Digital identity verification technology ensures secure and efficient user authentication online. It prevents fraud by validating user identities in real-time.

Digital identity verification technology has revolutionized online security. It verifies user identities using advanced methods like biometrics, document scanning, and artificial intelligence. This technology reduces fraud, enhances user trust, and streamlines digital processes. Online businesses and financial institutions widely adopt it to ensure secure transactions.

It also helps in complying with regulatory requirements, protecting sensitive data, and offering a seamless user experience. By leveraging this technology, companies can safeguard their systems and build stronger relationships with their customers. As digital interactions continue to grow, the importance of robust identity verification becomes even more critical.

Key Technologies Of Digital Identity Verification

Digital Identity Verification Technology is evolving rapidly. Key technologies drive this change. These technologies ensure secure and efficient identification processes. Below are two critical technologies enhancing digital identity verification.

Biometrics

Biometrics uses unique physical traits to verify identities. Common biometric methods include:

- Fingerprint Scanning: Scans and matches fingerprints.

- Facial Recognition: Analyzes facial features.

- Iris Scanning: Examines the eye’s iris pattern.

These methods offer high security. They are hard to fake. Biometrics provide quick and reliable verification. Users can access services without remembering passwords.

Blockchain

Blockchain technology secures digital identities. It uses a distributed ledger. This ledger records transactions in a secure, immutable way. Key features of blockchain include:

| Feature | Description |

| Decentralization | Data is stored across many nodes. |

| Transparency | Transactions are visible to all users. |

| Security | Each transaction is encrypted. |

Blockchain reduces the risk of data breaches. It ensures data integrity. Users can trust their information is safe.

Biometric Verification

Biometric verification uses unique biological traits to verify identities. It ensures high security and accuracy. This technology makes identity fraud almost impossible. Let’s explore some popular methods.

Facial Recognition

Facial recognition scans a person’s face to confirm their identity. This technology captures unique facial features. It matches these features with a stored database.

Facial recognition is fast and user-friendly. It is widely used in smartphones, airports, and secure facilities. Here are some key points:

- High accuracy

- Easy to use

- Non-invasive

Fingerprint Scanning

Fingerprint scanning is another popular biometric method. It captures the unique patterns on a person’s fingertip. This data is then compared to a stored template.

Fingerprint scanning is reliable and quick. It’s commonly used in mobile phones, banking, and access control. Key benefits include:

- High precision

- Fast processing

- Convenient for users

| Biometric Method | Advantages | Use Cases |

| Facial Recognition | High accuracy, Easy to use, Non-invasive | Smartphones, Airports, Secure facilities |

| Fingerprint Scanning | High precision, Fast processing, Convenient | Mobile phones, Banking, Access control |

Blockchain Applications

Blockchain technology is transforming digital identity verification. Its unique features offer new ways to secure personal data. Blockchain applications provide more control over digital identities.

Decentralized Identity

Decentralized identity uses blockchain to manage identities without a central authority. Each user has control over their own data. They can share only what is necessary. This reduces the risk of identity theft.

Traditional systems store data in central databases. These are vulnerable to attacks. Decentralized identity removes this risk. It stores data across a network of nodes. This makes it harder for hackers to access.

Security Benefits

Blockchain enhances security in many ways. It uses cryptographic algorithms to protect data. Each transaction is verified by multiple nodes. This ensures the data’s integrity.

Below is a table highlighting key security benefits of blockchain:

| Security Feature | Benefit |

| Cryptographic Algorithms | Protects data from unauthorized access |

| Decentralization | Reduces single points of failure |

| Immutable Ledger | Ensures data integrity and transparency |

| Multi-Factor Authentication | Enhances user verification processes |

Blockchain also supports multi-factor authentication. This adds an extra layer of security. Users must provide multiple forms of verification. This makes it harder for unauthorized users to gain access.

Artificial Intelligence

Artificial Intelligence (AI) transforms digital identity verification technology. AI enhances accuracy, speed, and security in identity verification. It powers advanced tools that ensure seamless and secure user experiences.

Machine Learning

Machine Learning (ML) is a subset of AI. ML algorithms learn from data patterns. They improve over time without human intervention. In digital identity verification, ML analyzes vast amounts of data. It identifies unique patterns that signify legitimate identities.

