Introduction: The Digital Identity Crisis in Fintech

In 2025, fintech companies are transforming global finance. From instant account opening to crypto trading and peer-to-peer lending, the digital experience is smoother than ever. But with this convenience comes a serious threat: identity fraud.

As fraud tactics evolve — from deepfakes to synthetic identities — basic ID verification is no longer enough. This is why ID document liveness detection is now mission-critical for any fintech company serious about security, compliance, and customer trust.

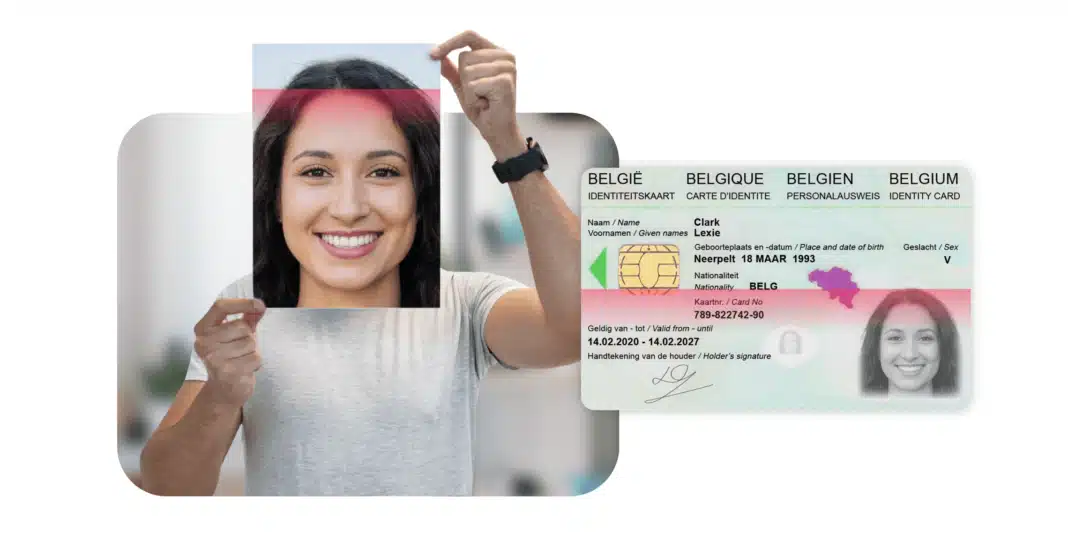

What Is ID Document Liveness Detection?

ID document liveness detection is an AI-based technique that verifies whether an ID (passport, driver’s license, etc.) is a real, physical document captured in real time, not a photo, printout, or replayed image from a screen.

Unlike traditional document scanning, this system uses:

-

Computer vision

-

Motion detection

-

3D surface estimation

-

Deep learning algorithms

Its goal: stop fraudulent documents before a fake user ever enters your system.

Why It Matters More Than Ever in 2025

1. Synthetic ID Fraud Is Exploding

Modern fraudsters combine real data (like a social security number) with fake names and AI-generated documents to create synthetic identities. These are incredibly hard to detect using OCR or image matching.

Document liveness detection analyzes:

-

Paper texture

-

Hologram behavior

-

Light reflection

-

Depth perception

This analysis reveals whether the ID is real and physically present — or not.

2. Stops Screen Replays and Photo Spoofing

Fraudsters increasingly hold up photos or screenshots of IDs to bypass weak verification systems.

Document liveness detects:

-

Moiré patterns (from screens)

-

Missing specular highlights

-

Depthless images

-

Uniform shadows

All of these signal a fake attempt.

3. Replaces Expensive Manual Review

Without automation, failed verifications fall back to manual review — expensive, slow, and error-prone.

With real-time document liveness detection:

-

Verification completes in 3–5 seconds

-

Fraudulent documents are filtered automatically

-

User onboarding is seamless

4. Regulatory Pressures Are Growing

Laws and standards like:

-

FATF AML Guidelines

-

eIDAS 2.0 in Europe

-

FinCEN KYC in the US

-

GDPR/CCPA privacy frameworks

Now require liveness, audit logs, and proof of real-time document capture in many jurisdictions.

How It Works: A Technical Breakdown

Document liveness detection combines several technologies:

1. Computer Vision & Deep Learning

Analyzes:

-

Frame-by-frame detail

-

Paper edge sharpness

-

Glare and reflection behavior

-

Holograms, microtext, seals

2. Depth and Motion Analysis

Estimates 3D structure by:

-

Monitoring hand movement

-

Measuring motion parallax

-

Detecting irregular surface distortions

3. Presentation Attack Detection (PAD)

Blocks attacks such as:

-

Paper printouts

-

Screen displays

-

Pre-recorded videos

-

Injection attacks via code

4. Sensor Fusion on Mobile Devices

Uses:

-

Phone gyroscope & accelerometer

-

Front camera + flashlight

-

Screen brightness shifts

To confirm natural, handheld motion and lighting.

