Fraud detection and prevention involves identifying and stopping fraudulent activities. It uses technology and data analysis to protect businesses.

Fraud detection and prevention is crucial for safeguarding financial assets and maintaining customer trust. Businesses face increasing threats from cybercriminals who use sophisticated methods to commit fraud. Implementing robust fraud detection systems helps identify suspicious activities early. Techniques like machine learning, data analytics, and real-time monitoring play a significant role in these systems.

Effective fraud prevention measures not only protect assets but also enhance the overall security framework of an organization. Companies must continuously update their strategies to keep pace with evolving fraud tactics. Investing in advanced fraud detection tools and employee training is essential for a comprehensive defense.

The Growing Menace Of Financial Fraud

Financial fraud is becoming a bigger threat every day. Scammers use new ways to trick people and steal money. This is a serious problem that needs our attention.

The Alarming Rise In Fraud Cases

In the past few years, fraud cases have increased. Many people and businesses lose money to scammers. The numbers show that fraud is a growing issue.

Statistics:

| Year | Fraud Cases Reported |

| 2019 | 300,000 |

| 2020 | 500,000 |

| 2021 | 700,000 |

These numbers are scary. They show a clear rise in fraud cases.

How Technology Fuels Financial Scams

Technology makes it easier for scammers to trick people. They use emails, phone calls, and fake websites to steal information. Many people fall for these tricks.

Common Scams:

- Phishing emails

- Fake tech support calls

- Online shopping scams

These scams can be hard to spot. Scammers use technology to make their tricks look real.

It’s important to stay aware and protect yourself from fraud. Always check who you are dealing with. Don’t share personal information with strangers. Together, we can fight the menace of financial fraud.

Types Of Financial Fraud To Watch Out For

Financial fraud is a serious concern. It can affect anyone at any time. Knowing the types of fraud can help you stay safe. Here are the most common financial frauds to watch for:

Identity Theft: A Personal Crisis

Identity theft happens when someone steals your personal information. This includes your name, Social Security number, or bank details. Thieves use this data to commit fraud or theft.

Warning signs of identity theft:

- Unfamiliar charges on your bank statement

- Calls from debt collectors about debts you don’t owe

- New credit accounts you didn’t open

To protect yourself:

- Keep your personal information private

- Monitor your bank and credit card statements regularly

- Use strong passwords and change them often

Phishing Scams: The Bait And Switch

Phishing scams involve fraudulent emails or messages. Scammers pose as trustworthy entities. They trick you into giving personal information.

Common phishing tactics:

- Emails claiming to be from your bank

- Fake alerts about account issues

- Links to fraudulent websites

To avoid phishing scams:

- Don’t click on links from unknown sources

- Verify the sender’s email address

- Report suspicious emails to your email provider

Card Fraud: Swiped Away

Card fraud occurs when your credit or debit card information is stolen. Thieves make unauthorized purchases or withdraw money.

Signs of card fraud:

- Unrecognized transactions on your statement

- Missing card transactions

- Declined card despite sufficient funds

To prevent card fraud:

- Use chip-enabled cards

- Notify your bank of lost or stolen cards immediately

- Check your statements frequently

The High Cost Of Financial Fraud

The high cost of financial fraud affects both individuals and businesses. The financial loss is staggering, with billions lost annually. This section explores the impact on victims and the economy.

Impact On Individual Victims

Victims of fraud often face severe consequences. Financial loss is immediate and significant. Many lose their life savings or retirement funds.

Emotional distress is common among victims. They feel betrayed and vulnerable. This can lead to anxiety, depression, and other health issues.

Rebuilding trust in financial systems is challenging. Victims may avoid banks and online transactions. This fear can limit their financial opportunities.

Economic Repercussions On Businesses

Businesses suffer immensely from fraud. Financial losses can be overwhelming. Small businesses are especially vulnerable and may face bankruptcy.

Reputation damage is another major issue. Customers lose trust in companies that experience fraud. This can lead to a loss of business and revenue.

Increased security costs are a direct consequence. Companies must invest in fraud prevention measures. This includes hiring experts and using advanced technology.

