Ever stood in line at the DMV for hours? Yeah, me too. Those days feel like torture. Good news though – that nightmare is becoming history.

Banks used to work the same way. Fill out endless paperwork. Wait forever for approval. Customers would rather watch paint dry.

Not anymore. AI just flipped the script completely.

KYC 101 – No Complicated Words, Promise

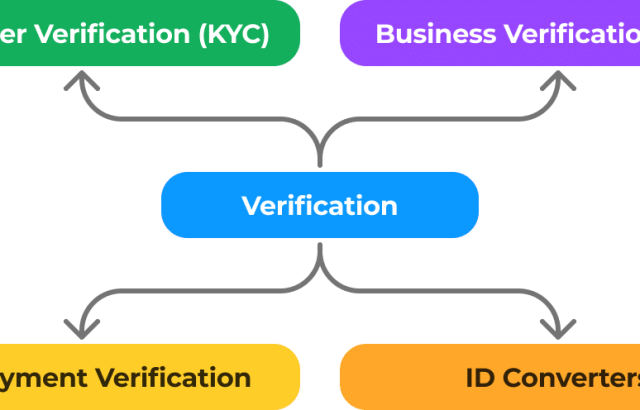

KYC means “Know Your Customer.” Fancy name for a simple idea. Companies need to verify you’re real. Not some scammer from who-knows-where.

Think of it as a digital bouncer. Checking IDs at the door. Keeping the riffraff out.

Old KYC was a mess though. Slow as molasses. Error-prone. Made customers want to scream into pillows.

Those days? Toast.

The AI Revolution Has Arrived

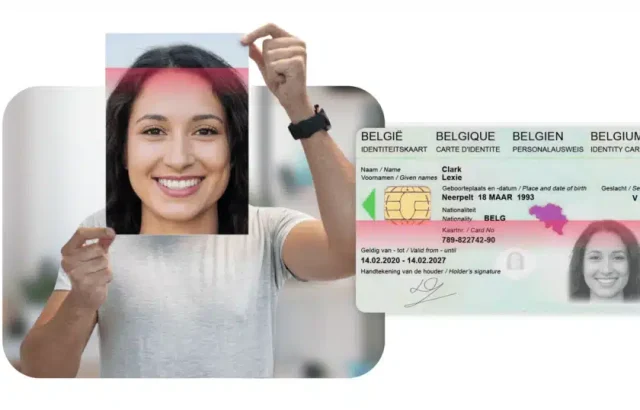

Picture this. You snap a photo of your driver’s license. Boom. Verified in 30 seconds flat.

No kidding. That’s happening right now.

These AI tools are like having Superman’s eyes. They see everything. Miss nothing. Work around the clock without coffee breaks.

Pretty sweet deal, right?

How This Magic Actually Works

Here’s the cool part. You don’t need a computer science degree to get it.

Step one: Take a photo. Any decent camera works.

Step two: AI goes to town. It examines every pixel. Checks fonts, colors, holograms. Even stuff invisible to human eyes.

Step three: Data extraction. The AI pulls out your name, address, birthday. Everything important.

Takes about as long as microwaving popcorn. Maybe less.

The AI has photographic memory too. It remembers every ID it’s ever seen. Millions of them. That’s how it spots fakes so fast.

Why 2025 Hits Different

You may wonder: why now? Why 2025? Hasn’t AI been here for years?

Yes – but the game changed. Three big things happened:

- Stricter rules. Regulators got tougher. KYC and AML checks must be sharper. Skip them, and fines hit hard.

- Smarter fraud. Deepfakes and fake IDs spread fast. Old tools couldn’t keep up.

- Better tech. AI grew stronger. Cloud got faster. Edge computing cut the wait. What was “extra” is now “essential.”

That’s why in 2025, businesses don’t just want AI ID checks. They need them.

Benefits That’ll Blow Your Mind

Let’s cut to the chase. What’s in it for you?

Lightning Speed. Remember waiting days for bank approval? Ancient history. We’re talking minutes now. Sometimes seconds.

Seriously. You could open three bank accounts faster than ordering a pizza. Wild times we’re living in.

Death of Paperwork. Print, sign, scan, email. That dance is over. Just point and shoot. Your phone does the rest.

My grandmother figured this out last week. If she can do it, anybody can.

Fort Knox Security. These systems are sharp. Really sharp. They catch fakes that would fool human experts.

It’s like having a detective with X-ray vision. Nothing gets past them.

Money in Your Pocket. Companies save big bucks. Less staff needed. Fewer mistakes. Happy customers stick around longer.

Win-win-win situation right there.

The Nerdy Stuff Made Simple

Don’t worry. We won’t get too deep in the weeds here.

OCR Magic. OCR teaches computers to read. Like teaching a robot the alphabet. Except way more advanced.

Your ID becomes data instantly. Every letter, every number. Perfectly captured.

