Online payment fraud detection involves identifying and preventing unauthorized transactions. Effective fraud detection systems use advanced algorithms and machine learning techniques.

Online payment fraud is a growing concern for businesses and consumers alike. With the rise of e-commerce, the need for robust fraud detection systems has never been greater. These systems analyze transaction patterns and user behavior to identify suspicious activities.

Machine learning and artificial intelligence play a crucial role in enhancing detection accuracy. By continuously updating algorithms, these systems can adapt to new fraud tactics. Businesses that invest in advanced fraud detection technology can significantly reduce financial losses and protect customer trust. Effective fraud detection not only safeguards revenue but also enhances the overall user experience.

Introduction To Online Payment Fraud

Online payment fraud is a serious threat to businesses and consumers. It involves unauthorized transactions that lead to financial loss. Understanding this menace is crucial for safeguarding digital transactions.

What Is Online Payment Fraud?

Online payment fraud occurs when cybercriminals steal payment information. They use various tactics to trick users and steal money. Fraudsters often target credit cards, bank accounts, and digital wallets.

This type of fraud can involve:

- Phishing scams

- Identity theft

- Card-not-present fraud

- Chargeback fraud

These tactics exploit weaknesses in online security systems. The consequences can be devastating for both businesses and individuals.

Why It’s A Growing Concern

The rise in online shopping has increased the risk of fraud. More people are using digital payments, making it a lucrative target. Cybercriminals are becoming more sophisticated in their methods.

Here are some key reasons why online payment fraud is growing:

| Factor | Explanation |

| Increased Online Transactions | More transactions mean more opportunities for fraud. |

| Advanced Hacking Techniques | Hackers are using more advanced tools and methods. |

| Poor Security Practices | Some businesses lack robust security measures. |

Cybercriminals constantly evolve their tactics. This ongoing battle makes it essential to stay informed. Implementing strong security measures can help reduce the risk.

Common Types Of Payment Fraud

Online payment fraud is a growing concern for businesses and consumers. Understanding common types of payment fraud can help protect against these threats. Here, we explore some of the most prevalent types.

Phishing Scams

Phishing scams trick users into revealing personal information. Attackers send fake emails or messages. These messages look like they come from trusted sources. Users are asked to click on links or enter data. The attackers then steal this information and use it for fraud.

- Emails with fake links

- Messages asking for personal data

- Fake websites mimicking real ones

Credit Card Fraud

Credit card fraud involves unauthorized use of card information. This can happen when card details are stolen. Fraudsters use these details to make purchases. They may also sell the information on the dark web.

- Stolen card numbers

- Fake cards made with real data

- Unauthorized transactions

Identity Theft

Identity theft occurs when someone steals personal information. They use this data to impersonate the victim. This can lead to unauthorized bank transactions and loans.

- Stolen social security numbers

- Fake IDs created with stolen data

- Opening new accounts in the victim’s name

| Type of Fraud | Description |

| Phishing Scams | Tricking users to reveal personal information via fake emails or messages. |

| Credit Card Fraud | Unauthorized use of credit card information for purchases or resale. |

| Identity Theft | Stealing personal information to impersonate and commit fraud. |

Signs Of Fraudulent Transactions

Online payment fraud is a growing concern for businesses and consumers. Detecting signs of fraudulent transactions early can save money and protect sensitive information. Below are some key indicators to watch out for.

Unusual Activity Alerts

Many systems generate alerts for unusual activity. These alerts can signal potential fraud. Common unusual activities include:

- Multiple purchases in a short time

- High-value transactions from new accounts

- Orders from different locations in a short period

Pay close attention to these alerts. They can help you catch fraud early.

Suspicious Account Changes

Fraudsters often change account details to avoid detection. Watch for suspicious changes, such as:

- Change of shipping address

- Update of email or contact number

- Modification of payment methods

Track these changes carefully. They can indicate fraudulent activity.

| Type of Change | Possible Fraud Indicator |

| Shipping Address | Unusual or unrecognized address |

| Email Address | Different from previous emails used |

| Payment Method | New card or account number |

By monitoring these signs, you can enhance your fraud detection efforts. Stay vigilant and protect your online transactions.

Advanced Fraud Detection Techniques

Online payment fraud is a serious issue. Businesses need advanced techniques to detect it. These techniques help reduce losses and protect customers.

