic identity fraud (SIF) has quickly become one of the most dangerous and costly fraud vectors facing financial institutions worldwide. As fraudsters adopt new tactics and advanced technology, detecting and preventing SIF is now essential for any institution looking to protect its customers and reduce financial risk. In the United States alone, Deloitte estimates the average payoff from a synthetic identity fraud attack is between $81,000 and $98,000, underscoring the scale and profitability of these schemes.

Rising Concerns Among U.S. Financial Institutions

According to our Global Fraud Report, 79% of U.S.-based financial institutions are increasingly concerned about the surge in synthetic identity fraud. A major driver of this rise is the growing use of generative AI, which enables fraudsters to create synthetic identities that appear far more realistic, consistent, and difficult to detect with traditional verification methods.

Modern fraudsters now combine fabricated personal data with AI-generated faces, documents, and behavioral profiles to create synthetic personas sophisticated enough to pass basic onboarding checks. This evolution makes SIF a persistent and high-impact threat across the financial services industry.

Why Synthetic Identity Fraud Is So Difficult to Defeat

Unlike stolen identities, synthetic identities often don’t belong to real individuals—making them harder to trace and even harder to flag. These fabricated personas can build credit histories, open accounts, and behave normally for months or years before executing a major fraud event. The combination of long-term buildup and high eventual payoff makes SIF both lucrative and challenging to stop.

Taking a Proactive Approach with the Right Tools

Despite its complexity, synthetic identity fraud is not unbeatable. With advanced identity proofing, deepfake detection, and AI-driven document authentication, financial institutions can detect inconsistencies, uncover fabricated personas, and block fraudulent accounts before they enter the system.

By adopting the right fraud prevention technologies, FIs can move from reactive defenses to proactive protection, significantly reducing the risk and financial losses associated with synthetic identities.

Biometric Deepfake Detection & ID Verification: A Powerful Solution Against Modern Fraud

Deepfakes, synthetic identities, and increasingly sophisticated fraud tactics are creating serious challenges for financial security worldwide. Fraud is no longer a local issue—it’s become industrialised, globalised, and accelerated by advances in generative AI. As these threats evolve, financial institutions must adopt stronger, more intelligent identity verification solutions.

A Global Rise in Synthetic Identity and Deepfake Threats

While synthetic identity fraud is a major issue in the United States, it is far from a U.S.-only challenge. Fraud prevention professionals across APAC, EMEA, and North America report growing concern about generative AI’s ability to create highly realistic synthetic identities capable of bypassing traditional verification systems.

In the U.S., the Financial Crimes Enforcement Network (FinCEN) has reported a significant increase in suspicious activity involving deepfake media—including AI-generated faces and fraudulent identity documents designed to fool legacy authentication tools.

Adding to the urgency, our Global Fraud Report reveals that 77% of U.S. respondents experienced financial losses linked to AI-generated voice deception, a clear indication that fraudsters are rapidly scaling their use of synthetic media.

Why Biometric Identity Verification Is Essential

As fraud becomes more technologically advanced, biometric identity verification stands out as a critical solution. Unlike static methods such as passwords, PINs, or basic ID checks, biometrics rely on unique physical traits—such as facial structure, voice, or behavioral patterns—that are far more difficult to replicate or forge.

By integrating biometric verification with advanced deepfake detection and AI-powered document authentication, financial institutions can prevent synthetic identities, stop deepfake-driven impersonation attempts, and ensure that the person on the screen is a real, verified human—not an AI-generated impostor.

Introducing the MiniAI Deepfake Detection SDK

As deepfake threats become more advanced, organizations need reliable tools that can be deployed quickly and operate efficiently. The MiniAI Deepfake Detection SDK addresses this growing challenge with an AI-powered toolkit built to detect manipulated images and videos in real time.

MiniAI provides developers, enterprises, and security platforms with a lightweight, high-performance solution that seamlessly integrates into:

-

Identity verification systems

-

Biometric authentication workflows

-

Mobile and web applications

-

Large-scale enterprise fraud detection pipelines

The SDK is engineered using state-of-the-art machine learning and computer vision technologies capable of identifying synthetic faces, face-swapped videos, manipulated textures, and other anomalies often overlooked by traditional verification methods. Its optimized and compact model architecture allows high-speed inference without requiring heavy compute resources, making it ideal for both cloud-based and on-device deployments.

Key Highlights of the MiniAI Deepfake Detection SDK

1. Real-Time Deepfake Detection

The SDK detects pixel-level inconsistencies across facial movements, lighting patterns, blending artifacts, and texture irregularities to identify fake media with high accuracy.