Document Liveness Detection System Architecture

A real-time document liveness system follows this pipeline:

[Camera Input]

↓

[Preprocessing]

– Denoising

– Frame extraction

– Color normalization

↓

[AI Inference]

– CNN-based document detection

– Liveness classification

– PAD risk scoring

↓

[Result API]

→ JSON output: { is_live: true, score: 0.95, doc_type: “ID Card” }

This can run:

-

On-device (via SDKs)

-

In the cloud (via REST API)

-

As a hybrid solution (for low-latency, low-bandwidth use)

Why Fintech Companies Must Act Now

✅ Enhanced Fraud Prevention

Stop fraud before the account is created.

✅ Higher Conversion Rates

Faster onboarding = less drop-off.

✅ Reduced Operational Costs

Fewer manual checks = lower overhead.

✅ Full KYC/AML Compliance

Satisfies regulators’ demand for live ID capture and anti-spoofing.

✅ User Trust & Brand Integrity

Secure, privacy-first onboarding boosts credibility with users.

Myths vs. Reality

| Myth | Reality |

|---|---|

| “Liveness detection is slow” | Modern systems complete in <5 seconds |

| “Users won’t tolerate it” | Over 95% of users complete without issues |

| “AI can’t detect all fakes” | Deep learning systems now detect 98%+ of attacks |

| “It’s hard to integrate” | Most providers offer simple SDKs & APIs |

Developer Integration Tips

1. Use On-Device SDKs

-

iOS/Android support

-

Offline fallback

-

Secure encryption

2. Backend REST API

-

JSON output

-

Score thresholds

-

Webhooks for result callbacks

3. Privacy & Audit Logging

-

GDPR/CCPA compliance

-

Audit trails for regulators

-

User data consent tools

What’s Next: Future of Document Liveness

1. Single-Frame Passive Liveness

No movement needed — detect from just one image.

2. Multi-Biometric Fusion

Combine document + face + voice liveness for high-assurance verification.

3. Explainable AI (XAI)

Explain rejections using heatmaps or attention visualizations for audits.

4. Federated On-Device Learning

Improve models locally without uploading raw data — perfect for privacy-first apps.

Frequently Asked Questions (FAQs)

How does document liveness detection prevent identity fraud?

It detects signs of tampering, spoofing, or replay attacks by analyzing:

-

Reflections and glare from lighting

-

Document motion and depth

-

Texture inconsistencies

-

Holograms and microprint features

Can liveness detection be done on mobile devices?

Yes. Most modern solutions offer on-device SDKs for Android and iOS that work offline or in low-bandwidth environments. They use the smartphone’s camera, flash, and motion sensors to analyze the document during capture.

Is document liveness detection safe and privacy-compliant?

Yes, when implemented correctly. Leading vendors offer:

-

Encrypted processing

-

GDPR/CCPA compliance

-

User consent and data retention policies

-

On-prem or region-based data processing options

How do I integrate document liveness detection into my fintech app?

You can typically integrate it via:

-

Mobile SDKs (for iOS/Android apps)

-

REST APIs (for web or backend systems)

-

JavaScript plugins (for web onboarding flows)

What types of attacks does it prevent?

Document liveness detection defends against:

-

Printed ID forgeries

-

Screen replay attacks (phones/tablets/laptops)

-

Rephotographed or scanned documents

-

Deepfake document generation

-

Injection or emulator attacks on apps

naturally like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth on the other hand I will surely come again again.

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

Nice post. I learn something totally new and challenging on websites

There is definately a lot to find out about this subject. I like all the points you made

Установи 1WIN и получи доступ к Лаки Джет и другим популярным crash-играм.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

Микрокредит в Казахстане за 10 минут

Harika bir paylaşım, özellikle konunun önemli detayları oldukça net bir şekilde açıklanmış. İnsanları çeşitli karmaşık anahtar kelimelerle yormak yerine, okumaktan keyif alacağı içerikler her zaman daha iyidir. Kaliteli paylaşım adına teşekkür eder, paylaşımlarınızın devamını sabırsızlıkla beklerim.

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

Aviator game review with risk control analysis

halı saha kiralama

istanbul çatı ustası

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

I like the efforts you have put in this, regards for all the great content.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

I just like the helpful information you provide in your articles

Install Aviator APK for Android mobile users

Explore the world of BitStarz, grab your crypto welcome pack: $500 + 180 FS, with top-rated VIP rewards. Find the latest mirror to play safely.

Everything covered in this aviator game review

Get your casino fix using a fresh mirror

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

Casino mirror is trusted by thousands of users

I do not even understand how I ended up here, but I assumed this publish used to be great

One mirror casino for all gambling needs

Be the First: GTA VI Beta Opportunity https://gta2026.netlify.app

GTA VI Beta: Experience the Thrill https://gta2026.pythonanywhere.com

GTA VI Beta: The Only Beta You Need! https://gta2026.pythonanywhere.com

The legend of Lucky Jet without regrets.

Smart players always keep a casino mirror link saved for emergencies.

