Introduction

The cryptocurrency industry is evolving at a rapid pace, and identity verification (IDV) is playing an increasingly critical role in maintaining security and compliance. As regulatory bodies tighten their grip on Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, crypto exchanges, wallets, and decentralized finance (DeFi) platforms must adopt robust IDV solutions.

One such powerful solution is the MiniAiLive SDK, which offers an efficient way to integrate identity verification into crypto platforms. In this blog, we will explore the latest IDV trends in the crypto space for 2025 and provide a detailed guide on implementing the MiniAiLive SDK.

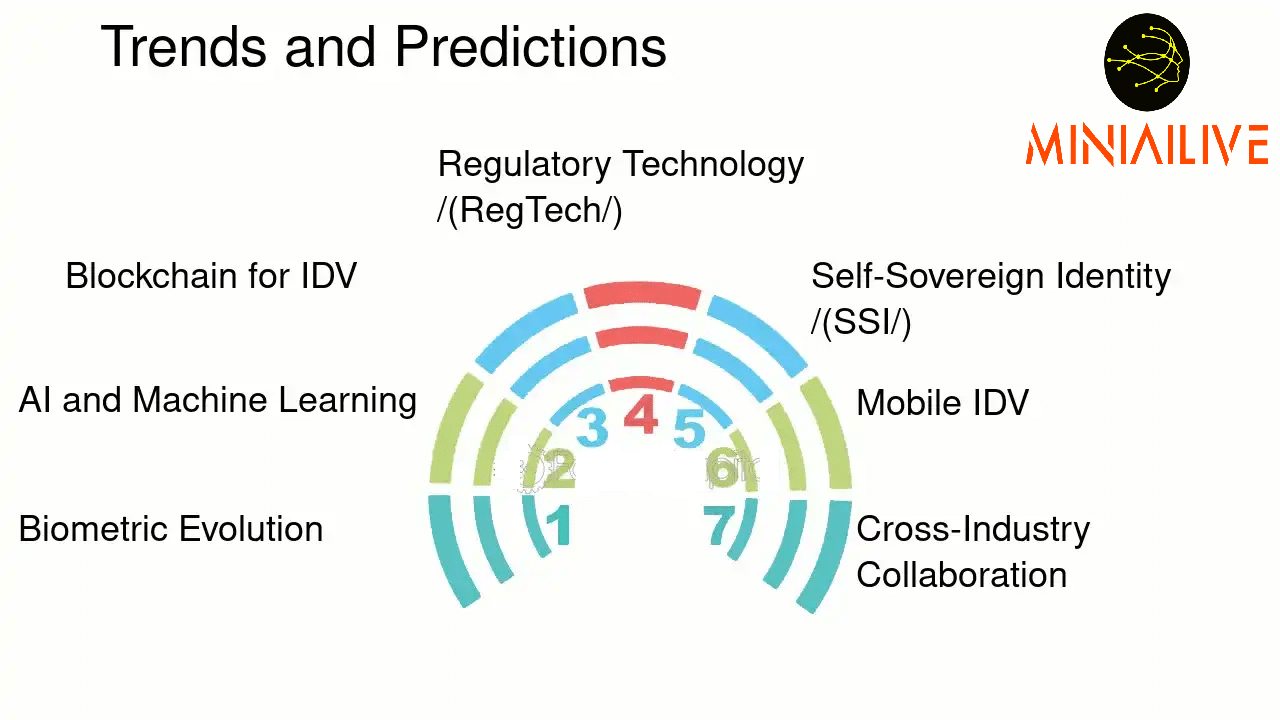

IDV Trends in Crypto Field 2025

1. AI-Driven Identity Verification

Artificial intelligence (AI) continues to enhance IDV processes by improving fraud detection, reducing verification times, and increasing accuracy. AI-powered IDV solutions can analyze biometric data, detect deepfakes, and identify fraudulent activities with greater precision.

2. Blockchain-Based Digital Identity

Decentralized identity (DID) solutions are gaining traction as blockchain technology provides a secure and immutable way to store identity data. Self-sovereign identity (SSI) allows users to control their own digital identities, reducing reliance on centralized databases and minimizing risks of data breaches.

3. Biometric Authentication for IDV

Biometric verification methods, such as facial recognition, palm vein scanning, and fingerprint authentication, are becoming standard in crypto IDV. These methods enhance security and streamline onboarding processes for users.

4. Regulatory Compliance and Global Standards

With increasing regulations such as MiCA (Markets in Crypto-Assets) in the EU and FinCEN’s Travel Rule in the US, IDV solutions must comply with global and local regulatory standards. Automated compliance checks will play a major role in ensuring seamless user onboarding while meeting legal requirements.

5. Zero-Knowledge Proof (ZKP) for Privacy-Preserving IDV

Zero-Knowledge Proof (ZKP) technology allows users to verify their identity without exposing unnecessary personal data. This trend aligns with privacy-focused crypto ecosystems, ensuring compliance without compromising user privacy.