2. Developer-Friendly Integration

MiniAI supports multiple platforms and offers flexible APIs, enabling fast integration into:

-

Android & iOS apps

-

Web-based authentication flows

-

Cloud/on-premise systems

3. Lightweight & High-Performance

The SDK delivers fast and stable performance, making real-time deepfake detection possible without overloading system resources.

4. Enhances Biometric Verification Systems

MiniAI integrates seamlessly with existing KYC and biometric identity verification workflows, ensuring that every selfie, video, or live capture is authentic—not AI manipulated.

5. Enterprise-Ready Scalability

Trusted for high-volume environments, the SDK scales efficiently for banks, telecom providers, government services, healthcare systems, and global identity platforms.

Comprehensive Biometric ID & Document Intelligence

The global fight against financial fraud is increasingly complex, with no single solution capable of addressing every threat. As fraud becomes more sophisticated and widespread, financial institutions must adopt a multi-layered, modern approach to identity verification.

By combining biometric ID verification, advanced document intelligence, and AI-driven fraud detection, organizations can create a secure, seamless customer journey—one that protects users while maintaining trust, speed, and compliance in an evolving digital landscape.

Stronger Identity Verification Through a Multi-Layered Approach

Document authentication and biometric verification deliver the greatest protection when combined within a multi-layered identity verification strategy. By leveraging diverse data sources, global intelligence, and advanced fraud signals, financial institutions can confidently detect threats and verify customers at scale.

1. Test identities for trust and fraud signals

Our cross-industry MiniAI connects more than 1,000 global brands across 28 sectors, giving you access to billions of identity insights. This expansive intelligence enables early detection of suspicious behavior and empowers you to assess trustworthiness beyond your own internal data.

2. Fight global fraud with an extensive document library

Strengthen your defenses with access to a global library of 8,500+ government-issued identity documents across 195 countries. This comprehensive coverage makes it possible to verify customers anywhere in the world and detect fraudulent or tampered documents with precision.

3. Simplify your tech stack with integrated biometrics and document solutions

Future-proof your fraud strategy by unifying data, documents, biometrics, risk signals, and fraud modules within MiniAI, our all-in-one identity platform. This streamlined approach reduces complexity, improves efficiency, and ensures consistency across your verification workflows.

