A Customer Identification Program (CIP) verifies the identity of customers for financial transactions. It ensures compliance with anti-money laundering regulations.

Banks and financial institutions implement CIPs to prevent fraud and illegal activities. The program involves collecting and verifying personal information like name, address, and date of birth. This process helps institutions confirm that they are dealing with legitimate customers. Effective CIP practices are crucial for maintaining the integrity of the financial system.

They protect both the institution and its customers from potential risks. By adhering to strict guidelines, financial entities can foster trust and security. Implementing a robust CIP is an essential step in combating financial crimes.

Introduction To Customer Identification Program

The Customer Identification Program (CIP) is a critical component of modern banking. It ensures that financial institutions verify the identity of their customers. This helps in preventing fraud and maintaining the integrity of the financial system.

Importance In Modern Banking

Banks need to know their customers. This is essential for preventing illegal activities. The CIP helps in identifying suspicious activities early. It also helps in building trust with customers. A secure financial system benefits everyone.

Banks can avoid heavy fines by following CIP protocols. It also helps in ensuring customer data is safe. By identifying customers, banks can offer better services. This leads to improved customer satisfaction.

Regulatory Requirements

The USA PATRIOT Act mandates the implementation of CIP. Banks must collect specific information from customers. This includes:

- Name

- Date of Birth

- Address

- Identification Number

Banks must verify this information. They can use documents like a driver’s license or passport. Non-compliance can lead to severe penalties. Thus, adhering to CIP is crucial for all financial institutions.

| Required Information | Examples |

| Name | Mitchel Mark |

| Date of Birth | 01/01/1980 |

| Address | 123 Main St, Anytown, USA |

| Identification Number | Driver’s License, Passport |

Banks must keep records of this information. These records should be updated regularly. This ensures ongoing compliance with regulatory requirements. The CIP is not just a legal obligation. It is a cornerstone of responsible banking.

Key Components

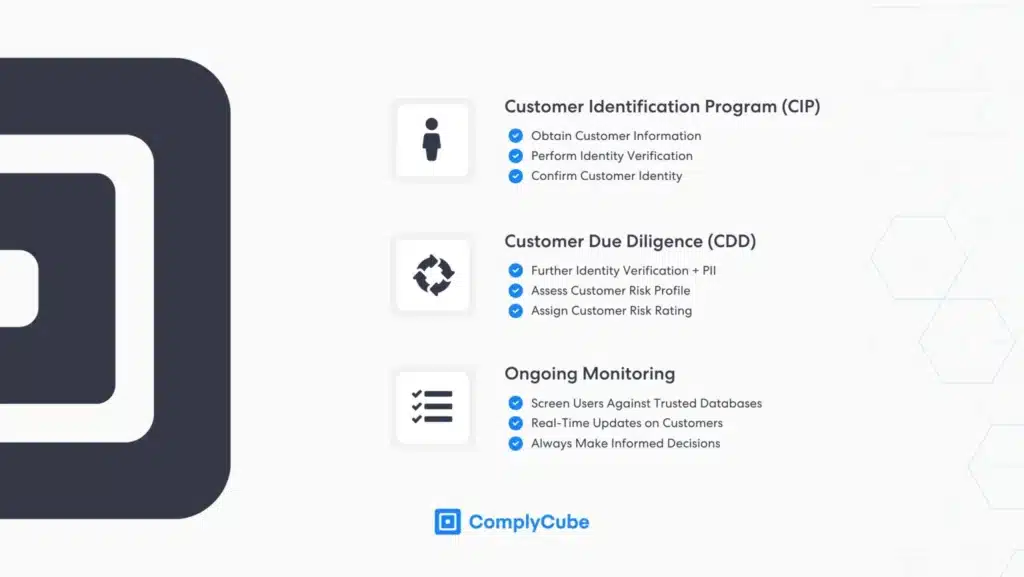

The Customer Identification Program (CIP) is essential for financial institutions. It helps in verifying the identity of customers. Understanding its key components is crucial for compliance and security.

Customer Due Diligence

Customer Due Diligence (CDD) involves gathering information about the customer. Financial institutions must collect personal details like:

- Name

- Date of Birth

- Address

- Identification Number

Institutions must also verify this information. They use documents such as:

- Government-issued ID

- Utility Bills

- Bank Statements

Effective CDD helps in detecting suspicious activities. It ensures compliance with regulations.