Machine Learning Models

Machine learning models are powerful tools for fraud detection. They analyze vast amounts of data quickly. This helps in identifying unusual patterns. These models learn from past transactions. They get better over time.

There are different types of models:

- Supervised Learning: Uses labeled data to train the model.

- Unsupervised Learning: Finds hidden patterns in unlabeled data.

- Reinforcement Learning: Learns from actions and rewards.

Table of common machine learning models:

| Model Type | Description |

| Logistic Regression | Predicts the probability of fraud. |

| Decision Trees | Classifies transactions based on features. |

| Neural Networks | Identifies complex patterns in data. |

Behavioral Analytics

Behavioral analytics focus on user behavior. They look for unusual actions. This helps detect fraud in real-time. Analyzing behavior can catch fraud early.

Key components of behavioral analytics:

- Transaction Patterns: Analyzes purchase history for anomalies.

- Login Behavior: Monitors unusual login attempts.

- Geolocation Tracking: Flags transactions from unexpected locations.

Behavioral analytics use various data points:

- Time of purchase

- Device used

- IP address

- Purchase frequency

These techniques help in building a comprehensive fraud detection system. They ensure customer safety and business integrity.

Importance Of Real-time Monitoring

Online payment fraud is a serious threat. Real-time monitoring helps detect fraud instantly. It prevents financial losses and protects customer data. This approach is crucial for any business handling online transactions.

Instant Alerts

Real-time monitoring offers instant alerts. These alerts notify you of suspicious activities immediately. You can take swift action to block fraudulent transactions. This reduces the risk of large financial losses.

Transaction Analysis

Another benefit is transaction analysis. Real-time monitoring reviews each transaction for unusual patterns. It looks for red flags such as:

- Unusual spending amounts

- Multiple transactions in a short period

- Transactions from different locations

This helps identify potential fraud early. You can then investigate further or block the transaction.

Implementing Strong Authentication

Online payment fraud is a significant threat today. Implementing strong authentication methods can help combat this. This ensures only authorized users access sensitive information. Here, we will explore two crucial methods: Two-Factor Authentication and Biometric Verification.

Two-factor Authentication

Two-Factor Authentication (2FA) adds an extra layer of security. It requires two forms of identification. This can be something you know, like a password, and something you have, like a phone.

2FA is commonly used in online banking and e-commerce. It helps protect against password theft and unauthorized access. Here is a simple breakdown of how 2FA works:

| Factor Type | Example |

| Knowledge | Password, PIN |

| Possession | Mobile device, Security token |

Using 2FA significantly reduces the risk of fraud. Even if a password is stolen, the second factor keeps the account secure. Many online platforms now offer 2FA as a standard option.

Biometric Verification

Biometric Verification uses unique physical traits for identification. This includes fingerprints, facial recognition, and iris scans. Biometrics provide a high level of security because they are hard to replicate.

Biometric verification is becoming more popular in mobile payments. It offers convenience and security. Here are some common types of biometric verification:

- Fingerprint Scanning: Uses unique fingerprint patterns.

- Facial Recognition: Analyzes facial features.

- Iris Scanning: Examines the iris of the eye.

Biometric systems ensure that only the authorized user can access the account. These systems are harder to fool, making them a robust option against fraud.

Both 2FA and biometric verification are essential tools in fighting online payment fraud. They offer strong security measures that protect user data and financial transactions.

Role Of Encryption In Security

Online payment fraud is a significant concern. Encryption plays a critical role in securing transactions. It ensures data privacy and protects sensitive information. Without encryption, online payments are vulnerable to hackers. Encrypting data makes it unreadable to unauthorized users. This enhances security and builds trust among users.

Data Encryption Standards

Data encryption standards set the rules for secure data transmission. These standards include algorithms that scramble data. The most common standard is AES (Advanced Encryption Standard). AES is widely used because it is secure and efficient.

| Standard | Description |

| AES | Advanced Encryption Standard, very secure and efficient. |

| RSA | Used for secure data transmission, relies on public and private keys. |

End-to-end Encryption

End-to-end encryption ensures data safety from sender to receiver. Only the sender and receiver can read the data. This method prevents third parties from accessing information. It is widely used in messaging apps and secure transactions.

- Messages are encrypted on the sender’s device.

- They travel encrypted over the internet.

- Only the receiver’s device can decrypt the message.

End-to-end encryption keeps data safe throughout its journey. This is vital for protecting sensitive payment information.

