Walk into any fintech conference in 2025 and you’ll hear the same hum beneath the buzzwords: fraud is getting smarter, faster, and cheaper to pull off. Fake IDs pop up like weeds. Deepfakes aren’t just in funny internet memes anymore, they’re in bank onboarding flows, slipping through like water through a sieve. And synthetic identities? They’re everywhere, stitched together like Frankenstein’s monster with bits of real and fake data.

So here we are, staring down the question that keeps fintech leaders awake at night: is traditional KYC enough, or is it time to double down on biometrics?

Spoiler: the paper-and-scan playbook of the past isn’t holding up. What used to be a fence is now more like a picket gate anyone can hop over. Biometrics, on the other hand, is the steel door with motion sensors bolted on top.

Let’s break down why the shift matters, how ROI actually plays out in the real world, and where the whole space is heading.

The Changing Face of KYC

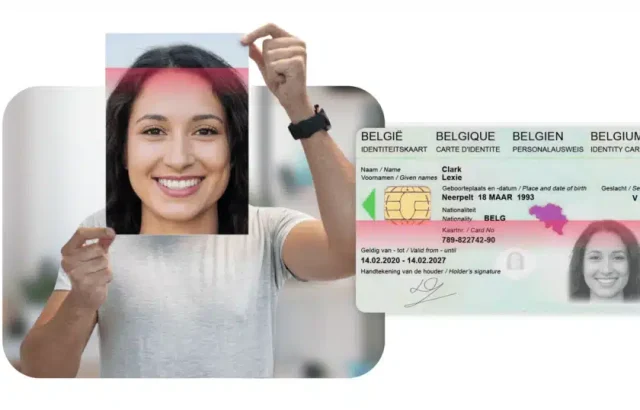

Old-school KYC was simple. A photo ID here, a utility bill there, maybe a selfie just to make sure you look like your photo. Add a database check and you’re good.

Back then, it did the job. Today? Not so much.

Fraudsters don’t need to be movie-level hackers anymore. They just need a cheap toolkit and a Telegram channel.

- Fake passports are pumped out like fast food.

- Deepfake videos can fool even seasoned compliance officers.

- Synthetic IDs—half real, half fiction—breeze through databases.

Traditional KYC is like locking your house with a flimsy padlock. Sure, it looks like security, but the first thief with bolt cutters is already inside.

And regulators have caught on. Customers too. Which is why biometrics is no longer the “fancy option”—it’s the minimum bar for survival.

Biometrics Takes the Spotlight

When people hear biometrics, they think fingerprints at the airport or Face ID on an iPhone. That’s child’s play compared to what fintech is doing now.

Here’s what’s actually in the mix:

- Face recognition with liveness detection. Not just “does this face match?” but “is this face alive, 3D, and in front of me right now—not a photo, mask, or video loop?”

- Document liveness. That shiny passport—does it reflect holograms, textures, microprints, or is it just a screenshot from Google Images?

- Palm and vein scans. Futuristic? Sure. But used where stakes are sky-high.

- Voice biometrics. Still maturing, but pairing voice with face adds another lock.

The real magic? Passive liveness. No awkward “blink three times” or “turn your head left.” The system does the heavy lifting in under a second. For the user, it’s as smooth as snapping a selfie. For a fraudster, it’s like hitting a brick wall at full speed.

And let’s be real: in a world where onboarding time makes or breaks user growth, this speed is gold. If your rival gets people through in three minutes and you take three days, you’re toast.

ROI: Where Biometrics Earns Its Keep

This isn’t about fluffy “future-proofing.” ROI shows up in three very concrete ways: fraud cut down, conversion lifted up, and operations running leaner.

1. Fraud Losses Drop Like a Stone

Every fraud attempt that slips through costs money—sometimes thousands per case. At scale, it’s a hemorrhage. By weeding out deepfakes, doctored docs, and spoof attempts upfront, biometrics keeps the hole plugged.

Case in point: one crypto exchange that rolled out biometric liveness slashed fraud by 50% in year one. That’s not “value-add.” That’s survival.