Legal consequences also add to the burden. Businesses may face lawsuits from affected customers. This can result in hefty legal fees and settlements.

| Impact Area | Consequences |

| Individual Victims | Financial loss, emotional distress, trust issues |

| Businesses | Financial loss, reputation damage, security costs, legal issues |

Key Indicators Of Fraudulent Activity

Understanding the key indicators of fraudulent activity is essential for businesses. Detecting fraud early can save money and protect reputation. Below, we explore some crucial signs of fraud.

Recognizing Red Flags

Recognizing red flags can help in identifying fraudulent activities. Here are some common red flags:

- Unusual account activity: Unexpected transactions or access times.

- Duplicate payments: Payments made more than once for the same invoice.

- Altered documents: Invoices or receipts with changes or inconsistencies.

- Unexplained losses: Missing funds or resources without clear reasons.

- High employee turnover: Frequent staff changes can indicate underlying issues.

Monitoring Suspicious Patterns

Monitoring suspicious patterns can provide early warnings of fraud. Consider these strategies:

- Analyze transaction history: Look for outliers or anomalies in data.

- Track login attempts: Monitor unsuccessful or frequent logins.

- Monitor vendor activities: Verify vendor details and payment histories.

- Employee behavior analysis: Watch for unusual actions or habits.

- Use automated tools: Implement software to detect irregular patterns.

Consistent monitoring and recognizing red flags are crucial. These methods help in early detection and prevention of fraudulent activities.

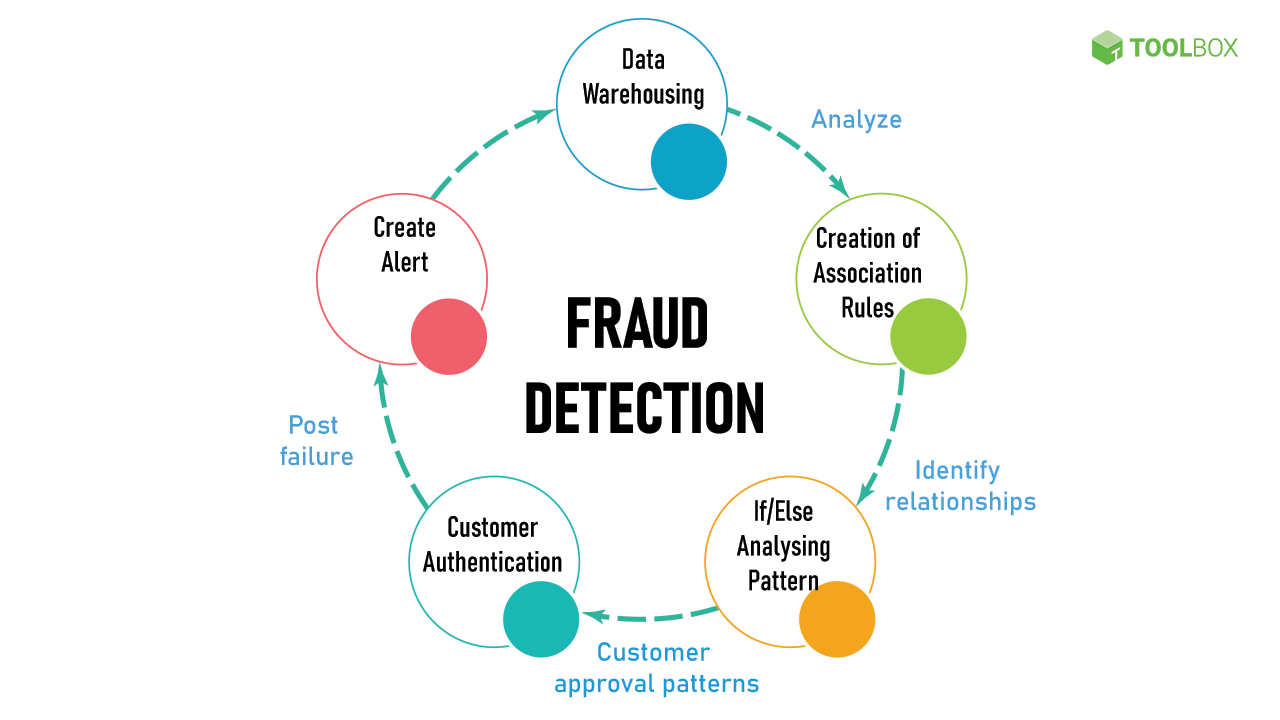

Technological Tools For Fraud Detection

Fraud detection is critical in today’s digital world. Technological tools help in identifying and preventing fraud. These tools use advanced techniques to analyze data and detect suspicious activities. Two major technological tools are AI and machine learning, and data analytics.