User Education And Awareness

Understanding online payment fraud detection is crucial in today’s digital world. One of the most effective ways to combat online fraud is through user education and awareness. Educated users can recognize threats and take steps to protect themselves. This section focuses on how users can learn to safeguard their online transactions.

Recognizing Phishing Attempts

Phishing is a common method used by fraudsters to steal information. Users should be aware of what phishing looks like.

- Suspicious Emails: Look for emails with spelling errors or urgent requests.

- Unverified Links: Avoid clicking on links from unknown sources.

- Fake Websites: Check the URL for spelling mistakes or unfamiliar domains.

Recognizing phishing attempts is the first line of defense. Here are some examples:

| Phishing Indicator | Description |

| Email from Unknown Sender | An email from a sender you do not know. |

| Urgent Request for Information | An email asking for your personal information quickly. |

| Unfamiliar Links | Links that direct you to unknown websites. |

Safe Online Practices

Following safe online practices can significantly reduce the risk of fraud. Here are some key practices:

- Use Strong Passwords: Create complex passwords using letters, numbers, and symbols.

- Enable Two-Factor Authentication: Adds an extra layer of security to your accounts.

- Keep Software Updated: Regular updates protect against new threats.

Safe online practices also include:

- Avoid Public Wi-Fi: Use secure networks when making transactions.

- Monitor Bank Statements: Regularly check your bank statements for unauthorized transactions.

- Be Cautious with Personal Information: Do not share personal info on social media.

By following these tips, users can protect themselves from online fraud. Awareness and education are the keys to staying safe online.

Legal And Regulatory Measures

Online payment fraud is a serious issue. Many countries have laws to stop it. These laws help protect businesses and consumers. They set rules for detecting and reporting fraud. Following these rules is very important.

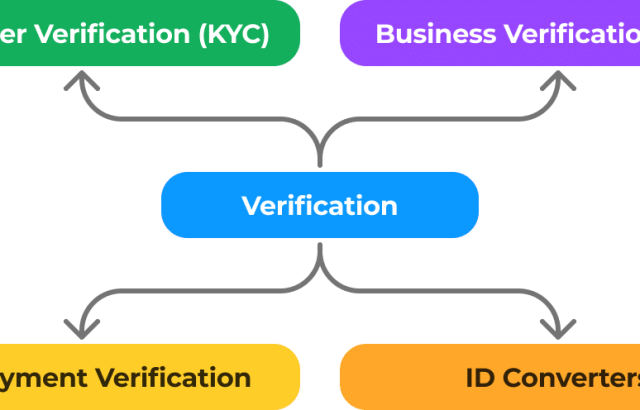

Compliance Requirements

Businesses must follow compliance requirements to avoid fraud. These rules ensure transactions are safe. Compliance helps in identifying fraudulent activities. It also protects sensitive customer information.

Here are some common compliance requirements:

- PCI DSS: Payment Card Industry Data Security Standard

- KYC: Know Your Customer

- AML: Anti-Money Laundering regulations

PCI DSS requires businesses to secure card data. KYC ensures businesses know their customers. AML rules prevent money laundering. Meeting these requirements is essential for fraud prevention.

Reporting Fraud

Reporting fraud is another key aspect. Businesses must report any suspicious activity. This helps in catching fraudsters quickly. Reporting fraud also helps in improving security measures.

Steps for reporting fraud:

- Identify the suspicious transaction.

- Gather all relevant information.

- Contact the appropriate authorities.

- Follow up on the report.

Contacting authorities can include banks, credit card companies, and law enforcement. Following up ensures the issue is being addressed. Reporting fraud can also protect other businesses from similar attacks.

Collaborating With Financial Institutions

Collaborating with financial institutions is crucial for effective online payment fraud detection. Banks and other financial entities have robust systems to identify and prevent fraud. By working together, businesses can leverage these systems to protect their transactions and customers.

Bank Fraud Departments

Bank fraud departments are specialized units within banks. They focus on detecting and mitigating fraudulent activities. These departments use advanced algorithms and monitoring tools to spot unusual patterns. Businesses can benefit by partnering with these departments. This collaboration helps in identifying fraud early, reducing potential losses.

Here are some key functions of bank fraud departments:

- Monitoring transactions for unusual patterns

- Analyzing data to identify potential fraud

- Coordinating with other banks and law enforcement agencies

- Providing businesses with insights and alerts

Shared Fraud Databases

Shared fraud databases are collaborative platforms used by financial institutions. These databases store information on known fraudulent activities and entities. By accessing this information, businesses can stay ahead of potential fraudsters.