2. Onboarding Speeds Up (and So Do Sign-Ups)

Nobody loves waiting. Traditional KYC often takes hours, days even. People bounce before finishing. Biometrics delivers verdicts in seconds.

That same exchange? Their onboarding got 30% faster, and more customers actually stuck around to complete sign-up. That’s straight revenue.

3. Compliance Teams Breathe Easier

Manual reviews eat budgets. Agents second-guessing fuzzy selfies. “Maybe” cases bouncing between desks. Every one of those is time (and money) lost.

Biometrics strips most of that out. Higher first-pass accuracy, fewer false alarms, less human back-and-forth. Your team finally gets to work on what matters.

Risk Reduction in Numbers You Can Feel

Let’s get concrete.

- Traditional KYC lets 1–2% of fraudsters sneak in. Seems tiny, until you’re handling millions of accounts. Then it’s a disaster.

- False rejections in old KYC? That’s real customers getting unfairly locked out. They don’t come back.

- Biometric KYC with liveness clocks 99.99% accuracy and up to 97% first-pass success (MiniAiLive data).

The risk delta isn’t small. It’s night and day.

And here’s the kicker: regulators now demand proof of liveness. A static screenshot of an ID won’t cut it anymore. They want evidence that the human and document were real at the moment of onboarding. Traditional KYC can’t deliver that. Biometrics can.

The Human Side of ROI

Numbers tell one story. Humans tell another. And if you’re in fintech, you’d better be listening to both. Sure, ROI spreadsheets can show fraud reduction percentages, onboarding times, or cost savings—but they don’t tell you how a real person feels when they try to sign up for your app.

Think about it. Onboarding is the very first date with your customer. If the process feels clunky, slow, or worse, mistrustful, you can bet your bottom dollar they won’t stick around. You can have the most bulletproof compliance system in the world, but if someone bounces at the first click, that ROI you calculated? Poof—gone like steam.

Biometrics changes that first impression completely. A quick face scan. Done. A document check in seconds. Done. No awkward emails back and forth. No blurry uploads that make your customer feel like they’re navigating a bureaucratic maze. It’s smooth. It’s fast. And it subtly whispers: “We trust you, and we’ve got your back.”

And here’s the magic part—trust begets loyalty. When users feel safe, when the friction is minimal, they’re more likely to stick around. They’re more likely to come back, tell a friend, or even pay for a premium service without batting an eye. That kind of intangible ROI—customer trust, satisfaction, and retention—is just as real as any number on your balance sheet. It’s the kind of ROI that compounds quietly, steadily, like interest in a high-yield account.

Of course, not every moment is perfect. There will always be edge cases—low-light selfies, shaky hands, slow internet. But even then, a well-designed biometric system guides users gently, rather than throwing up an error message that reads like a slap in the face. It feels human, like someone’s there holding your hand.

So yes, the human side of ROI is about numbers, but it’s also about feelings. It’s about the sigh of relief when a process just works. The smile when someone breezes through verification in seconds. And the quiet confidence knowing your personal data isn’t floating around in some unprotected server somewhere.

At the end of the day, smooth, trustworthy onboarding isn’t just a nice-to-have—it’s a revenue engine in disguise. You protect your business, sure—but more importantly, you respect your customers. And in 2025, that kind of respect? It’s gold.

Real-World Stories in 2025

This isn’t just theory. Let’s look at where it’s playing out.

Neobanks and Fintech Apps

Margins are thin. Fraud hurts more. A European neobank saw fraud write-offs plummet 40% after adding biometric onboarding. That freed up capital for—guess what—new product launches.

Crypto and DeFi Platforms

Wild West, highest fraud pressure. Exchanges with biometric checks not only halved fraud but also looked more trustworthy to regulators. That opened new markets and licenses faster.

Traditional Banks

Old guard, slow to move—but moving nonetheless. A South Asian bank cut manual review teams by half with document liveness. Their auditors practically applauded.

Governments

Digital ID programs in several countries now require biometric liveness. They know static photo IDs are an open door for fraudsters armed with AI.