Smart Learning. Here’s the kicker. The AI gets smarter every day. Each ID teaches it something new.

It’s like having a student who never forgets anything. And studies 24/7 without complaining.

Face Matching. Some systems check if your face matches your ID photo. Stops people from using stolen documents.

Pretty clever stuff.

Who’s Jumping on This Train?

Spoiler alert: everyone.

Banks Lead the Pack. They had the most to lose from fraud. Now they’re opening accounts faster than ever.

Customers are eating it up. Who doesn’t want instant service?

Crypto Gets Serious. Bitcoin bros need verification too. AI makes it painless. No more waiting weeks to trade.

Gaming Goes Legit. Online casinos verify ages lightning-fast. Gamers can start playing immediately. No more twiddling thumbs.

Healthcare Joins In. Hospitals prevent identity theft. Insurance companies stop fraud. Everyone wins.

Travel Gets Smooth. Hotels check you in instantly. Airlines verify passengers quickly. More vacation time, less paperwork time.

Old Problems, New Solutions

Traditional KYC was broken in so many ways. AI fixed them all.

Blurry Photos? No Problem. Old systems choked on bad images. AI works with whatever you give it. Torn IDs, coffee stains, crumpled corners. It handles everything.

Foreign Documents? Piece of Cake. German passports, Japanese licenses, Brazilian IDs. AI reads them all. It’s like having a universal translator for documents.

Fraud Detection on Steroids. Criminals keep getting cleverer. But AI stays ten steps ahead. It spots new tricks before fraudsters perfect them.

Volume? Bring It On. Processing thousands of IDs daily? Child’s play. AI never gets tired. Never needs lunch breaks. Never calls in sick.

Shopping for the Perfect SDK

Not all AI tools are created equal. Here’s your cheat sheet.

Accuracy is Everything. Look for 99%+ success rates. Anything less isn’t worth your time. Or your customers’ frustration.

Speed Matters Big Time. Fast is good. Instant is better. Customers expect Amazon-level speed everywhere now.

Plug-and-Play Simple. Integration shouldn’t require rocket scientists. Good SDKs work like USB cables. Plug in and go.

World Domination Ready. Your tool should handle documents from everywhere. US, Europe, Asia. The whole planet.

Anti-Fake Protection. This stops photo attacks cold. Someone can’t just hold up a picture anymore.

Security That Actually Works

This isn’t optional anymore. It’s everything.

Spoofing? Not Today. Good systems catch screen recordings, printouts, masks. All the tricks criminals try.

Data Locked Down Tight. Your info gets scrambled during transfer. Even hackers can’t read it.

Regulation Ready. GDPR, CCPA, whatever your industry demands. The system handles it all.

The Future is Now, Not Later

We’re not talking science fiction here. This tech exists today.

Mom-and-pop shops compete with mega-banks. All thanks to AI democratizing everything.

Your customers expect this experience. If you don’t deliver, they’ll find someone who does. Simple as that.

Success Stories That’ll Inspire You

Real companies are seeing jaw-dropping results.

Onboarding Revolution. Days became minutes. Sometimes seconds. Customers can’t believe how fast it is.

Fraud Gets Crushed. Some companies cut fraud by 80%. That’s serious money saved. Reputation protected too.

Happy Customers Everywhere. Satisfied customers become walking advertisements. Word spreads like wildfire.

Costs Plummet. Less staff overhead. Fewer fix-it tickets. Operations run smoother than butter.

Picking Your Battle Partner

This decision matters. Choose wisely.

Track records beat marketing promises every time. Look for real customers using real systems.

Support matters when things go sideways. And they will sometimes. Make sure someone answers the phone.

Test drive everything yourself. Run your documents through the system. See what happens.

Think long-term too. Will they keep innovating? Or leave you stuck with yesterday’s technology?

Implementation Without Tears

Rolling out AI KYC the right way saves headaches later.

Map Your Journey. Study your current mess first. Find the worst pain points. Set realistic goals. Nobody fixes everything overnight.

Get the Boss on Board. Leadership needs to drink the Kool-Aid. Show them competitor advantages. Make them champions, not obstacles.

Prep Your People. Change scares folks. That’s human nature. Show them how AI makes life easier. Not harder.

Test Like Your Life Depends on It. Pilot programs reveal problems early. Better to find bugs before customers do.

Rookie Mistakes to Dodge

Learn from others’ face-plants. Save yourself the embarrassment.

Don’t Sprint Out of the Gate. Rushing creates disasters. Take time to do things right. Quality beats speed every time.

Don’t Skip the Learning. Even brilliant AI needs smart humans. Train your team properly. They’re your safety net.

Don’t Fake the Testing. Use real documents from real situations. Demos look pretty. Reality bites harder.

Don’t Gamble with Security. One data breach kills reputations forever. Better safe than sorry.

ROI That Makes CFOs Smile

Let’s talk turkey. Money matters to bean counters.