Benefits of using shared fraud databases include:

- Real-time access to fraud data

- Improved accuracy in fraud detection

- Enhanced collaboration between different financial entities

- Faster response to emerging fraud trends

Businesses should integrate these databases into their fraud detection systems. This integration provides an additional layer of security. It helps in validating transactions and identifying suspicious activities quickly.

Future Trends In Fraud Detection

The landscape of online payment fraud detection is evolving rapidly. As fraudsters become more sophisticated, businesses must adopt advanced technologies to stay ahead. Understanding future trends in fraud detection is crucial for safeguarding transactions and customer trust.

Ai And Machine Learning

AI and Machine Learning are revolutionizing fraud detection. These technologies can analyze vast amounts of data quickly, identifying patterns and anomalies that humans might miss. Here are key benefits:

- Real-time detection: AI can detect fraud as it happens.

- Adaptive learning: Machine Learning models adapt to new fraud patterns.

- Reduced false positives: More accurate fraud detection means fewer false alarms.

Businesses using AI and Machine Learning see a significant drop in fraud cases. This technology helps them stay one step ahead of fraudsters.

Blockchain Technology

Blockchain Technology offers a transparent and secure way to handle transactions. It creates an immutable record of all transactions, making it difficult for fraudsters to alter data. Key features include:

| Feature | Benefit |

| Decentralization | No single point of failure, reducing fraud risk. |

| Transparency | All transactions are visible, ensuring accountability. |

| Security | Advanced cryptographic techniques protect data. |

Blockchain technology ensures secure and tamper-proof transactions. Businesses adopting blockchain see improved trust and reduced fraud.

Conclusion And Best Practices

Online payment fraud is a growing concern for businesses. Safeguarding transactions is essential to protect both businesses and customers. Employing best practices can significantly reduce the risk of fraud. This section summarizes key points and provides actionable steps to secure online transactions.

Summarizing Key Points

Understanding and implementing fraud detection techniques is crucial. Here are the key points:

- Monitor transactions in real-time to spot unusual activities.

- Use multi-factor authentication to add extra security layers.

- Employ machine learning algorithms to identify fraud patterns.

- Regularly update security protocols and systems.

Steps To Protect Transactions

Adopting certain steps can enhance transaction security. Follow these practices to protect your business:

- Encrypt data to protect sensitive information.

- Implement tokenization to replace sensitive data with tokens.

- Set up transaction limits to control the risk.

- Educate customers about recognizing and reporting fraud.

- Conduct regular audits to ensure compliance with security standards.

The table below highlights these best practices for quick reference:

| Practice | Description |

| Data Encryption | Protects sensitive information from being accessed by unauthorized users. |

| Tokenization | Replaces sensitive data with a unique identifier or token. |

| Transaction Limits | Sets thresholds for transactions to manage and reduce risk. |

| Customer Education | Informs customers about security practices and fraud detection. |

| Regular Audits | Ensures all security measures are up-to-date and effective. |

Following these steps ensures a safer transaction environment. Implementing these practices will help in significantly reducing the risk of online payment fraud.

Frequently Asked Questions Online Payment Fraud Detection

What Is Online Payment Fraud?

Online payment fraud is unauthorized transactions via digital payments, exploiting vulnerabilities.

How Does Fraud Detection Work?

Fraud detection uses algorithms to identify suspicious patterns and behaviors in transactions.

Why Is Payment Fraud Detection Important?

Detecting payment fraud protects businesses and customers from financial losses.

What Are Common Types Of Payment Fraud?

Common types include phishing, identity theft, and chargeback fraud.

How Can Businesses Reduce Payment Fraud?

Businesses can implement multi-factor authentication and real-time monitoring.

What Tools Are Used For Fraud Detection?

Tools include machine learning algorithms and rule-based systems.

Is Machine Learning Effective In Fraud Detection?

Yes, machine learning improves accuracy by analyzing vast amounts of data.

Conclusion

Detecting online payment fraud is crucial for protecting your business. Implementing advanced security measures reduces risks significantly. Stay updated with the latest fraud detection technologies. Educate your team about common fraud tactics. Prioritize customer security to build trust and loyalty.

Effective fraud detection ensures smoother transactions and protects your revenue.