Enhanced Due Diligence

Enhanced Due Diligence (EDD) is required for high-risk customers. This process involves deeper scrutiny. Financial institutions must:

- Perform more thorough identity checks

- Monitor transactions more closely

- Conduct background checks

EDD aims to prevent money laundering and other illegal activities. It’s crucial for maintaining the integrity of the financial system.

Institutions must document all EDD efforts. This ensures transparency and accountability.

| Component | Description |

| Customer Due Diligence | Basic identity verification and information collection |

| Enhanced Due Diligence | Additional scrutiny for high-risk customers |

Verification Processes Of Customer Identification Program

Verifying customer identity is crucial for any business. It ensures compliance with regulations and protects against fraud. Two main methods are used: Documentary Verification and Non-Documentary Verification.

Documentary Verification

Documentary Verification relies on physical or digital documents. These documents prove the customer’s identity.

Common documents include:

- Government-issued IDs like passports or driver’s licenses.

- Utility bills showing the customer’s address.

- Bank statements confirming financial details.

The process involves checking the authenticity of these documents. Businesses use various tools and technologies to verify them.

Non-documentary Verification

Non-Documentary Verification does not rely on physical documents. Instead, it uses information and data from different sources.

Methods include:

- Credit checks to confirm financial history.

- Database searches to verify personal details.

- Biometric verification like fingerprints or facial recognition.

This method is often faster and more secure. It uses technology to ensure the customer is who they claim to be.

| Verification Method | Examples | Benefits |

| Documentary Verification | Passports, Driver’s licenses, Utility bills | Reliable, widely accepted |

| Non-Documentary Verification | Credit checks, Database searches, Biometrics | Fast, secure, tech-driven |

Both methods have their own advantages. Choosing the right method depends on the business needs and regulatory requirements.

Technological Tools

The Customer Identification Program (CIP) has evolved dramatically with the rise of new technologies. These technological tools enhance security, streamline processes, and ensure compliance with regulations. Below, we explore two key technological advancements in CIP: Biometric Authentication and AI and Machine Learning.

Biometric Authentication

Biometric authentication uses unique physical traits to verify a person’s identity. This method is more secure than traditional passwords. Common biometric methods include:

- Fingerprint Scanning

- Facial Recognition

- Iris Scanning

- Voice Recognition

Fingerprint scanning is widely used in smartphones. Facial recognition is popular in airports for quick identity verification. Iris scanning offers high accuracy and is used in secure facilities. Voice recognition is gaining traction in banking and customer service.

Ai And Machine Learning in Customer Identification Program

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the CIP landscape. These technologies analyze vast amounts of data swiftly and accurately. They help in detecting suspicious activities and anomalies.

Key benefits of AI and ML in CIP include:

| Benefit | Description |

| Enhanced Accuracy | AI and ML reduce human error and improve precision. |

| Real-Time Analysis | These tools provide instant analysis of customer data. |

| Fraud Detection | AI can spot fraud patterns that humans may miss. |

AI-driven systems continuously learn and adapt. They become more effective over time. This makes them invaluable in maintaining a robust CIP.

Challenges In Implementation

Implementing a Customer Identification Program (CIP) can be challenging. Various factors make the process complex. This section explores some of these challenges.

Data Privacy Concerns

Data privacy is a major concern in CIP implementation. Collecting and storing customer information requires strict security measures. Organizations must comply with data protection laws. Failure to do so can result in heavy fines.

Ensuring customer data remains confidential is critical. Unauthorized access to data can lead to identity theft. Customers need assurance that their information is safe. This requires investing in advanced security technologies.

Operational Costs

Implementing a CIP involves significant operational costs. The process requires investment in technology and training. Organizations need to hire skilled personnel. This increases the overall cost of implementation.

Maintaining an effective CIP requires continuous monitoring. Regular updates to security protocols are necessary. This ongoing process adds to the operational costs. Small businesses might find it challenging to bear these costs.

A table can help illustrate the key areas of operational costs:

| Cost Area | Description |

| Technology | Investing in secure systems and software |

| Training | Educating staff on CIP protocols |

| Personnel | Hiring skilled professionals |

| Maintenance | Regular updates and monitoring |

Organizations must plan for these costs. Proper budgeting ensures smooth CIP implementation.

Global Standards

The Customer Identification Program (CIP) is a crucial part of financial security. It helps prevent money laundering and terrorism financing. Global standards ensure consistency in these programs. This section discusses key guidelines and regulations.

Fatf Guidelines

The Financial Action Task Force (FATF) provides global guidelines for CIPs. They recommend specific steps for verifying customer identities. These steps include gathering basic personal information:

- Full Name

- Date of Birth

- Address

- Identification Number

Financial institutions must also monitor and report suspicious activities. This helps detect and prevent illegal financial operations. Compliance with FATF guidelines ensures global financial safety.