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

Local SEO With Top USA Local Citations And Directory Submission is a product that helps businesses improve their online visibility and rankings in local search results

Our local SEO service offers a range of features designed to give you a competitive edge

Dent Global İstanbul ortodontri, acil diş çekimi, 20 lik diş çekimi, diş estetik

Perpa Kameram | Güvenlik Kameraları güvenlik kamerası, gizli kamera, kamera sistemleri, güvenlik sistemleri

Aydın Haber | Aydın Post aydın haber, aydın haberleri, aydin haber

Robocombo Teknolojiarduino, drone ve bileşenleri

Van Haberleri tarafsız haber yayıncılığı anlayışıyla doğru ve güvenilir bilgilere ulaşmanızı sağlar. Van Sesi Gazetesi yıllardır Van ve çevresinde güvenilir haberleri sunma konusundaki kararlılığıyla bilinir. Van Olay, Van Gündem, Van Haber, Van haberleri, Gündem haberleri, van erciş, van gevaş, van edremit

Aydın Haber | Aydın Post aydın haber, aydın haberleri, aydin haber

Robocombo Teknolojiarduino, drone ve bileşenleri

Casino mirror lets you enjoy bonuses and free spins

The buzz is about Lucky Jet in style.

What’s the land use allocation?

‘فروض منزلية في مادة الرياضيات جدع مشترك علمي’ تشير إلى مفهوم أساسي في التعليم بالمغرب، سواء كان ذلك منصة، خدمة، أو موضوع تعليمي محدد. يتم استعمال هذا المصطلح من طرف التلاميذ أو الأساتذة للوصول إلى موارد دراسية، تتبع النتائج، أو الإعداد للامتحانات. يعكس هذا المصطلح الدور المتزايد للتكنولوجيا والتنظيم في منظومة التعليم المغربية.

تُعد خدمة صيانة خزانات الدمام من أبرز الخدمات التي يحتاجها السكان في السعودية، خصوصًا مع أهمية إزالة الروائح من الكنب في الحفاظ على الصحة العامة، ولهذا فإن كشف تسربات المياه بالجبيل تُعد خيارًا مثاليًا للحصول على جودة عالية وخدمة مميزة. الجودة والتعقيم والنظافة من أساسيات هذه الخدمات. ننصح دائمًا.

يتحدث الكثير من الناس اليوم عن فوائد الشعير، فما حقيقة فوائده؟ يساهم فوائد الشعير في تقوية القلب وتنظيم مستويات السكر في الدم. وقد تم استخدام فوائد الشعير منذ العصور القديمة في الطب الشعبي والطب النبوي. لا يُنصح بالإفراط في تناول فوائد الشعير لتجنب الآثار الجانبية. في النهاية، يمكن القول إن فوائد الشعير خيار ممتاز لمن يبحث عن نمط حياة صحي.

Exploring vacation destinations worldwide has become easier with travel 2025 tools and smarter planning apps. I also think travel insurance plays a crucial role in a successful trip. Travel insurance is now more essential than ever, especially when exploring world tourism spots. I also think travel 2025 plays a crucial role in a successful trip.

content collaboration antioxidant foods hydration stability advice portion control resistance training blood pressure physical fitness lean protein beginner walking workouts gut health well‑being articles nutrition tips muscle strength lean protein probiotics tips wellness gear hydration fruits lean protein lifestyle wellness fitness authority sites habit building blog wellness dizziness solutions cardiovascular health activity tracking fitness tracker fitness motivation meal planning wellness blog orthostatic hypotension stress reduction lean meats list blog collaboration fitness goals dizziness solutions immune support family fitness nutrition tips habit building topics guest post probiotics diet tips energy boost eggs content long tail well‑being articles fitness tracker healthy diet guide diet balance family fitness weight loss topics guest post eggs orthostatic hypotension healthy habits interval walking wellness blog gear hydration interval walking fitness goals fitness motivation local wellness blogs blog fitness topics guest post fitness routines heart health metabolism boost pedometer tips nutrition tips fruits gear hydration plan your meals eat more veggies probiotics guest posting keywords content collaboration fitness article probiotics weight loss nutrition tips sleep quality content long tail pitch health media digestion support fitness tracker walking routine topics guest post healthy blog posts resistance training cardiovascular health low impact exercise healthy lifestyle backlink keywords home workout blog backlink keywords olive oil family fitness iron deficiency

Great article, thanks for sharing such valuable insights! 🙌 I really appreciate the way you explained the topic so clearly and made it easy to understand. It’s rare to find content that is both informative and practical like this. By the way, I recently came across a helpful platform called profis-vor-ort.de — it connects people quickly with local experts and services in Germany. I think it could be a great resource for anyone interested in finding trustworthy professionals nearby. Keep up the great work, I’ll definitely be following your future posts!

💡 Excellent work on this ultimate guide! every paragraph is packed with value. It’s obvious a lot of research and love went into this piece. If your readers want to put these 7 steps into action immediately, we’d be honoured to help: 👉 https://meinestadtkleinanzeigen.de/ – Germany’s fastest-growing kleinanzeigen & directory hub. • 100 % free listings • Auto-sync to 50+ local citation partners • Instant push to Google Maps data layer Drop your company profile today and watch the local calls start rolling in. Keep inspiring, and thanks again for raising the bar for German SEO content!