Introduction

Know Your Customer (KYC) verification has evolved significantly over the past decade, leveraging cutting-edge technology to enhance security and fraud prevention. With the rise of artificial intelligence (AI), biometric authentication, and deep learning, financial institutions and regulatory bodies are looking for more robust ways to verify identity. One of the most promising developments is document liveness detection, which ensures the authenticity of identity documents in real time.

As we move into 2025, document liveness detection is set to become a key component of KYC verification, enhancing security while reducing fraud. This blog explores how this technology will shape the future of KYC compliance, its applications, and the benefits it offers to businesses and consumers alike.

What Is Document Liveness Detection?

Document liveness detection is an advanced AI-driven technology designed to detect whether an identity document is real, physically present, and unaltered during the verification process. Unlike traditional document verification, which only checks for textual and visual authenticity, liveness detection ensures that the document is being presented in real time and has not been tampered with digitally.

How Document Liveness Detection Works

- Real-Time Scanning: The user captures an image or video of their identity document using a smartphone or webcam.

- AI-Powered Authenticity Checks: The system analyzes the document for inconsistencies, hologram reflections, microprinting, and security features.

- Liveness Detection Algorithms: These detect whether the document is physically present (not a digital screenshot or printout) by analyzing lighting conditions, angles, and movement.

- Cross-Referencing with Databases: The document is checked against government-issued identity databases for verification.

- Fraud Prevention Filters: Deep learning models assess whether the document has been photoshopped, altered, or presented in a deceptive manner.

The Role of Document Liveness Detection in KYC in 2025

1. Eliminating Identity Fraud

One of the biggest challenges in KYC verification is the increasing sophistication of identity fraud. Deepfake technology and AI-generated forgeries make it difficult for traditional verification methods to detect fraudulent documents.

By 2025, document liveness detection will play a crucial role in:

- Preventing spoofing attacks, where fraudsters present manipulated images or deepfake videos.

- Detecting synthetic identities, which combine real and fake information to create an entirely new persona.

- Ensuring that only original government-issued IDs are used for verification.

2. Enhancing Remote Onboarding for Financial Institutions

With the rise of digital banking and fintech solutions, remote onboarding has become the new standard. However, ensuring document authenticity without an in-person visit remains a challenge.

How document liveness detection will enhance remote onboarding in 2025:

- Real-time document scanning during the onboarding process to prevent fraud.

- Instant verification using AI models trained on millions of document samples.

- Integration with biometric verification, such as facial recognition, to match the document holder’s photo with their real-time selfie.

3. Compliance with Global Regulatory Standards

Regulatory bodies worldwide are tightening KYC and Anti-Money Laundering (AML) laws, making document verification more critical than ever. By 2025, document liveness detection will be a mandatory requirement for compliance with regulations such as:

- EU’s Anti-Money Laundering Directive (AMLD6)

- Financial Action Task Force (FATF) guidelines

- U.S. Bank Secrecy Act (BSA)

- Asia-Pacific KYC regulations

Governments will require financial institutions, crypto exchanges, and fintech companies to implement AI-driven document verification with liveness detection to reduce financial crime.

4. Preventing Deepfake and AI-Generated Identity Attacks

As AI-generated deepfake technology improves, fraudsters are using AI to create hyper-realistic fake documents and videos. Document liveness detection in 2025 will be powered by deep learning models that:

- Detect AI-generated anomalies in identity documents.

- Identify fake holograms, microtexts, and watermarks.

- Cross-check user data with global identity verification databases to ensure authenticity.

5. Reducing False Rejections in KYC Verification

Traditional KYC verification methods often result in false rejections due to:

- Poor-quality document images

- Variations in lighting conditions

- Differences in document versions issued by different regions

AI-powered liveness detection will significantly reduce false rejections by:

- Enhancing adaptive document recognition for different formats and lighting conditions.

- Using machine learning models to improve verification accuracy over time.

- Providing real-time feedback to users for better image capture.

6. Faster and More Efficient Customer Onboarding

By 2025, document liveness detection will streamline onboarding processes across industries, including:

- Banking & Fintech: Faster account opening without manual review delays.

- Cryptocurrency Exchanges: Seamless verification of user identities for compliance.

- Healthcare: Secure access to patient records through digital ID verification.

- E-commerce & Gig Economy: Identity checks for fraud prevention in online transactions.

Advanced AI will enable companies to complete KYC verification in seconds instead of hours, improving customer experience while maintaining security.

How MiniAiLive Verification Works and Use Cases?