6. Fraud Prevention Using Machine Learning

Machine learning models are being integrated into IDV solutions to detect anomalies in user behavior and transaction patterns. Real-time fraud detection helps prevent identity theft and other illicit activities within crypto platforms.

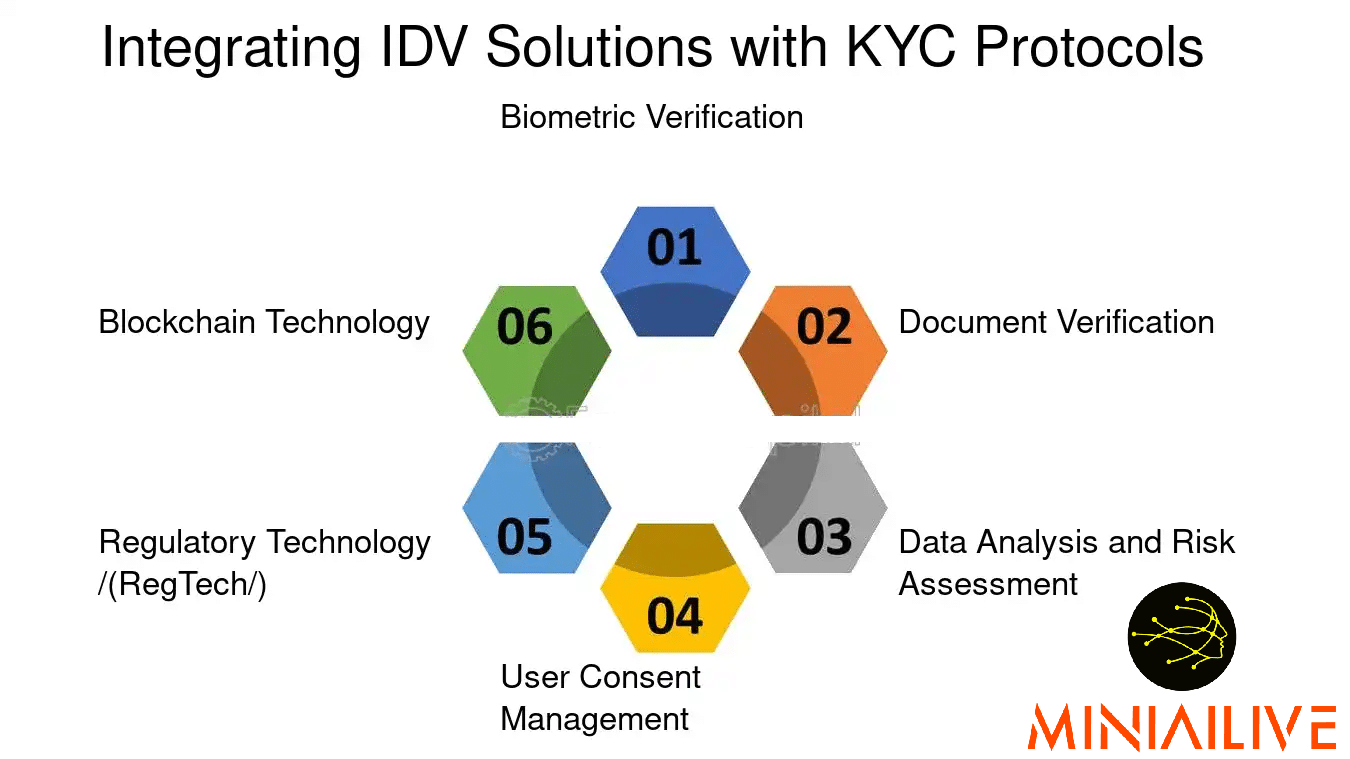

Integrating IDV Solutions with KYC Protocols

The convergence of Identity Verification (IDV) systems with Know Your Customer (KYC) frameworks is pivotal in fortifying the security and integrity of financial transactions and digital services. As digital interactions become ubiquitous, the demand for highly secure and compliant IDV solutions that seamlessly align with KYC mandates has reached a critical threshold. Financial institutions and fintech service providers increasingly deploy advanced IDV methodologies to optimize customer onboarding, mitigate fraud risk, and ensure adherence to stringent regulatory frameworks. These solutions leverage cutting-edge technologies, including biometric authentication, AI-driven document forensics, and risk-based analytics, each introducing distinct advantages and implementation challenges.

From a regulatory compliance standpoint, integrating IDV mechanisms with KYC procedures ensures conformity with Anti-Money Laundering (AML) directives and Counter-Terrorist Financing (CTF) protocols. Conversely, from an operational and user experience perspective, robust integration expedites identity validation, reducing onboarding latency and enhancing usability. For enterprises, this synergy establishes an equilibrium between security imperatives, regulatory obligations, and process efficiency.

Key Technological Aspects of IDV-KYC Integration

-

Biometric Authentication: The incorporation of biometric markers such as fingerprints, facial geometry, and iris scans augments the robustness of KYC authentication frameworks. Financial institutions deploy liveness detection algorithms and multi-modal biometric comparison models to validate user identities against official documentation in real-time.