Regional Regulations

Different regions have their own CIP regulations. These regulations align with FATF guidelines but may have additional requirements. Here are a few examples:

| Region | Regulation |

| United States | USA PATRIOT Act |

| European Union | 4th Anti-Money Laundering Directive |

| Asia-Pacific | APG Recommendations |

In the United States, the USA PATRIOT Act enforces strict CIP rules. Financial institutions must verify identities before opening accounts. In the European Union, the 4th Anti-Money Laundering Directive requires enhanced due diligence. The Asia-Pacific Group (APG) has its own set of recommendations. These ensure the safety and integrity of financial systems in the region.

Case Studies

Understanding the implementation of a Customer Identification Program (CIP) can be challenging. Examining real-world cases provides valuable insights. The following case studies highlight successful implementations and lessons learned.

Successful Implementations

Several companies have effectively implemented CIP, ensuring compliance and improving security.

| Company | Implementation Strategy | Outcome |

| Bank A | Automated identity verification using AI | Reduced fraud by 40% |

| FinTech B | Multi-factor authentication | Enhanced customer trust |

| Retailer C | Real-time document verification | Streamlined onboarding process |

Lessons Learned

Learning from both successes and challenges is crucial for improving CIP.

- Invest in Technology: Using advanced technology like AI can reduce errors.

- Customer Experience: Simplifying the process boosts customer satisfaction.

- Regular Training: Ensure staff are well-trained to handle CIP tasks.

- Continuous Monitoring: Regularly update CIP to address new risks.

These lessons highlight the importance of a proactive approach to CIP.

Best Practices

Implementing a strong Customer Identification Program (CIP) is essential for any business. Following best practices ensures compliance and security. Let’s explore some key practices.

Risk-based Approach

A risk-based approach tailors the CIP to specific business needs. Identify potential risks and focus on higher-risk areas.

- Assess customer risk levels.

- Set procedures for different risk levels.

- Review and update the risk assessment regularly.

This approach helps allocate resources efficiently and enhances security.

Continuous Monitoring

Continuous monitoring is crucial to detect suspicious activities. Regularly review customer information and transactions.

- Implement automated monitoring systems.

- Set alerts for unusual transactions.

- Conduct regular audits and reviews.

Continuous monitoring maintains the integrity of the CIP and prevents fraud.

Role Of Financial Institutions

The Customer Identification Program (CIP) is crucial for financial institutions. These institutions play a key role in ensuring compliance and security. They must identify and verify the identity of their customers. This helps prevent fraud and money laundering.

Compliance Officers

Compliance officers ensure that financial institutions follow the CIP rules. They are responsible for creating and maintaining policies. They also monitor compliance and report any issues. Their role is vital for maintaining the integrity of the financial system.

Key responsibilities of compliance officers include:

- Developing CIP policies and procedures

- Monitoring customer transactions

- Conducting regular audits

- Reporting suspicious activities

Staff Training

Staff training is essential for effective CIP implementation. All employees must understand the importance of customer identification. They should know how to identify and verify customers. Regular training ensures that staff stay updated with the latest regulations.

Important aspects of staff training:

- Understanding CIP regulations

- Learning how to verify customer identities

- Recognizing suspicious activities

- Knowing how to report issues

Training sessions should be interactive and engaging. Use real-life examples to make the learning process easier. Employees should feel confident in their ability to comply with CIP requirements.

Customer Experience

An effective Customer Identification Program (CIP) greatly enhances the customer experience. It builds trust and simplifies processes. Here, we focus on how CIP improves customer interactions.

Ease Of Onboarding

Onboarding should be simple and quick. A good CIP makes this possible. Customers can easily provide their information. This reduces the time to start using services.

- Automated verification saves time.

- Digital forms are user-friendly.

- Data entry is minimized.

| Traditional Onboarding | Modern CIP Onboarding |

| Manual data entry | Automated data capture |

| Long wait times | Instant verification |

| Paper forms | Digital forms |

Trust And Security

Trust is crucial in customer relationships. A robust CIP enhances security and builds trust. Customers feel safe sharing their personal information.

- Data is encrypted.

- Only authorized personnel can access the data.

- Regular audits ensure compliance.

Secure systems protect customer data from breaches. Transparent processes reassure customers about data handling practices.

By implementing a strong CIP, businesses can significantly improve the overall customer experience. It ensures ease of onboarding and strengthens trust and security.