ML models use various data points, such as:

- Facial recognition

- Voice patterns

- Behavioral biometrics

These models adapt and evolve, offering more accurate results. The adaptability of ML is crucial. It helps in mitigating emerging threats and maintaining robust security.

Fraud Detection

Fraud Detection is a critical aspect of identity verification. AI excels at detecting fraudulent activities. It processes and analyzes data at lightning speed. AI can identify suspicious patterns and anomalies that humans might miss.

Key methods AI uses for fraud detection include:

- Analyzing transaction histories

- Monitoring user behavior

- Flagging unusual activities

AI tools cross-reference multiple data sources. They ensure comprehensive fraud detection. This multi-layered approach minimizes false positives and enhances security.

| Technology | Function |

| Machine Learning | Analyzes data patterns |

| Fraud Detection | Identifies suspicious activities |

AI-driven digital identity verification ensures a safer online environment. It combines speed, accuracy, and security to protect user identities effectively.

Use Cases Of Digital Identity Verification Technology

Digital Identity Verification Technology has transformed many industries. This technology ensures secure and efficient identity verification. Here, we explore its use in Financial Services and Healthcare.

Financial Services

Financial institutions use Digital Identity Verification to safeguard transactions. This technology helps prevent fraud and ensures compliance with regulations.

- Account Opening: Verify customer identity quickly and securely.

- Loan Approvals: Ensure applicants are genuine and reduce risks.

- Fraud Detection: Identify and mitigate fraudulent activities.

The table below highlights key benefits:

| Benefit | Description |

| Efficiency | Speeds up verification processes. |

| Security | Enhances protection against fraud. |

| Compliance | Meets regulatory requirements. |

Healthcare

In Healthcare, Digital Identity Verification ensures patient information is accurate. It helps maintain data integrity and enhances patient safety.

- Patient Registration: Authenticate patient identity securely.

- Telemedicine: Verify patient identity during online consultations.

- Medical Records: Ensure only authorized access to patient records.

Below are some key advantages:

- Accuracy: Ensures correct patient information.

- Security: Protects sensitive health data.

- Convenience: Streamlines patient verification processes.

Regulatory Landscape

Digital identity verification technology is growing fast. Regulatory bodies are setting laws to ensure data privacy and security. Understanding these regulations is crucial for businesses.

Data Privacy Laws

Data privacy laws protect personal information. These laws vary by region. The General Data Protection Regulation (GDPR) in Europe is one of the strictest. It requires companies to protect user data.

In the US, the California Consumer Privacy Act (CCPA) gives residents more control over their data. These laws ensure that data is collected and used responsibly.

Compliance Challenges

Businesses face challenges in complying with these laws. They need to understand the regulations in each region they operate. This can be complex and time-consuming.

Here are some common compliance challenges:

- Keeping up with changing laws

- Ensuring data security and encryption

- Managing user consent and data access

Companies must invest in technology and training. This helps them stay compliant and avoid fines.

Consumer Trust

Digital Identity Verification Technology plays a crucial role in building consumer trust. Consumers need to feel safe and secure while using online platforms. This is where digital identity verification comes into play. By ensuring that only verified users can access services, companies can build stronger relationships with their customers.

User Experience

A seamless user experience is vital for consumer trust. Simple and quick verification processes improve user satisfaction. Long and complicated procedures can frustrate users, leading to loss of trust. User-friendly interfaces make the process less daunting.

Many companies use biometric authentication methods like fingerprint or facial recognition. These methods are fast and reliable. They make the verification process smoother and more secure. This adds to a positive user experience.

Trust-building Measures

There are several trust-building measures companies can implement:

- Transparency: Inform users about data usage and storage.

- Security: Use advanced encryption methods to protect data.

- Compliance: Follow international data protection laws.

- Customer Support: Provide robust customer support for queries.

Companies often provide visible security badges on their platforms. These badges reassure users about the platform’s safety. Regular security audits and updates also help in maintaining trust.

| Measure | Importance |

| Transparency | High |

| Security | Very High |

| Compliance | High |

| Customer Support | Medium |

Implementing these measures can significantly enhance consumer trust. They ensure that users feel secure and valued. This results in stronger customer relationships and loyalty.

Challenges On Digital Identity Verification

Digital identity verification technology is crucial in today’s digital world. It ensures security and privacy in online transactions. Yet, it faces several challenges. Below, we will discuss these challenges in detail.

