How to Use Face Recognition SDK

Face Recognition SDK Overview

Abigail Forester

CEO, MiniAI.Live

Various SDKs

Cross-Platform Compatibility Face Recognition

Enjoy cross-platform support that allows integration across multiple environments, including web, iOS, and Android, providing a flexible and consistent user experience. It maks our company attracts many clients and our energitic support maks our clients happy.

- On-Premises Server SDKs

- On-Device Android & iOS SDKs

- Seamless User Experience

- Reduced Development Cost

- Uniform Anti-Spoofing

- Lightweight and Portable Models

- Easy SDK Integration

- Unmatched user experience

- 5M+ faces verified monthly

- Consistency in Security & Accuracy

- High Scalability

- On-Device Processing

- Real-Time Performance

Face Recognition Server SDK

Our Face Verification SDK delivers precise and swift identification, even in complex conditions like low lighting and varying angles, ensuring optimal performance and security.

- Face Detection

- Face Templates Extraction

- Face Matching

- Pose Estimation

- 68 points Face Landmark Detection

- Face Quality Calculation

- Face Occlusion Detection

- Eye Closure Detection

- Mouth Opening Check

Security and Simplicity with MiniAI’s facial recognition

Facial verification systems are designed to provide a higher level of assurance to businesses, however, in doing so, they create a lot of friction for the user. MiniAI is the only vendor in the world that achieves security, not at the cost of simplicity, but alongside it.

- Instantly detect image manipulation, use of emulators, or face detect in video stream manipulation.

- Use advanced liveness detection and 3D depth analysis for our face verification SDK to prevent replay and printed photo spoof attacks in real time.

- Deliver a fast and frictionless face verification technology in under 1 second, no extra steps, gestures, or waiting time.

- Provide real-time face verification on any device, and automatically detect blur, glare, and improper framing in face verification system.

- Certified iBeta Level 1 and 2 face verification solution from NIST NVLAP independent test lab.

- Unlike other face verification vendors, MiniAI offers in-house technology that means that all your data is secured at one place, securely.

Facial Biometrics System built for Real-World Identity

From face verifying physical presence to enabling document-free onboarding, MiniAI's biometric face verification SDK deliver fast, accurate, and adaptive verification.

- Liveness Detection

- Deepfake Detection

- Photo ID Matching

- Facial Age Estimation

- Passwordless Authentication

How To Use Face Recognition Server SDK

Face Recognition Mobile SDK

We developed face matching android app which is available on Google Play Store.

10K+ downloaded and high ranking reviews on google play store, became already Top one face recognition app on google.

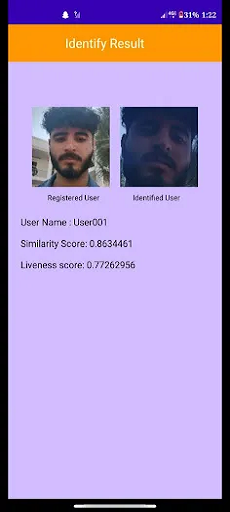

Process of MiniAI Mobile Face Recognition SDK

Register User

Add a user’s face to the database by extracting face templates from the gallery or directly via the camera.

Identify User

Use the camera to capture face templates and identify users by matching them against the database.

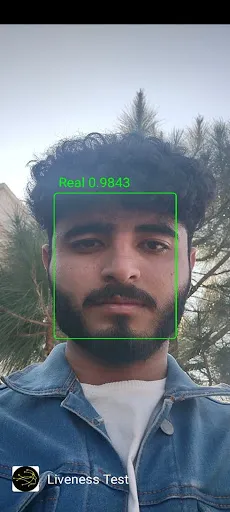

Liveness Check

During the identification process, the app performs liveness detection to ensure the face is real and spoofed.

Settings

Access the settings page to adjust liveness detection and identification thresholds.

Questions About Face Recognition SDK

Yes, our Facial verification Free Online service is completely free. No installation is needed, and it’s free. Just open the webpage and start using it right away.

But if you want to implement our face matching SDK on your own server or need to change mobile application ID, then you need to purchase our license.

Yes, our Mobile Face matching technology will work perfectly on any device. You may use it as a phone browser, which makes it easy to use on the go.

If you want to build your own app then you need to purchase our SDK with affordable price.

The Face Matching Attendance System checks a person’s face in real-time and keeps track of who is there. It works faster than older systems and doesn’t require physical contact, which helps stop buddy punching.

It is doing face register manually for company members or students and match with unregistered faces automatically.

MiniAi uses AI-based technology to find and check faces with a high level of accuracy. It works effectively in a range of lighting settings and can recognize different types of faces.

Our face matching technology already marked top level accuracy and listed top ranking on NIST.

Yes. Your privacy is important. We don’t keep or share your pictures. The tool just utilizes your photo for a short time to process it and then deletes it.

It is fully on-prem solution which means no data leaves on server and it is fully offline solution for mobile version.