Future Trends

The Customer Identification Program (CIP) is evolving rapidly. Future trends are shaping how businesses verify and protect their customers. Here are some key trends to watch.

Blockchain Technology

Blockchain technology is revolutionizing the CIP landscape. It offers unparalleled security and transparency. Companies use blockchain to create tamper-proof customer records. This ensures data integrity and trust.

Benefits of using blockchain in CIP:

- Enhanced data security

- Reduced fraud risks

- Improved compliance with regulations

Blockchain provides a decentralized database. This means no single entity controls the data. It is distributed across many nodes, making it almost impossible to hack.

Real-time Verification

Real-time verification is another game-changer in CIP. It enables instant identity checks, reducing customer onboarding time. Businesses can verify identities in seconds, not days.

Advantages of real-time verification:

- Faster customer onboarding

- Improved customer experience

- Reduced operational costs

Many companies are adopting AI and machine learning for real-time verification. These technologies can analyze vast amounts of data quickly. They detect anomalies and flag suspicious activities in real-time.

Both blockchain technology and real-time verification are setting new standards in CIP. Businesses must stay updated to leverage these trends for better customer identification and protection.

Impact Of Non-compliance

Non-compliance with the Customer Identification Program (CIP) can have severe consequences. These range from legal penalties to reputation damage. Understanding these impacts helps businesses stay compliant and avoid negative outcomes.

Legal Penalties

Non-compliance can lead to hefty legal penalties. Regulatory bodies enforce strict rules on customer identification. Violations can result in fines or other punishments. Here are some potential legal penalties:

- Fines ranging from thousands to millions of dollars

- Suspension or revocation of business licenses

- Criminal charges against company executives

These penalties not only hurt financially but also disrupt business operations. It’s crucial to follow CIP guidelines to avoid these legal issues.

Reputation Damage

Non-compliance with CIP can also lead to severe reputation damage. Customers trust businesses to handle their information securely. When this trust is broken, it can have lasting effects. Here are some ways reputation can be damaged:

- Negative media coverage

- Loss of customer trust

- Decreased customer retention

A damaged reputation can lead to a decline in business. Customers may choose competitors who are seen as more trustworthy. Ensuring compliance helps maintain a positive reputation and customer loyalty.

Collaboration With Authorities in Customer Identification Program

The Customer Identification Program (CIP) plays a vital role in financial security. One key aspect is collaborating with authorities. This cooperation ensures compliance and enhances the effectiveness of CIP.

Information Sharing

Effective information sharing between financial institutions and authorities is crucial. It helps in identifying and preventing fraudulent activities. Institutions must report suspicious activities promptly. This ensures quick action from authorities.

Financial institutions often use secure channels for information sharing. This protects sensitive data from unauthorized access. Institutions must also follow strict protocols for data transmission. This ensures data integrity and confidentiality.

| Information Type | Shared With |

| Suspicious Transactions | Financial Crimes Enforcement Network (FinCEN) |

| Customer Identities | Local Law Enforcement |

Joint Investigations

Authorities and financial institutions often engage in joint investigations. These collaborations lead to the timely resolution of cases. Joint efforts also enhance the accuracy of investigations.

Joint investigations involve multiple stakeholders:

- Financial Institutions

- Regulatory Agencies

- Law Enforcement Agencies

These stakeholders share resources and expertise. This maximizes the efficiency of the investigation. It also ensures that no crucial aspect is overlooked.

Frequently Asked Questions

What Is A Customer Identification Program?

A Customer Identification Program (CIP) is a regulatory requirement to verify the identities of customers.

Why Is Customer Identification Program Important?

CIP prevents financial crimes by ensuring the authenticity of customers’ identities.

How Does Customer Identification Program Work?

CIP involves collecting identification documents and verifying customer information.

What Documents Are Needed For Customer Identification Program?

Common documents include passports, driver’s licenses, and utility bills.

Who Must Comply With Customer Identification Program Regulations?

Financial institutions, including banks and credit unions, must comply with CIP regulations.

How Often Is Customer Identification Program Updated?

CIP requirements are reviewed periodically to stay compliant with regulations.

What Happens If Customer Identification Program Is Not Followed?

Non-compliance can lead to legal penalties and fines.

Conclusion

A robust Customer Identification Program ensures secure transactions and builds customer trust. Implementing it correctly safeguards against fraud. Regularly updating the program keeps it effective. Businesses benefit from compliance and customer confidence. Prioritize a strong Customer Identification Program to achieve long-term success and security.