- 0 Comments

- KYC Verification

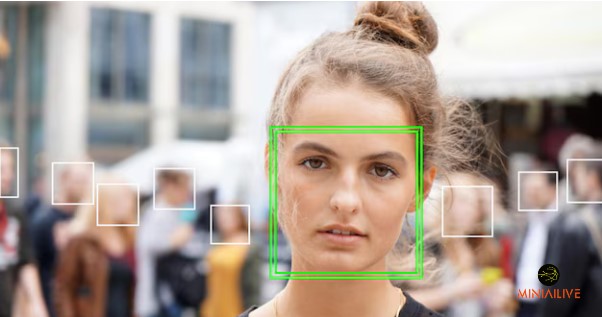

In today’s digital-first world, Know Your Customer (KYC) verification has become a foundational pillar for organizations in fintech, banking, government, and compliance sectors. With the surge in online transactions, digital onboarding, and remote identity verification, the stakes have never been higher. Organizations face mounting risks from sophisticated identity fraud, deepfake attacks, and severe regulatory fines, […]