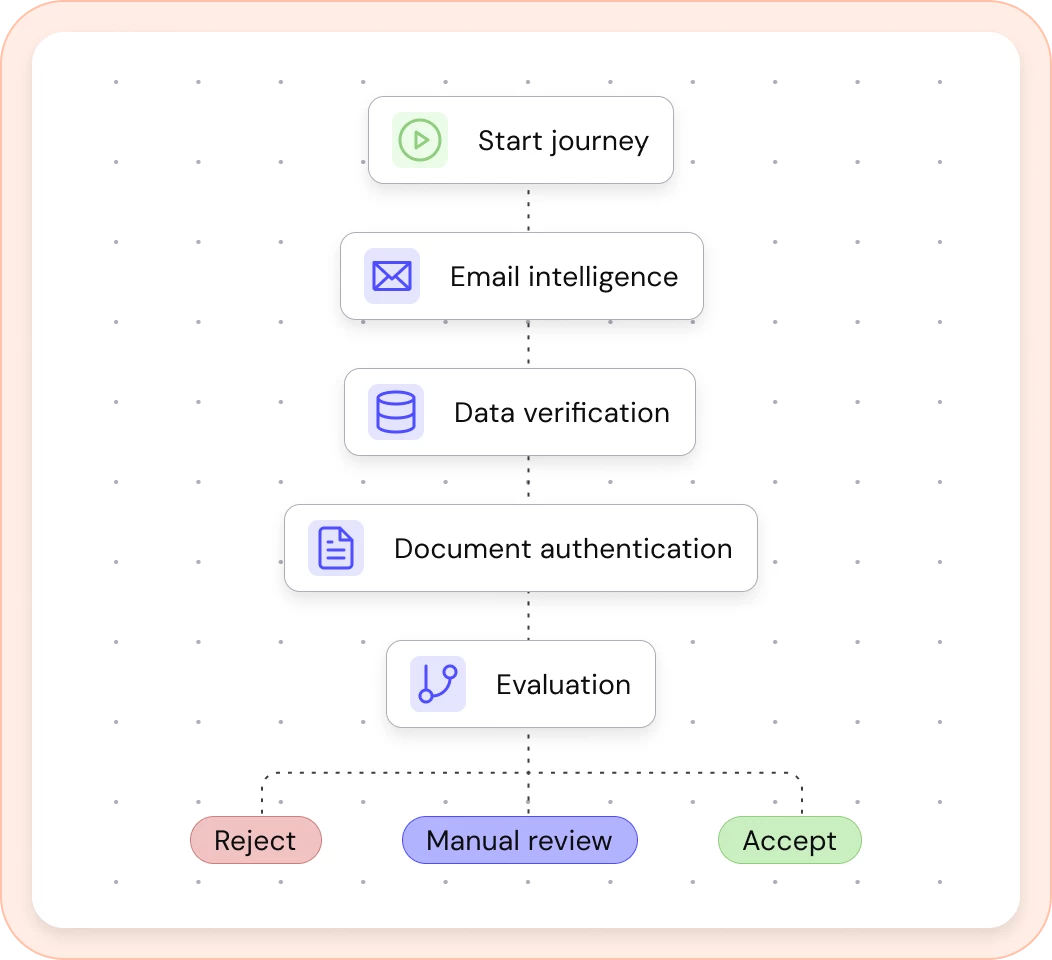

4. Get to market faster with ready-made customer journeys

Accelerate deployment using our pre-built customer journey templates, designed around the most common digital identity verification and fraud prevention use cases. Launch faster with proven flows that reduce friction and enhance customer experience from day one.

Build Smarter, More Secure Identity Journeys with Biometric ID Validation and Document Authentication

By integrating biometric ID validation and document authentication into a seamless end-to-end workflow, financial institutions can deliver a fast, secure and frictionless identity proofing experience. When these capabilities work together, organisations are fully equipped to design and deploy intelligent, adaptive customer journeys that enhance trust while reducing fraud.

Start with confidence

MiniAI empowers you to begin your identity journey with confidence. Choose from a range of industry-specific, country-specific, or identity standard templates designed to address today’s compliance, risk, and fraud prevention challenges. Prefer complete flexibility? Start with a blank canvas and design your workflow from the ground up.

Whether you select a pre-built template or customise your journey from scratch, MiniAI gives you the tools to build verification flows that align with your business goals, regulatory requirements, and risk appetite from day one.

Add intelligence with ease

MiniAI makes it simple to integrate advanced verification capabilities with drag-and-drop precision. Incorporate identity verification, fraud detection, risk assessment, and biometric checks directly into your customer flow—ensuring every step is both secure and seamless for genuine users.

Tailor outcomes to your risk appetite

Every organisation manages risk differently. MiniAI allows you to customise your journey by:

-

Adjusting labels and risk markers

-

Selecting verification variants

-

Defining acceptance, review, and rejection criteria

This ensures your identity workflow supports your risk tolerance, compliance requirements, and fraud prevention strategy with precision.

Make smarter decisions with intelligent evaluations

MiniAI’s intelligent evaluation checkpoints guide each customer through the most appropriate verification path based on their risk profile. This dynamic decisioning strengthens security while preserving a smooth, user-friendly experience.

Maximise ROI with adaptive routing

MiniAI’s adaptive routing helps balance conversion and security by automatically responding to risk signals:

-

Accept low-risk users instantly

-

Reject high-risk identities

-

Route medium-risk profiles to enhanced verification—including document authentication or biometric facial matching

This systematic approach optimises operational efficiency, reduces friction, and improves fraud detection accuracy.

Deploy with peace of mind

MiniAI provides dedicated preview and production environments, allowing you to test, refine, and validate your identity journeys before they go live. This ensures every update meets your operational, compliance, and security standards—without disrupting your user experience.

The result: intelligent, data-driven identity journeys that build trust

With MiniAI’s powerful combination of biometric identity verification, document authentication, and adaptive risk decisioning, organisations can deliver dynamic, data-driven identity journeys that protect against evolving fraud threats. The result is a secure, scalable solution that boosts customer trust and satisfaction at every touchpoint.

What Are Deepfakes and Why Are They a Threat?

Deepfakes are AI-generated media created using deep learning algorithms capable of producing realistic images, videos, and audio that mimic real people. While the underlying technology has legitimate applications in entertainment and education, it has also opened the door to unprecedented fraud.

Common Risks Posed by Deepfakes

-

Identity Theft

Criminals can generate fake selfies or videos to impersonate legitimate users. -

Financial Fraud

Executives or customers can be impersonated to authorize illegal transactions. -

Social Engineering

Deepfake audio can mimic someone’s voice to trick employees or customers. -

Political Manipulation

Fake political statements or fabricated content can influence public opinion. -

Reputational Damage

Individuals or brands may be targeted with falsified media designed to mislead and harm.

These threats create significant challenges for digital trust and security—making reliable detection tools like MiniAI essential.

Why Biometric Identity Verification Is the New Standard

Biometric identity verification relies on unique biological or behavioral traits such as facial patterns, fingerprints, iris scans, or voice signatures to confirm identity. Unlike passwords or ID numbers, biometrics cannot be easily forged or stolen.

Benefits of Biometric Verification

-

High accuracy and reliability

-

Reduced fraud risk

-

Smooth user onboarding

-

Compliance with KYC, AML, and global identity regulations

-

Faster verification processes

When combined with deepfake detection tools such as the MiniAI SDK, biometric verification becomes significantly more secure.