Trade-Offs: Because Nothing’s Free

Let’s be real for a second: nothing in life—or fintech—is free. Biometrics isn’t a magic wand you wave and poof, all your problems vanish. Nope. It’s a powerful tool, sure, but like any tool, it has its quirks, bumps, and “aha—didn’t see that coming” moments.

First, the integration costs. They sting a bit. But honestly? A few months of setup is nothing compared to years of chasing fraud, sifting through manual reviews, and begging customers not to abandon the signup halfway through. It’s like buying a sturdy, reliable car versus a clunker that breaks down every week—you pay more upfront, but you don’t spend the rest of your life at the mechanic.

Then there’s UX hiccups. Old phones, bad lighting, shaky internet—these things trip people up. No one likes an onboarding system that’s like navigating a funhouse of error messages. A good biometric system guides users smoothly, gently nudging them along. The bad ones? They’ll leave your users grumbling and support tickets piling up like a game of Jenga in a hurricane.

Don’t forget the false rejects versus false accepts dance. Too strict, and you lock out genuine users. Too loose, and fraudsters waltz right in. It’s a tightrope act—you need constant tuning, a steady hand, and a clear eye on analytics.

And of course, the vendor choice matters—passive 3D liveness is a total game-changer. “Blink-and-nod” gimmicks? Not so much. Picking the right partner can make or break your ROI and, more importantly, your customer trust.

So, here’s the bottom line: biometrics isn’t plug-and-play. It’s an investment, one that pays off if you respect the bumps, plan for the twists, and embrace the trade-offs. Take it seriously, tune it smartly, and you’ll find the juice is worth the squeeze.

2025 and the Road Ahead

Here’s the reality: it’s AI versus AI now.

Fraudsters use generative AI to churn out fake faces, fake voices, even entire synthetic IDs. Defenders counter with AI that spots the tiny glitches: pixels off, depth inconsistent, shadows not lining up.

The next frontier? Continuous verification. Not just at onboarding. Every time you log in, the system quietly checks it’s really you—no password, no fuss. Already rolling out in high-security apps.

Then there’s privacy. People worry where their biometric data goes. Vendors that bake in encryption, data control, and GDPR/CCPA compliance will win. Those that don’t? They’ll be toast.

Fast forward to 2030, and the real debate won’t be “biometrics or traditional.” It’ll be “which biometric system adapts fastest to the next fraud mutation?”

Wrapping It Up: Skeleton Keys vs Steel Doors

Traditional KYC is a skeleton key. Fraudsters already copied it. It opens too many doors, too easily.

Biometrics with liveness? That’s the steel door. With sensors. And an alarm system. Sure, nothing’s perfect—but it raises the cost of attack sky-high.

The ROI’s not fuzzy anymore. It’s cold, hard numbers: fraud cut, onboarding sped up, costs trimmed, customers happier.

In 2025, the winners will be the ones who stop treating KYC as red tape and start treating it as a growth engine.

So, ask yourself this: are you still guarding millions with a paper wall—or have you built the steel door?

FAQs

What’s the main difference between biometrics and traditional KYC?

Traditional KYC is like showing a photo ID and hoping for the best—paper, pixels, and prayers. Biometrics goes a step further: it checks that you’re really you in real time, with liveness detection, facial recognition, or document authenticity. Think of it as a digital bouncer that never sleeps.

How does biometrics improve onboarding speed?

Gone are the days of waiting hours—or even days—for account approval. A quick scan, a live selfie, and your documents verified in seconds. Making things easy makes users happy and gets more sign-ups. It’s like switching from a long line to a fast lane.

What are the costs or trade-offs?

Sure, setup isn’t free. Integration, UX tweaks, and vendor choice take planning. Think of it as planting a tree—you water it now, reap shade (and fruit) later.

Can biometrics handle poor lighting or older devices?

Modern systems are surprisingly forgiving. Passive 3D liveness and smart algorithms adapt to less-than-perfect conditions. Users might stumble a bit here or there, but a good setup guides them gently—no shouting “try again” at every step.