Leveraging Ai And Machine Learning in Fraud Detection

Artificial Intelligence (AI) and machine learning are powerful tools for fraud detection. They can analyze large amounts of data quickly. This helps in identifying patterns and anomalies that might indicate fraud.

AI systems learn from past fraud cases. They improve their ability to detect fraud over time. Machine learning algorithms can adapt to new fraud techniques. This makes them more effective in preventing fraud.

Here are some key benefits of using AI and machine learning in fraud detection:

- Real-time monitoring and analysis

- Improved accuracy in detecting fraud

- Reduced false positives

- Scalability to handle large datasets

The Role Of Data Analytics in Fraud Detection

Data analytics is another essential tool for fraud detection. It involves examining large datasets to find patterns and trends. These patterns can indicate fraudulent activities.

Data analytics helps organizations understand their data better. It provides insights into potential fraud risks. By analyzing data, businesses can identify unusual transactions and behaviors.

Here are some ways data analytics is used in fraud detection:

- Transaction monitoring

- Behavioral analysis

- Risk scoring

- Predictive modeling

Data analytics provides a detailed view of transactions. It helps in identifying suspicious activities and preventing fraud. The combination of AI, machine learning, and data analytics is powerful. These tools work together to detect and prevent fraud effectively.

Best Practices For Fraud Detection and Prevention

Fraud prevention is essential for businesses to protect their assets. Implementing effective strategies can significantly reduce the risk of fraud. Below are some of the best practices for fraud prevention.

Strong Authentication Protocols in Fraud Detection

Implementing strong authentication protocols is crucial. Use multi-factor authentication (MFA) to add an extra layer of security. Ensure passwords are complex and updated regularly. Encourage users to use unique passwords for different accounts. Consider Biometric verification methods like fingerprint or facial recognition. These methods add an additional layer of security.

Continuous Education And Awareness in Fraud Detection

Ongoing education and awareness are key to fraud prevention. Conduct regular training sessions for employees. Teach them how to recognize phishing attempts. Provide examples of common fraud schemes. Create a culture where employees feel comfortable reporting suspicious activities. Regular updates on new fraud tactics keep everyone informed. Use newsletters, emails, or workshops to disseminate this information.

Below is a summary of these practices in a table:

| Practice | Description |

| Strong Authentication Protocols | Use MFA, complex passwords, and biometrics for added security. |

| Continuous Education and Awareness | Regular training and updates on fraud schemes. |

By implementing these best practices, businesses can significantly reduce the risk of fraud. Prioritizing these actions helps in creating a secure environment.

Legal Framework And Regulations

The legal framework and regulations for fraud detection and prevention are crucial. Understanding these regulations helps protect businesses and individuals. Compliance ensures you stay within the law and avoid penalties. Let’s delve into some important aspects.

Understanding Your Rights

Every individual has rights regarding fraud protection. Knowing your rights can help you take action quickly.

- Right to information: You have the right to know if your data is compromised.

- Right to compensation: You can seek compensation for any fraud-related losses.

- Right to privacy: Your data should be protected against unauthorized access.

Compliance And Regulatory Requirements

Businesses must comply with various laws to prevent fraud. Here are some key requirements:

| Regulation | Description |

| GDPR | Protects personal data in the EU. |

| PCI DSS | Secures credit card transactions. |

| Sarbanes-Oxley Act | Prevents corporate fraud in the USA. |

Meeting these requirements is essential. Non-compliance can result in heavy fines.

Implement strong security measures. Ensure regular audits and updates. This keeps your systems secure and compliant.