Technical Barriers

Technical barriers are significant in digital identity verification. One major issue is system integration. Many businesses use different systems. Integrating these systems can be complex.

Another challenge is data accuracy. Incorrect data can lead to false verifications. This can cause problems for both businesses and users.

Cybersecurity threats also pose a risk. Hackers constantly try to breach systems. This makes it hard to keep data safe.

Adoption Issues

Adoption issues arise due to various factors. First, there is a lack of awareness. Many people do not know about digital identity verification. This hinders its widespread use.

Next, there is the cost factor. Implementing this technology can be expensive. Small businesses may find it hard to afford.

Finally, there is user resistance. People may not trust new technology. They may prefer traditional methods instead.

| Challenge | Details |

| System Integration | Complex integration of different systems |

| Data Accuracy | Incorrect data leading to false verifications |

| Cybersecurity Threats | Constant threat of data breaches |

| Lack of Awareness | People unaware of digital identity verification |

| Cost Factor | High cost of implementation |

| User Resistance | Preference for traditional methods |

Future Trends

The future of Digital Identity Verification Technology promises exciting advancements. Rapid innovations are transforming how we verify identities. Let’s explore key trends shaping the future.

Emerging Technologies

Emerging technologies are redefining identity verification processes. Here’s a look at some of the most promising:

- Biometric Authentication: Uses physical traits like fingerprints or facial recognition.

- Blockchain Technology: Ensures secure and tamper-proof identity records.

- Artificial Intelligence: Enhances accuracy with machine learning algorithms.

- Behavioral Biometrics: Analyzes unique behavior patterns for verification.

Market Predictions

The market for digital identity verification is growing rapidly. Below are some predictions:

| Year | Market Size (Billion USD) |

| 2023 | 10.5 |

| 2025 | 15.8 |

| 2030 | 25.4 |

Key factors driving this growth include:

- Increased Cybersecurity Threats: Demand for robust verification methods rises.

- Regulatory Compliance: Governments enforce stricter identity checks.

- Technological Advancements: New technologies make processes faster and secure.

Case Studies

Digital Identity Verification Technology is revolutionizing many industries. Case studies offer a deeper understanding of its real-world applications. Here, we explore successful implementations and lessons learned.

Successful Implementations

Many companies have successfully integrated Digital Identity Verification Technology.

- Bank of America: Reduced fraud by 40% using biometric verification.

- Uber: Implemented facial recognition to verify drivers, enhancing safety.

- Airbnb: Enhanced user trust with document verification, boosting user confidence.

Lessons Learned

Implementing Digital Identity Verification Technology offers valuable lessons.

| Company | Lesson |

| Bank of America | Biometric data requires robust security measures. |

| Uber | Regular updates improve verification accuracy. |

| Airbnb | Customer education is key to adoption. |

Bank of America learned the importance of protecting biometric data. Strong security measures are essential to avoid breaches.

Uber discovered that regular software updates are crucial. These updates improve the accuracy of facial recognition technology.

Airbnb found that educating customers is vital. Users need to understand the verification process for smooth adoption.

Security Concerns

In the digital age, identity verification technology is crucial. Yet, it brings security concerns that must be addressed. These concerns can impact both individuals and businesses. Understanding these issues is key to safeguarding information.

Potential Risks

Digital identity verification has several potential risks. The most alarming risk is data breaches. Hackers can access sensitive personal information. This can lead to identity theft and financial loss.

Another risk is phishing attacks. These attacks trick users into giving away their credentials. Phishing can be hard to detect, making it a significant threat.

Also, there is the risk of system vulnerabilities. Weaknesses in the verification systems can be exploited. This can compromise the integrity of the entire process.

Mitigation Strategies

There are several strategies to mitigate these risks. The first strategy is encryption. Encrypting data makes it difficult for hackers to access information. It is a strong defense against data breaches.

Multi-factor authentication (MFA) is another effective strategy. MFA requires multiple forms of verification. This makes it harder for unauthorized users to gain access.

Regular security audits are also essential. These audits help identify and fix system vulnerabilities. Keeping systems updated ensures they remain secure.

| Potential Risk | Mitigation Strategy |

| Data Breaches | Encryption |

| Phishing Attacks | Multi-Factor Authentication |

| System Vulnerabilities | Regular Security Audits |

By understanding these risks and implementing mitigation strategies, the integrity of digital identity verification can be maintained.