The Role of Secure Document Authentication

Document authentication is the first step in most identity verification flows. It ensures that a user’s ID document—passport, driver’s license, national ID, etc.—is authentic and unaltered.

How AI-Based Document Authentication Works

-

User captures their ID document.

-

AI analyzes fonts, patterns, holograms, and security features.

-

System detects forged, altered, or photoshopped content.

-

Biometric and document data are cross-checked.

This ensures fraudulent IDs don’t enter your system.

How Deepfake Detection Complements Biometrics

Deepfake detection adds a critical layer of security to biometric verification. Modern AI detectors examine the user’s selfie or video to identify if it is:

-

AI-generated

-

Face-swapped

-

Manipulated or retouched

-

Generated by adversarial models

With deepfake attacks rising, a robust detector like MiniAI Deepfake Detection SDK is essential to stop synthetic identity fraud.

The Power of Combining Deepfake Detection, Biometrics & Document Authentication

Individually, each technology provides some level of protection. Combined, they deliver enterprise-grade identity security.

Benefits of the Unified Approach

-

Enhanced fraud prevention through multi-layer analysis

-

Automated identity proofing requiring minimal manual review

-

Regulatory compliance for global KYC/AML standards

-

Frictionless onboarding for legitimate users

-

Robust defense against AI-driven fraud

This combined strategy is the future of digital identity verification.

Practical Use Cases Across Industries

1. Banking & Fintech

-

Remote KYC onboarding

-

Real-time transaction verification

-

Prevention of account takeovers

2. Government & Public Sector

-

e-Government identity systems

-

Passport and visa validation

-

Voter identity checks

3. Healthcare & Telemedicine

-

Patient identity verification

-

Secure portal access

-

Insurance fraud prevention

4. E-Commerce & Marketplaces

-

Seller/buyer verification

-

Anti-scam security layers

-

Trust-building for users

5. Enterprise & Workforce Security

-

Remote employee onboarding

-

Access control

-

Eliminating impersonation risks

How These Systems Work Together During a Typical Verification Flow

-

User uploads an ID document.

-

AI verifies document authenticity.

-

User takes a selfie or video.

-

Deepfake detection (via MiniAI SDK) ensures media is genuine.

-

Biometrics compare the face to the document photo.

-

Identity is verified with high confidence.

This multi-step approach significantly reduces fraud.

Future Trends in Identity Security

-

AI-powered real-time detection tools becoming mainstream

-

Decentralized identity frameworks with embedded biometrics

-

Voice and behavioral biometrics for multi-modal verification

-

Continuous authentication replacing one-time checks

Deepfake defense tools like the MiniAI SDK will play a central role in this evolution.

Conclusion: Strengthening Digital Trust with Advanced Identity Verification

The rise of deepfakes has transformed the threat landscape for identity verification. Organizations must now combine deepfake detection, biometric verification, and secure document authentication to stay secure.

The MiniAI Deepfake Detection SDK adds a crucial layer of protection, empowering businesses to accurately detect synthetic media and prevent identity fraud in real time. With its lightweight design, seamless integration, and enterprise scalability, MiniAI is a powerful solution for modern identity security challenges.

As digital transformation accelerates, adopting these advanced verification technologies is not optional—it is essential for building trust, preventing fraud, and protecting users across every industry.

Frequently Asked Questions

How does document authentication help prevent financial fraud?

Document authentication uses advanced technologies—such as artificial intelligence, machine learning, and computer vision—to verify the legitimacy of identity documents. These systems analyze security features, detect signs of tampering, and identify forged or altered information. By validating documents at the point of onboarding, financial institutions can stop fraudulent attempts before they lead to financial loss or reputational damage.

Is biometric ID verification more secure than traditional methods?

Yes. Biometric identity verification is significantly more secure than traditional methods such as passwords, PINs, or knowledge-based questions. Biometrics leverage unique biological and physiological traits—including fingerprints, facial recognition, and voice patterns—making them extremely difficult to replicate or steal.

Modern face-matching algorithms compare a user’s ID photo with a live selfie by analyzing up to 68 biometric facial landmarks, ensuring the person presenting the document is the true document owner. This creates a highly accurate and secure method of confirming identity, reducing the risk of unauthorized access and identity fraud.

Can biometric ID verification improve the customer experience?

Absolutely. Most biometric verification processes take only a few seconds, offering fast, frictionless, and highly secure identity checks. Because biometrics eliminate the need for passwords, PINs, or cumbersome security questions, they simplify user authentication and reduce friction during onboarding or login.

Biometric systems offer convenience without compromising security—customers carry their identity credentials with them naturally, making verification seamless, intuitive, and resistant to imposters.