Recovering From Financial Fraud

Financial fraud is a distressing experience. It can shake your confidence and cause significant financial loss. Recovering from financial fraud involves several steps to regain control and ensure it doesn’t happen again. This section will guide you through the necessary actions to take after experiencing fraud and provide resources for victims.

Steps To Take Post-fraud

Immediate action is crucial after discovering fraud. Follow these steps to start your recovery process:

- Report the Fraud: Contact your bank or credit card company. Inform them of the fraudulent activity.

- Freeze Your Accounts: Freeze all affected accounts. This prevents further unauthorized transactions.

- Document Everything: Keep a detailed record of all communications and transactions related to the fraud.

- File a Police Report: Report the fraud to your local police department. Obtain a copy of the report for your records.

- Notify Credit Bureaus: Contact credit bureaus to place a fraud alert on your credit report.

- Change Passwords and PINs: Update all passwords and PINs for online accounts and banking.

Resources For Victims in Fraud Detection

Several resources can assist victims of financial fraud. These organizations provide support and information:

- Federal Trade Commission (FTC): The FTC offers a wealth of information and a complaint form for reporting fraud. Visit their website.

- Identity Theft Resource Center (ITRC): ITRC provides free assistance for victims. Access their resources on their website.

- Consumer Financial Protection Bureau (CFPB): CFPB helps with financial issues and complaints. Learn more on their website.

- National Fraud Information Center (NFIC): NFIC offers advice and support for fraud victims. Visit their website.

Utilizing these resources can provide guidance and support during the recovery process. Stay proactive and vigilant to protect yourself from future fraud attempts.

The Future Of Fraud Detection

The future of fraud detection is rapidly evolving. Advanced technologies and methods are paving the way for more robust systems. These innovations are crucial in staying ahead of increasingly sophisticated fraudsters.

Predictive Technologies

Predictive technologies play a vital role in fraud detection. They help identify suspicious activities before they become significant threats. These technologies use machine learning and artificial intelligence to analyze patterns.

- Machine Learning: This helps in predicting fraudulent transactions.

- Artificial Intelligence: AI improves the accuracy of predictions.

- Data Analytics: Analyzes vast amounts of data for anomalies.

Predictive models continuously learn from new data. This makes them better at detecting fraud over time. Businesses can thus stay one step ahead of fraudsters.

The Evolving Landscape Of Cyber Threats

The landscape of cyber threats is ever-changing. New threats emerge as old ones are mitigated. Keeping up with these changes is crucial for effective fraud prevention.

Here are some emerging cyber threats:

- Phishing Attacks: Fraudsters trick users into giving personal information.

- Ransomware: Malicious software blocks access to data until a ransom is paid.

- Account Takeover: Unauthorized access to user accounts for fraudulent transactions.

Organizations must adapt to these evolving threats. This involves updating their fraud detection systems regularly. They should also educate their employees and customers about these threats.

| Technology | Application |

| Machine Learning | Predicts and identifies fraudulent transactions. |

| Artificial Intelligence | Enhances prediction accuracy and decision-making. |

| Data Analytics | Analyzes data for suspicious patterns and anomalies. |

Frequently Asked Questions

What Is Fraud Detection?

Fraud detection involves identifying and preventing fraudulent activities. It uses data analysis and algorithms to spot suspicious behavior and anomalies.

How Does Fraud Detection Work?

Fraud prevention uses techniques like monitoring, algorithms, and user authentication. It aims to stop fraudulent activities before they happen.

Why Is Fraud Detection Important?

Fraud detection protects businesses and individuals from financial loss. It also maintains trust and ensures compliance with regulations.

What Are Common Types Of Fraud?

Common types include identity theft, credit card fraud, and phishing. Each type exploits different vulnerabilities.

Conclusion

Effective fraud detection and prevention are crucial for safeguarding businesses. By implementing robust strategies, companies can minimize risks. Leveraging advanced technologies and continuous monitoring is key. Stay proactive in identifying threats to protect your assets. Prioritize security to ensure a safe and trustworthy environment for your customers.

One Reply on “Fraud Detection and Prevention: Powerful Strategies to Safeguard Your Finances in 2024”