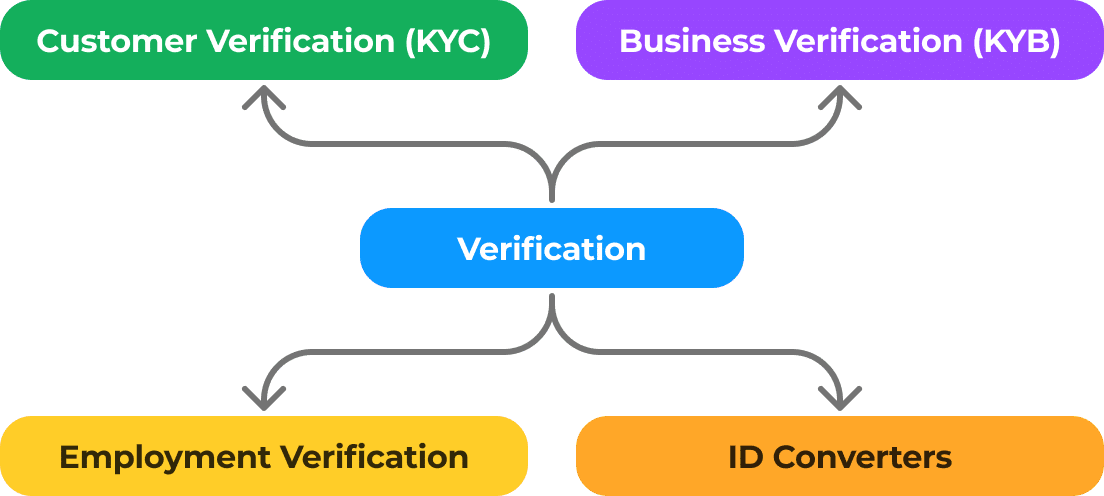

The Verification Services Group provides a flexible suite of APIs designed to address a wide range of identity verification needs across consumer, employment, and legal entity sectors.

These APIs equip businesses with robust solutions to ensure the accuracy, authenticity, and reliability of critical identity information.

Customer Verification

The Consumer ID Verification API offers a robust solution for businesses to efficiently authenticate consumer identities with speed and security.

By integrating this API, organizations can perform seamless validation of personal data, ensuring compliance with regulatory standards while enhancing trust and security in customer interactions.

Employment Verification

The Employment Verification API streamlines the complexity of employment authentication by leveraging data from the Employees’ Provident Fund Organization (EPFO) alongside alternative sources such as MCA and GSTIN to validate employee details, including email.

By integrating this API, businesses gain access to authoritative employment data, enabling fast and precise verification while ensuring compliance with employment regulations.

Legal Entity & Business Verification

This API provides a comprehensive solution for legal entity and business identity verification by interfacing with authoritative data repositories.

By leveraging these integrations, businesses can rapidly authenticate the legitimacy of legal entities, optimizing onboarding workflows while maintaining compliance with regulatory mandates and reinforcing operational integrity.

ID Converters

ID Converters serve a critical function in enabling seamless interoperability between diverse identification formats.

For instance, the PAN to GSTIN API facilitates the conversion and validation of Permanent Account Number (PAN) data into the Goods and Services Tax Identification Number (GSTIN) format, ensuring accuracy and consistency in identity mapping across financial and regulatory frameworks.

This capability enhances data integration efficiency, streamlining cross-format identity management for businesses.

The Verification Services Group functions as a comprehensive and adaptable suite of APIs, empowering organizations to enhance their identity verification workflows across multiple domains.

Whether authenticating consumer identities, verifying employment records, or validating the legitimacy of legal entities, this suite offers a unified, compliance-driven approach to identity verification—reinforcing trust, security, and regulatory adherence.

Benefits of Document Liveness Detection in KYC

1. Higher Accuracy and Security

Liveness detection ensures that only authentic and physically present documents are accepted, reducing fraud risks significantly.

2. Cost Savings for Businesses

Automating document verification eliminates the need for manual review teams, cutting operational costs while increasing efficiency.

3. Faster Customer Onboarding

Instant document verification speeds up user registration, enhancing customer experience and reducing churn rates.

4. Improved Regulatory Compliance

Financial institutions can stay compliant with global KYC/AML regulations effortlessly by integrating AI-powered document verification.

5. Protection Against Evolving Fraud Tactics

AI models continuously learn from new fraud patterns, making document liveness detection a future-proof solution for identity verification.

The Future of Document Liveness Detection in 2025 and Beyond

Looking ahead, we can expect continued advancements in document verification technology:

- AI-powered forgery detection using Generative Adversarial Networks (GANs) to detect even the most sophisticated fake documents.

- Blockchain-based identity verification, ensuring secure and tamper-proof digital identities.

- Cross-border KYC interoperability, allowing seamless identity verification across multiple countries and institutions.

- Integration with Web3 and Metaverse applications, enabling secure identity verification for decentralized digital platforms.

By 2025, document liveness detection will not just be an enhancement to KYC—it will be an essential standard for digital security and identity verification worldwide.

Conclusion

As financial institutions, fintech startups, and regulatory bodies strengthen KYC requirements, document liveness detection will become a core component of identity verification in 2025. This technology will play a pivotal role in preventing identity fraud, streamlining remote onboarding, and ensuring compliance with global regulations.

Businesses that adopt AI-driven liveness detection early will gain a competitive advantage by offering faster, more secure, and more reliable KYC verification. With the rise of deepfake fraud and synthetic identities, real-time document authentication is no longer optional—it’s a necessity.

Are you ready for the future of KYC? Now is the time to integrate document liveness detection into your verification process and stay ahead of the evolving digital security landscape.