Payroll Savings. One AI system replaces multiple human checkers. Those salaries add up fast. Math doesn’t lie.

Mistake Insurance. Errors cost money to fix. They tick off customers. Create legal nightmares. AI makes way fewer mistakes.

Speed Equals Revenue. Quick approval keeps customers happy. Happy customers spend more. Stay longer. Tell friends.

Compliance Safety Net. Regulatory fines hurt bad. Really bad. AI helps you stay clean. Think of it as legal insurance.

Every Industry’s Different

Cookie-cutter solutions don’t work everywhere.

Banking Needs Bulletproof. Financial services face strict rules. Expensive mistakes. Choose battle-tested solutions only.

E-commerce Needs Lightning. Online shoppers abandon slow checkouts. Every second costs sales. Speed trumps everything.

Healthcare Needs Privacy. Medical data is sacred territory. HIPAA violations destroy careers. Choose systems built for healthcare.

Government Needs Proven. Public sector moves like molasses. But safely. Pick vendors with government street cred.

Global Rules Are Tricky

Operating worldwide? Better know the rulebook.

Europe Takes Privacy Seriously. GDPR fines make grown executives cry. Make sure your AI plays by European rules.

US States Do Their Own Thing. California’s tough. New York’s tougher. Each state has different demands. Know them all.

Asia’s a Mixed Bag. Singapore’s strict. Japan’s different. China’s… complicated. Local knowledge saves bacon.

New Rules Pop Up Daily. Regulations change faster than fashion trends. Stay informed. Partner smart. Don’t wing it.

Tech Integration Reality Check

Connecting AI to old systems isn’t always smooth sailing.

Legacy Systems Hate Change. Older systems weren’t built for AI. They need updates. Or complete replacement. Plan accordingly.

APIs Don’t Always Play Nice. Not all systems speak the same language. Choose flexible SDKs. Save yourself migraines.

Data Needs a Home. Where does extracted info go? How does it get there? Map your data journey carefully.

Maintenance Never Ends. AI systems need regular check-ups. Updates, monitoring, problem-solving. Budget for ongoing care.

Customer Experience Gets Turbocharged

AI doesn’t just help businesses. It transforms lives.

Mobile Rules Everything. Everyone lives on smartphones now. Your KYC better work perfectly on tiny screens.

Everyone Deserves Access. Vision problems shouldn’t block people. Neither should mobility issues. AI can help everyone participate.

Speak Their Language. Customers speak dozens of languages. So should your AI. Global business demands global thinking.

Never Close for Business. AI works weekends, holidays, 3 AM Tuesday. Whenever customers need service.

Winning the Competition Game

AI KYC isn’t about keeping up anymore. It’s about getting ahead.

Early Birds Catch Everything. First adopters own customer mindshare. They set expectations. Define markets.

Excellence Compounds. Lower costs plus higher accuracy plus better experience. These advantages snowball over time.

Growth Gets Easy. More customers? No sweat. New markets? Bring it on. AI scales without breaking.

Innovation Opens Doors. KYC is just the beginning. AI unlocks fraud detection, risk assessment, customer analytics. The whole shebang.

Measuring What Matters

Can’t improve what you can’t measure.

Track the Right Stuff. Approval speed, error rates, customer happiness, fraud catches. Set baselines. Measure progress.

Ask Your Customers. Survey after onboarding. Listen to gripes. Fix problems fast.

Watch Your Team. How much time does AI save? What do people do with extra hours? Measure human impact.

Count the Money. Calculate real returns. Include all costs. All benefits. Be brutally honest with numbers.

The Bottom Line

KYC used to feel like a hassle. But in 2025, it’s turning into a real advantage.

With AI-powered ID document recognition SDKs, businesses can stop fraud, earn trust, and onboard customers without the headaches.

MiniAiLive makes the whole process smoother, safer, and smarter.

Still on the fence? Take this as your sign: the future is already here. The tools are ready. Your customers are, too.

Don’t let outdated KYC hold you back. Step boldly into the new era.

FAQs

Q: How fast can AI check my ID?

Really fast. Most systems do it in under a minute. MiniAiLive has lightning-fast recognition capabilities. Way faster than waiting in line at the bank.

Q: What if someone uses a fake ID?

MiniAiLive catches fakes with 99% accuracy and uses special technology to detect forged faces and documents. The AI spots tiny details humans miss. Pretty hard to fool this system.

Q: My ID photo is blurry. Will it still work?

The system works with IDs from more than 200 countries. Blurry, torn, or faded photos? No problem. The AI cleans them up on its own and makes everything clear.

Q: Do I need to download an app?

Nope. MiniAiLive integrates with existing systems without complex installations. Just use your phone camera. Take a photo. The AI handles everything else behind the scenes.

Q: How accurate is this AI system?

MiniAiLive delivers 99.996%+ accuracy for facial recognition and 99% verification accuracy with 98% customer satisfaction. That is really good. Way better than humans doing it manually.