- 1 Comment

- document liveness detection, Fraud Prevention, Id Card Recognition, ID Card Recognition System, ID Card Verification, ID Document Liveness, ID document recognition, ID Document Verification, ID Recognition, identity liveness detection, identity verification

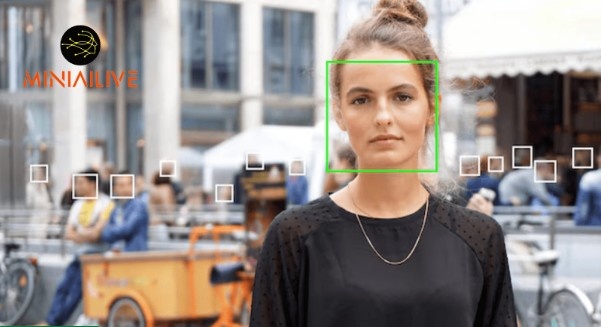

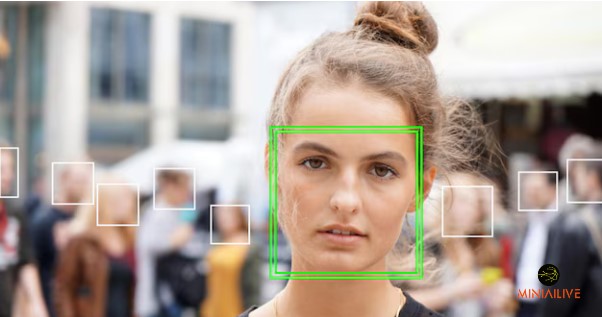

Document liveness detection ensures the authenticity of documents by verifying their physical presence and integrity. This technology prevents the use of fake or altered documents. Document liveness detection is a crucial tool in the fight against document fraud. It uses advanced technologies like AI and machine learning to verify the physical presence and integrity of […]