Ever get that tiny thrill when your app just works perfectly? Like, you hit submit and boom, done. No awkward waiting, no “try again” errors. That feeling? That’s the dream in digital banking these days. And behind the curtain there’s something called liveness detection making it all happen. It’s a tech superhero quietly keeping fraudsters out while letting real users glide through.

But here’s the thing, not every liveness detector is made the same. Some ways of training work well, while others might make users hit their heads against the screen. It’s not just tech talk to know the difference between passive and active liveness detection in 2025. It can save you time, money, and your image.

Let’s break it down.

What Exactly is Liveness Detection in KYC?

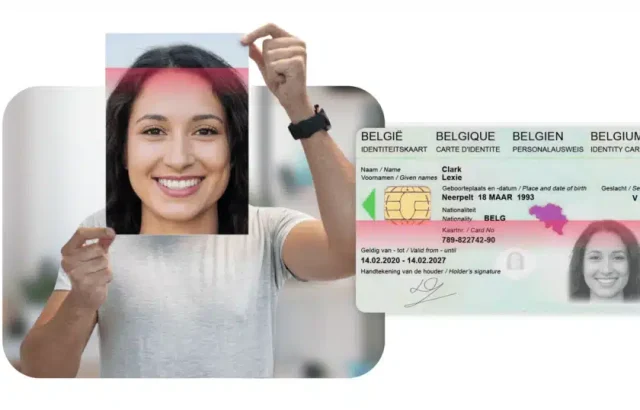

Okay, let’s simplify. Liveness detection is a technology that makes sure the person submitting their ID or face scan is actually there. Not a photo, not a video, not some AI-generated double sneaking in.

Think of it as a bouncer at a club. IDs can be faked but liveness detection looks at the little things like skin texture, face depth and micro-movements to see if you’re real or not.

Why care?

- Keeps scammers from making fake accounts.

- Stops deepfake scams in their tracks.

- Helps your company follow rules like KYC, AML, GDPR, and more.

So yeah, it’s not just cool tech, it’s critical.

Active vs. Passive Liveness Detection: The Real Differences

Here’s where things get interesting. Liveness detection has two flavors: active and passive. Let’s dig in.

Active Liveness Detection

Active methods are the ones that ask you to do stuff. Blink. Turn your head. Smile. Say a phrase. Kind of like a mini game before you get your money.

Pros:

- Straightforward to implement

- Gives clear verification cues

Cons:

- Can frustrate users (blink one more time? Really?)

- Slower onboarding

- Not the strongest shield against sneaky deepfakes

Example: This was also used by a small number of banks in 2023 on high-risk accounts. But users would quit mid-verification. High churn, low patience, lots of sighs.

Passive Liveness Detection

Now, passive liveness is the smooth operator. There are no warnings or blinking contests; just smart AI looking at your face in silence. It can see small motion, depth, lighting, and texture.

Pros:

- Users can get started quickly and easily.

- It is harder for deepfakes to trick the system.

- Not as many people are leaving in the middle and faster decisions are being made

Cons:

- Requires advanced AI technology

- Uses a bit more computing power

Example: A top fintech in Europe switched to passive in 2024. Account approvals? Under 30 seconds. Fraud attempts? Dropped 70%. Users were happy. And yes, so were the auditors.

Why Liveness Detection is Non-Negotiable in 2025

1. Fraud Isn’t Waiting Around

Digital fakes have gotten scary good. A fake movie could be used to try to trick your system, and if your identity check isn’t ready scary. Passive liveness picks up on the little things that AI can’t, like tiny changes in skin texture or face twitches.

2. Compliance Is Serious Business

Regulators are breathing down digital onboarding necks. Tracking logs, proof of presence, and secure records aren’t just suggestions; they’re necessary. Both active and passive help meet standards, but passive makes life a lot easier because it automates those logs.

3. Users Don’t Have Time for Delays

If your verification process feels like a pop quiz, users will bail. Passive liveness? They barely notice. Active liveness? Blink one more time, and goodbye, potential customer.

4. Money Matters

Manual reviews cost money. Staff hours, overtime, errors, it adds up. Passive systems flag only suspicious cases, saving both time and cash.

How Liveness Detection Works (Without Geek Overload)

Here’s the magic, step by step:

- The user sends a movie or selfie through the app.

- AI analyzes facial features and micro-movements.

- The system can tell when something is alive by looking at things like blinking, changes in the skin’s structure, and even small movements of the head.

- Result: Pass, fail or suspicious.

- The KYC system approves or flags the account.

Pro Tip: Look over papers and live together in peace. That’s your power pair for 2025.

Making Liveness Detection Part of Your System

Here’s a practical roadmap:

Pick the Right Tech – SDKs that examine data in real time on several devices are available. They should also work online.

Ensure Compliance – GDPR, CCPA, SSL storage, and logs that are ready for an audit.

Pilot Before Launch – Test with real people keep an eye on drop-offs, and change the limits.

Continuous Improvement – Keep AI up to date train staff and get feedback.

Real-World Wins

Case Study 1: Asian Fintech Startup

- Problem: Users leaving during verification

- Solution: Switched from active to passive

- Result: Fraud attempts are down 65% and onboarding time is down 80%.

Case Study 2: European Digital Bank

- Problem: Audit gaps in manual verification

- Solution: Document + passive liveness

- Result: Passed audit increased user trust, and sped up reviews.

Common Pitfalls to Avoid

- Ignoring User Experience: People generally don’t like it when prompts are used over and over. Test the features with real people.

- Device Limitations: Low-quality cameras need calibration.

- Skipping AI Updates: Fraud evolves, so should your models.

- Relying Only on Liveness: To make things safer add IDs and multi-factor verification.

- Neglecting Documentation: Risk reviews and audit logs help enforce rules and keep people safe.