Global Impact Of Digital Identity Verification

Digital Identity Verification Technology is changing the world. It helps in many ways. It secures online transactions, protects personal data, and stops fraud. This technology makes our lives easier and safer. It has a global impact on economies and societies. Let’s explore its benefits.

Economic Benefits

Digital Identity Verification Technology boosts economies worldwide. It reduces the cost of identity theft. It also helps businesses by reducing fraud. This technology speeds up customer verification. It saves time and money.

Banks and financial institutions benefit a lot. They can verify customers quickly. This reduces the risk of fraud and loss. It also helps in compliance with regulations.

| Sector | Economic Benefits |

| Banking | Reduced fraud, compliance ease |

| E-commerce | Faster transactions, secure payments |

| Healthcare | Protected patient data, efficient services |

Societal Changes

Digital Identity Verification Technology brings many societal changes. It improves security and privacy for individuals. People feel safer online. This technology also makes services more accessible.

Remote areas benefit greatly. People can access banking and healthcare services online. They do not need to travel long distances. This technology also helps in digital inclusion.

- Enhanced online security

- Increased access to services

- Greater digital inclusion

Governments use this technology too. It helps in providing services efficiently. Citizens can access government services online. This saves time and resources.

Best Practices Of Digital Identity Verification

Best practices in digital identity verification technology ensure robust security and seamless user experience. Adopting these practices helps organizations protect sensitive data and build trust with users. Here we explore the key implementation guidelines and scalability considerations.

Implementation Guidelines

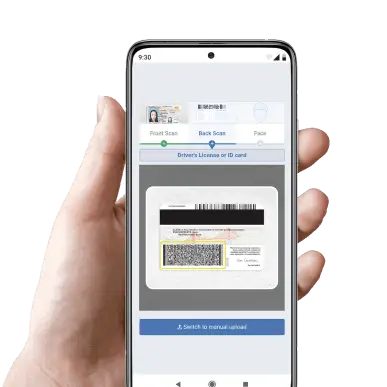

Adopt a multi-layered verification process to enhance security. Use a combination of biometric authentication, document verification, and database checks. Ensure the system is user-friendly and accessible to all users.

- Biometric Authentication: Use fingerprints, facial recognition, or iris scans.

- Document Verification: Verify government-issued IDs and passports.

- Database Checks: Cross-reference with trusted databases.

Ensure compliance with regulatory standards like GDPR and CCPA. Regularly update your technology to address new security threats. Train your staff on the latest digital identity verification techniques.

Scalability

Design the system to handle a growing number of users efficiently. Use cloud-based solutions to ensure flexibility and scalability. Implement load balancing to distribute traffic evenly across servers.

| Scalability Feature | Benefit |

| Cloud-Based Solutions | Offers flexibility and scalability |

| Load Balancing | Distributes traffic evenly |

Monitor system performance regularly to identify and address bottlenecks. Use analytics to predict future growth and scale your system accordingly.

Frequently Asked Questions

What Is Digital Identity Technology?

Digital identity technology verifies and manages individuals’ online identities. It uses biometrics, passwords, and digital certificates. This technology enhances security and privacy.

What Is Digital Identification Verification?

Digital identification verification confirms a person’s identity using electronic methods. It ensures secure access to online services. This process often involves biometric data, document scans, or two-factor authentication. Digital ID verification helps prevent fraud and enhances security. It is essential for banking, e-commerce, and other digital transactions.

How Do You Digitally Verify Your Identity?

To digitally verify your identity, use a trusted app or service. Upload your ID and take a selfie. The service will match your documents and photo. Verification is quick and secure.

What Is A Digital Identity Check?

A digital identity check verifies a person’s identity online. It uses documents, biometrics, and databases to confirm authenticity. This process ensures secure transactions and access.

Conclusion

Digital identity verification technology is crucial for secure online interactions. It protects personal data and prevents fraud. Businesses and individuals benefit from its implementation. Adopting this technology enhances trust and security. Stay ahead by embracing digital identity verification to ensure a safer digital environment.

Its importance will only grow in our increasingly digital world.

Real Estate Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.