-

AI-Powered Document Verification: Machine learning-driven document forensics automate the validation of government-issued identity credentials (e.g., passports, driver’s licenses, and utility statements). These systems leverage optical character recognition (OCR), deep learning anomaly detection, and tamper-evidence analysis to detect synthetic identity fraud and document forgeries with high accuracy.

-

Data-Driven Risk Scoring & Behavioral Analytics: By integrating IDV solutions with risk-based KYC assessment models, financial entities can harness predictive analytics to quantify customer risk profiles. AI-powered transactional pattern analysis and anomaly detection algorithms proactively flag potentially fraudulent behaviors by assessing historical customer activity, geolocation data, and device intelligence.

-

User Consent & Data Governance Mechanisms: Ensuring GDPR-compliant data sovereignty is paramount in IDV-KYC integrations. Advanced solutions implement privacy-preserving cryptographic techniques, such as zero-knowledge proofs (ZKPs) and decentralized identity (DID) frameworks, to enforce user data control and granular consent management in compliance with regulatory mandates.

-

Regulatory Technology (RegTech) Automation: The deployment of RegTech solutions facilitates real-time compliance monitoring and regulatory reporting automation. AI-powered compliance engines dynamically adapt to evolving AML/KYC regulatory landscapes, ensuring seamless policy enforcement within IDV infrastructures while minimizing compliance overhead.

-

Blockchain-Based Identity Management: Distributed Ledger Technology (DLT) is being explored as a trustless verification mechanism for secure identity data storage and interoperability. Blockchain-integrated KYC solutions eliminate redundant verification loops by enabling tamper-proof identity attestations that can be shared across financial ecosystems without compromising data integrity.

How to Use MiniAiLive SDK for IDV in Crypto

1. Overview of MiniAiLive SDK

MiniAiLive SDK is a comprehensive identity verification solution designed for crypto applications, enabling seamless user authentication while ensuring compliance with KYC and AML regulations. It offers features such as:

- OCR for ID Documents (Passport, Driver’s License, National ID, etc.)

- Biometric Verification (Facial recognition, Liveness detection)

- Fraud Detection (AI-powered anti-spoofing mechanisms)

- Integration with Blockchain and DeFi protocols

2. Integrating MiniAiLive SDK into a Crypto Application

Step 1: Setting Up the MiniAiLive SDK

Before integrating the SDK, ensure you have the following prerequisites:

- API Credentials from MiniAiLive

- A crypto platform (exchange, wallet, or DeFi app)

- Development environment (React Native for mobile, Python or Node.js for backend)

Step 2: Installing the SDK

For mobile applications, install the SDK in your project:

npm install miniailive-sdkFor Python-based backend integration:

pip install miniailive-sdkStep 3: Configuring API Keys

Initialize the SDK with your API key:

import MiniAiLive from 'miniailive-sdk';

const miniAi = new MiniAiLive({

apiKey: 'your-api-key',

environment: 'production' // or 'sandbox' for testing

});Step 4: Implementing Document OCR Verification

Capture and verify user ID documents using OCR:

async function verifyUserID(imageData) {

const result = await miniAi.processID({ image: imageData });

console.log(result);

}Step 5: Adding Biometric Authentication

Facial recognition and liveness detection ensure a secure IDV process:

async function verifyFace(faceImage) {

const result = await miniAi.verifyFace({ image: faceImage });

console.log(result);

}Step 6: Real-Time Fraud Prevention

MiniAiLive SDK includes AI-driven fraud detection features:

async function checkFraud(userID) {

const result = await miniAi.checkFraud({ userId: userID });

console.log(result);

}Step 7: Compliance Checks and Reporting

Ensure regulatory compliance with automated AML checks:

async function amlCheck(userData) {

const result = await miniAi.checkAML({ user: userData });

console.log(result);

}Case Study: Implementing MiniAiLive in a Crypto Exchange

A mid-sized crypto exchange integrated MiniAiLive SDK to streamline its KYC verification process. The results included:

- 30% faster onboarding times for new users

- Reduction in fraud cases by 50%

- Improved compliance with AML regulations

- Enhanced user experience with smooth biometric authentication

The exchange reported improved customer trust and higher engagement, making MiniAiLive an essential part of their security infrastructure.

Conclusion

The crypto industry is moving towards more robust IDV solutions to enhance security, regulatory compliance, and user experience. MiniAiLive SDK offers a comprehensive solution to implement cutting-edge identity verification in crypto platforms. By integrating AI-powered OCR, biometric authentication, and fraud prevention tools, businesses can ensure a safer and more compliant crypto environment.

If you’re building a crypto exchange, wallet, or DeFi platform, integrating MiniAiLive SDK is a step toward future-proofing your identity verification processes in 2025 and beyond.

Get Started with MiniAiLive Today!

To learn more about MiniAiLive SDK and start integrating it into your crypto project, visit the official website and request an API key.

Stay Secure. Stay Compliant. Stay Ahead.