The AI Edge

Nowadays machines are taught using millions of pictures to tell whether an object is alive or not. Strengths:

- Anomaly Detection: Flags suspicious patterns

- Adaptive Learning: Models get smarter over time

- Multi-Modal Verification: Combines facial voice, and behavioral cues

It will be as neglecting to use AI-powered liveness in 2025 as leaving the front door open.

User Experience Tips

- Keep It Invisible: Background recognition that doesn’t do anything.

- Real-Time Feedback: Active methods should guide users gently.

- Adaptive Thresholds: Adjust based on risk profile.

- Accessibility Matters: It works for all platforms, even old ones.

- Be Transparent: When privacy notices are transparent, users feel safe.

Compliance Essentials

- GDPR: Clear permissions and ways to delete information

- CCPA: Rights to see and remove data

- KYC/AML: Logs for audits

- ISO/FIDO: Credibility is raised by global standards

Future Trends

- Behavioral Biometrics: Typing, swipes, and motions

- Continuous Verification: Not Just When You Sign Up

- Decentralized Identity: Verification ready for blockchain

- Multi-Language Support: AI that is ready for the world

- Privacy-Preserving AI: Processing on the device, sending less info to servers

Practical Advice

- Mix Passive + Active: High-risk accounts get extra security.

- Prioritize UX: Easy proof increases adoption.

- Audit Everything: Follow the rules and do the right thing.

- Stay Updated: There are new deepfakes every day.

- Educate Users: People who stop midway happen less often when people can talk to each other.

Choosing the Right Liveness Detection Solution

When you signed up for something online, did you ever wonder why it was taking so long? Doesn’t it bother you? So, it’s important to pick the right way to check for liveness. While the system checks to see if the person is real, they shouldn’t be able to tap their fingers.

- Check Compatibility: Make sure it works on all devices, web, mobile, tablets, and even older phones. Users love options, and nothing kills momentum like a system that doesn’t recognize their gadget.

- Evaluate Speed vs. Security: Some systems are quick, but not very clean, like cheetahs. Others are like turtles, very safe, but very slow. That’s the sweet spot, fast enough to keep users happy and strong enough to keep thieves out.

- Consider AI Updates: People who commit fraud don’t have time to sleep. Your AI needs to be constantly improved so that it can find new deepfakes or fake attempts before they become a problem.

- Ease of Integration: Look for SDKs or APIs that plug into your existing KYC setup easily. Fewer headaches, faster deployment, and less coffee spillage from stressed-out developers.

Best Practices for Onboarding Users

Users don’t want a pop quiz while they’re proving who they are, let’s be honest. When things go smoothly people feel like they’re in safe hands instead of stuck in a maze.

- Keep It Simple: Cut down on confusing steps. When it comes to flow, a clear sense always wins.

- Guide Gently: If active liveness is needed provide friendly prompts. “Turn your head slowly” beats “Blink now!” any day. Think helpful coach, not a strict teacher.

- Test with Real Users: First, do some small tests. Change the limits based on what you see people do and where they stop. Imagine a play that is about to start, and you are preparing it.

- Educate Users: A tiny heads-up about why liveness detection exists can calm nerves. Most users just want to know, “Am I safe here?”

Handling Security and Privacy

Let’s not sugarcoat it, users care about their data. And honestly, they should. Protecting it builds trust, plain and simple.

- Encrypt Everything: Lock up facial scans and documents with strong encryption. Safety first.

- Transparent Policies: Tell users how you collect save and delete their data. Keep it clear and easy to understand.

- Audit Logs: Management and the law should be able to inspect logs; thus, they should be kept safe. You should have these for when you need them, but not very often.

- Limit Human Access: Access to flagged cases should be limited to trained personnel. The system eliminates risk and provides confidence to the system users.

Benefits of Combining Passive and Active Methods

When you use both inactive and active liveness, it’s like having a security tag and a helpful guard. It gives you extra safety without being bothersome.

- Layered Security: Passive handles the bulk of users, active steps in for higher-risk accounts. Two layers are better than one.

- Faster Approvals: Most people zip through with passive verification. Nobody likes waiting.

- Lower Fraud Risk: When you use both, you catch tricky deepfakes or faking attempts that you might miss with just one.

- Improved User Trust: When users know that the system is safe and easy to use, they feel better and safer.

Conclusion

Liveness recognition is an important part of KYC and can’t be skipped. Passive ways make things faster safer and more enjoyable for users. Active methods still have their place for higher-risk accounts. Combine the right tech, compliance measures, and AI updates, and you’re ahead of fraudsters.

MiniAiLive has both passive and active solutions, strong SDKs and seamless integration for businesses that want a safe and easy onboarding process. Ready to make verification frictionless and trustworthy? Let MiniAiLive guide your KYC process today.

Question for readers: How would a smooth, smart verification process improve your onboarding?

FAQs

What is the difference between passive and active liveness detection?

When they see you people blink or smile. It tells you that the individual is present even if you can’t hear them. Passive is faster and safer.

Can liveness detection prevent deepfake attacks?

Yes, especially the quiet acceptance of life. It can find parts of the face that deepfakes made by AI can’t copy. This helps stop deepfakes.

Do businesses still need active liveness in 2025?

Active liveness is good for high-risk situations, but most current KYC systems use passive methods because they are faster, more efficient, and better for the user.

How does liveness detection improve compliance?

Follow the rules for Know Your Customer (KYC), Anti-Money Laundering (AML), GDPR, and CCPA with this proof that the person is in the room. To follow the law, logs can be looked at.

Is passive liveness more expensive to implement?

This may be more expensive initially to purchase AI models and incorporate SDKs; however, in the long term, it reduces the operating expenses and turnover of users.